The U.S. economy added 431,000 jobs in March and the unemployment rate dropped to a pandemic low of 3.6%, the Labor Department announced Friday.

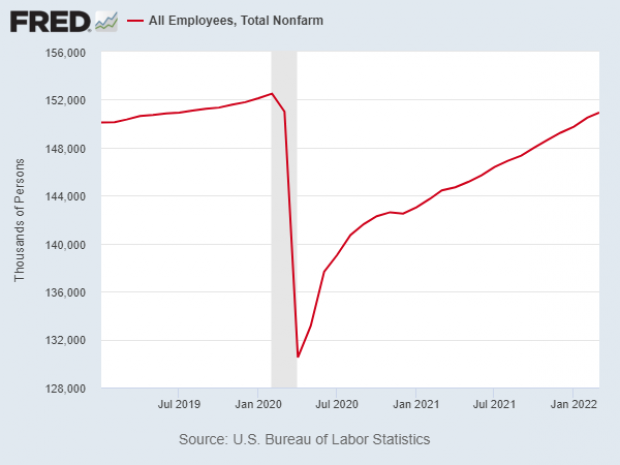

While the report fell a bit short of expectations, the results were quite robust nevertheless and buttressed by the upward revision of February’s jobs gains to 750,000. The labor market has now added more than 600,000 jobs on average over the last six months, more than 400,000 jobs for the last 11 months, and is within roughly 1%, or 1.5 million jobs, of its pre-pandemic level.

“It’s been a remarkable recovery; we’ve never seen anything like this,” Jane Oates of the nonprofit WorkingNation told The Washington Post. “Two years ago, every sector was at least disrupted if not completely shut down. But we’ve had such a quick recovery that things are almost back to normal.”

Solid trends: The unemployment rate is now just one-tenth of a percent below where it stood before the pandemic. Although employers still report a tight labor market and difficulty filling jobs, workers continue to come off the sidelines in massive numbers, fueling hopes that the expansion can continue. And wages are rising, up 0.4% in March and 5.6% over the last year, though not so fast that it’s causing concerns about a wage-price spiral.

White House happy to brag: White House Chief of Staff Ron Klain cited the “historic unemployment report” and the 3.6% unemployment rate as he highlighted the Biden administration’s accomplishments this past week, which also include a pandemic low for the national Covid-19 hospitalization rate, the approval of a second booster for those over 50, and the release of the 2023 budget request. And President Biden noted that the 7.9 million jobs created so far during his time in office are more than those created in the first 14 months of any other administration.

Another green light for the Fed: The March report will likely bolster the Federal Reserve’s effort to start reining in the economy with higher interest rates. The report is the last one before the next Fed meeting on May 3 and 4, and some inflation hawks are calling for an aggressive rate hike of half a percentage point. “This is an economy and labor markets overheating, the Fed has to accelerate” its tightening, Jeffrey Rosenberg of BlackRock told Bloomberg Television.

Still a way to go: As strong as the jobs numbers have been, it’s worth remembering that the economy is still millions of jobs short of where it was projected to be in the absence of the pandemic. At the current rate of growth, the job market will return to pre-pandemic levels this year, as soon as summer. “We are on pace to recover nearly EIGHT YEARS faster than we recovered from the Great Recession,” Heidi Shierholz of the Economic Policy Institute tweeted, while crediting the rapid recovery to the fiscal policy choices made by Congress.

At the same time, the gap between where we are and where we could have been is enormous, and could take years to fill. “The recession left a huge hole, and depending on how you measure the counterfactual, the total gap in the labor market right now is around 4-6 million jobs,” Shierholz noted, before adding that the “gap is closing astonishingly fast.”