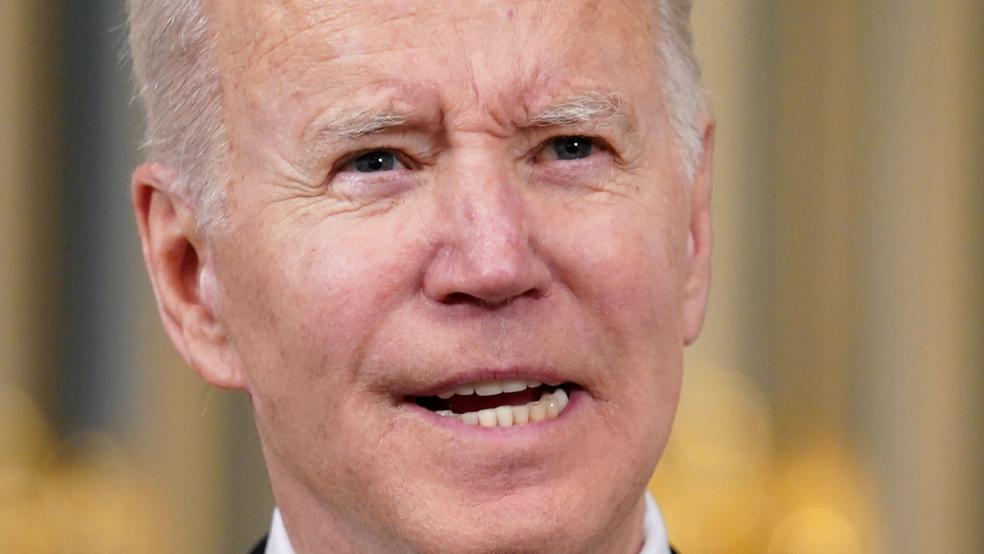

President Biden on Wednesday blasted seven major oil companies, criticizing them for limiting refining capacity and posting “historically high” profit margins that are worsening the financial pain for Americans.

In a letter sent to the top executives of oil companies BP America, Chevron, ExxonMobil, Marathon, Phillips 66, Shell USA and Valero, Biden said there is now “an unprecedented disconnect between the price of oil and the price of gas and that refiners’ margins are now at all-time highs. He asked the companies to explain why refinery capacity that had been reduced during the pandemic hasn’t been restored.

“[A] t a time of war, refinery profit margins well above normal being passed directly onto American families are not acceptable,” Biden wrote. “There is no question that Vladimir Putin is principally responsible for the intense financial pain the American people and their families are bearing. But amid a war that has raised gasoline prices more than $1.70 per gallon, historically high refinery profit margins are worsening that pain.”

In response to the letter, Mike Sommers, president and CEO of the American Petroleum Institute, said that the administration shares blame for high energy prices. ““While we appreciate the opportunity to open increased dialogue with the White House, the administration’s misguided policy agenda shifting away from domestic oil and natural gas has compounded inflationary pressures and added headwinds to companies’ daily efforts to meet growing energy needs while reducing emissions,” Sommers said in a statement.

What’s next: Biden said Energy Secretary Jennifer Granholm will convene an "emergency meeting” to try to find near-term ways to address what he called a “crisis.”

Sen. Ron Wyden (D-OR), who chairs the Senate Finance Committee, reportedly is developing a plan to impose a new 21% federal surtax on oil companies that post a profit margin of more than 10%. “The proposal I’m developing would help reverse perverse incentives to price gouge, by doubling the corporate tax rate on companies’ excess profits, eliminating egregious buybacks and reducing accounting tricks,” Wyden told Bloomberg News. “By contrast, companies that provide relief to consumers by either reducing prices or investing in new supply would not be affected.”

>The bottom line: Biden has been working to demonstrate that he is doing everything he can to bring down gas prices that now average more than $5 a gallon nationally — and redirect public anger where possible. “It’s part of the combative narrative that it’s the refiner’s fault, the oil companies’ fault,” Tom Kloza, global head of energy analysis at Oil Price Information Service, told The New York Times of Biden’s letter. “The narrative from the Republicans is it’s all Biden’s fault, and that’s not true. But it’s also not true that refiners have conspired” to jack up prices, he said.