Economists are starting the new year facing the same big question they’ve been batting around for months: Are we headed for a recession?

Most analysts expect to see some kind of crash landing for the economy in 2023 as a result of the Federal Reserve’s war on inflation, Bloomberg reports, but there are significant outliers, including researchers at Goldman Sachs and JPMorgan Chase. Mark Zandi, chief economist at Moody’s Analytics, thinks the economy will hit a rough patch but avoid a recession, thanks in part to the savings Americans have built up since the beginning of the pandemic.

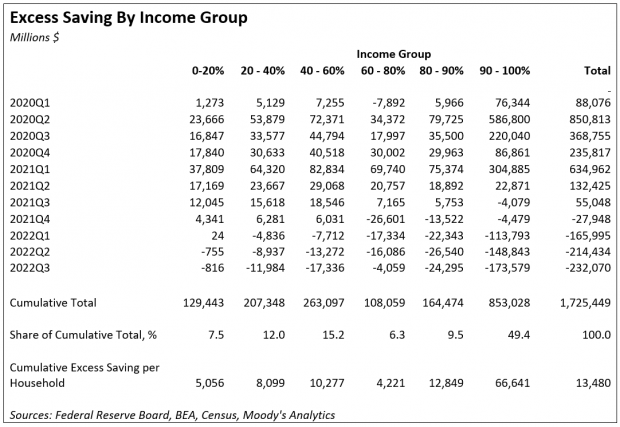

“Shoppers are the firewall between an economy in recession and an economy that skirts a downturn,” Zandi said in a report Tuesday. “While the firewall is sure to come under pressure, particularly as financially hard-pressed low-income households struggle, it should continue to hold.” Zandi provides this chart showing that households in all income groups still have some pandemic-era savings remaining.

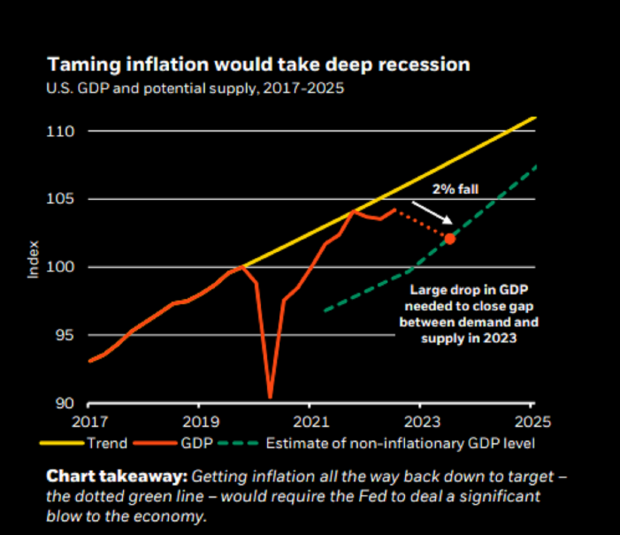

By contrast, analysts at BlackRock say that if the Fed is serious about bringing inflation down close to its target of 2%, the economy will necessarily experience a recession. The chart below shows just how hard the Fed would have to push to get inflation under control in an economy that is now seriously constrained by production bottlenecks and an aging workforce.

“Signs of a slowdown are emerging,” the analyst said, and a “recession is foretold.” At the same time, the BlackRock team thinks the Fed will ease up as it becomes clear just how much damage its tightening campaign is doing, with the central bank coming to accept inflation levels above its target rate.