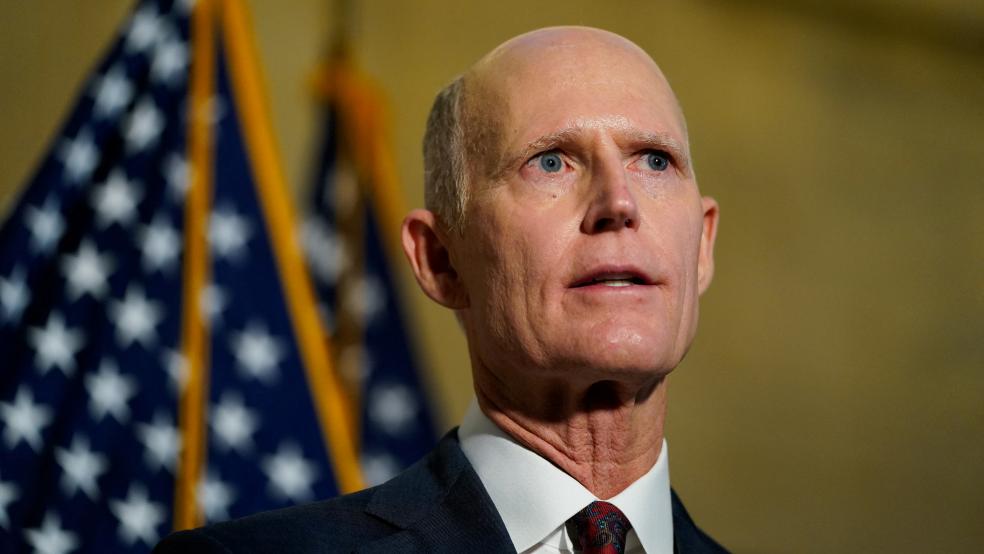

Republican Sen. Rick Scott of Florida is doubling down on his policy agenda — including a controversial call for all Americans to pay some income taxes — despite some intense pushback from fellow GOPers.

In an op-ed for The Wall Street Journal titled "Why I'm Defying Beltway Cowardice," Scott defends his 11-point proposal, which also calls for having all federal legislation sunset after five years, slashing the IRS budget, finishing the southern border wall (and naming it after former President Donald Trump) and imposing 12-year term limits for members of Congress and “government bureaucrats.”

Scott, who serves as chairman of the GOP campaign arm devoted to having the party win back the Senate, argues that Republicans must lay out an agenda to fight what he calls the “militant left” push toward a “woke socialist utopia.” Critics have called Scott’s overall plan a “batshit crazy” appeal to the MAGA right, but the senator portrays himself as a bold truth-teller willing to buck Republicans who are afraid of Democratic attacks:

“I’ve been told there are unwritten rules in Washington about what you can and cannot say. You can’t tell the public that Social Security and Medicare are going bankrupt. You can’t talk about term limits, because, while voters want them, nobody in Washington does. You can’t talk about balancing the budget or shrinking the debt.

“It turns out you also can’t point out that the federal government has figured out how to disconnect many Americans from fiscal reality. Politicians peddle a fiction that they can waste as much money as they want with no downside. They even have a fancy name for it—'modern monetary theory’—and President Biden’s crowd pushes it like crazy. Their plan is to give away money borrowed from your grandkids, get re-elected, and never pay a penalty for their irresponsibility.”

Scott goes on to defend his call to have everyone pay some income taxes in order to have “skin in the game” — a proposal that has drawn fierce blowback from both Democrats and Republicans, forcing him to later explain that his plan wouldn’t apply to seniors or those who are not “able bodied.” He writes: “The change we need is to require those who are able-bodied but won’t work to pay a small amount so we’re all in this together. That means both free-loaders who abuse the welfare system and billionaires who pay lawyers and lobbyists to help them get around the tax laws.”

Senate Minority Leader Mitch McConnell (R-KY) this week publicly bashed some Scott proposals, telling reporters that if Republicans win control of the Senate next year, he as leader would decide where their focus would be. "Let me tell you what would not be a part of our agenda,” McConnell said. “We would not have as part of our agenda a bill that raises taxes on half the American people and sunsets Social Security and Medicare within five years. That will not be part of a Republican Senate majority agenda.”

A reality check: Scott may be looking to carve out a political lane for himself ahead of a potential 2024 presidential run, but a Politico/Morning Consult survey this week found that 51% of voters — including 62% of Democrats and 39% of Republicans — oppose his proposal to have all Americans pay some federal income tax. Only 33% support it. (The same poll found much greater support among voters for some other parts of his plan, with the idea of term limits for Congress backed by 79% of respondents.)

Even conservatives who like the idea of having everybody pay some income tax have questioned Scott’s plan, while others have just wondered about Scott’s logic.

“Most Americans who do not pay federal income taxes already do pay thousands in Medicare and Social Security taxes, property taxes, sales taxes, etc.,” writes John McCormack at the conservative National Review. “But what’s really baffling about Scott’s defense of his plan is his assertion that Americans who do not pay taxes now might only have to pay ‘a few bucks.’ Does anybody believe that raising an American’s income-tax liability from $0 to $3 is going to change how that American views federal spending? Does three dollars really count as ‘skin in the game’?”