Shortly after taking over as head of the D.C. Department of Employment Services in the spring of 2011, Lisa Mallory began poking around in search of inefficiencies and waste in the processing of her agency’s burgeoning unemployment insurance claims.

Mallory was part of a new administration in a city that had been wracked by corruption and mismanagement for decades, and the D.C. inspector general had recently complained that the unemployment compensation office she was now overseeing didn’t provide its employees with basic training, “opening the door for fraud.”

What Mallory and other D.C. officials and federal investigators ultimately turned up shocked and enraged Mallory: As many as 300 city employees – including a handful of D.C. Council staffers – had been collecting unemployment insurance benefits while holding down their full time jobs with the city. Taken together, these employees had illegally pocketed between $800,000 and $1 million over the previous several years.

RELATED: Doc Charged in $375 Million Medicare Scam

While the magnitude of D.C. government workers who gamed the system is extraordinary, this type of unemployment insurance fraud is far from rare. Over the past three years, the incidence of fraudulent claims for benefits and improper payments has mushroomed nationally amid the worst economic times in modern U.S. history.

The Obama administration announced last September that it was cracking down on waste and fraud in Medicaid and unemployment insurance, in an effort to save taxpayers billions of dollars. The White House initiative came in the wake of news that the Department of Labor tallied $16.5 billion in wrongful payments of unemployment insurance over the previous three years. States were suddenly under pressure to tighten their procedures and to become far more aggressive in trying to recover the improper overpayments.

One employee in the D.C. Department of Consumer and Regulatory Affairs who recently pleaded guilty to fraud will have to return nearly $20,000 of unemployment benefits she illegally claimed over a two-year period. Other D.C. government workers claimed hundreds or thousands of dollars of improper payments.

“Any time that you have an individual that is not only employed but is also defrauding the government, it’s quite disturbing,” Mallory, the director of the D.C. Department of Employment Services, told The Fiscal Times last week. “Here we have individuals that are employed collecting benefits when we have so many unemployed individuals that are not able to get assistance. We’re not going to tolerate it.”

The Federal-State Unemployment Compensation Program provides temporary assistance to involuntarily unemployed workers and helps stabilize the economy during recessions through a combination of federal and state funds. The Department of Labor oversees the system, but each state and the District of Columbia and Puerto Rico administers its own program.

As government spending on unemployment insurance more than tripled between 2008 and 2010 -- from $42 billion to $143 billion – about one out of every ten dollars spent went to people who didn’t qualify or who falsely claimed to be unemployed, according to Department of Labor statistics. Last year, an estimated 12 percent of the $114.1 billion of total unemployment insurance outlays – or about $13.7 billion -- was deemed improper “overpayments” by the Labor Department.

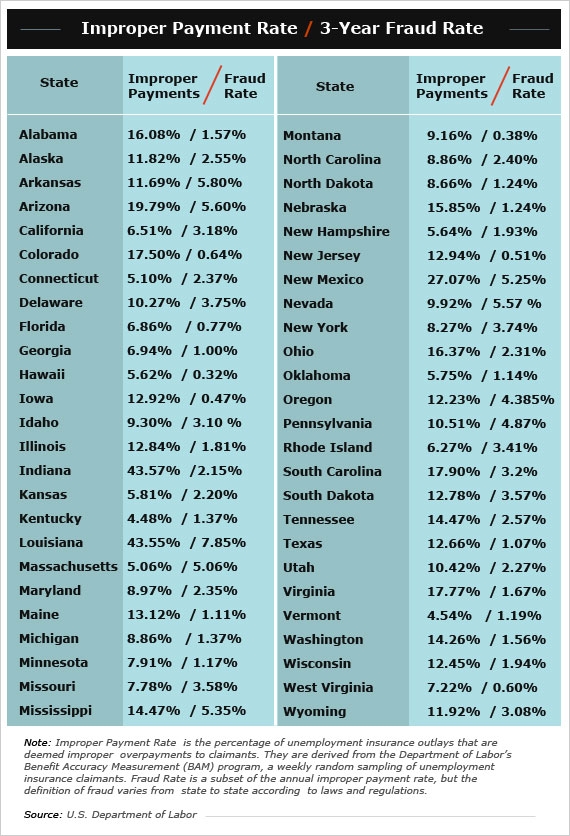

Many states, including Arizona, Indiana, Louisiana, Mississippi, New Mexico and Oregon, have registered troubling rates of improper payments or blatant fraud, according to the latest Department of Labor statistics. For example, more than 43 percent of Louisiana’s unemployment insurance payments were deemed improper and 7.85 percent was described as fraudulent, according to the Labor Department figures. Indiana also registered a 43 percent improper payment rate, while Arizona had overpayments of 19.79 percent, New Mexico 27 percent and Oregon 12.23 percent.

By comparison, the District of Columbia’s improper payment rate is only 9.25 percent, according to the data. Mallory said that while the District scandal understandably is receiving considerable attention because of the involvement of so many government workers, “That’s a very small percentage of the fraud that we find in general in the unemployment insurance program,” she said. “And that has been the trend for years,” Mallory added. “The fraud throughout the country, it has been a challenge for many of the jurisdictions.”

By eliminating a provision that gave states the option to recover improper payments, Congress and the Obama administration this year ordered a crackdown on overpayments of extended federal unemployment benefits as part of the Middle Class Tax Relief and Job Creation Act. .

Now state officials have no choice but to go after that money. But states at best have had mixed success recovering overpayments or benefits that were obtained fraudulently. That’s because some states have been lackadaisical or lacked the legal tools – like wage garnishment laws – to force people to repay the government.

Some state officials bridle at the criticism and note that the Labor Department’s methodology includes a fair amount of guesswork and extrapolation of data. They note that only 2.94 precent of last year’s overpayments was due to intentional fraud, citing the Labor Department’s own figures, and that several other factors contributed far more to the problem:

• Delays in people informing the state that they have found work and no longer are entitled to unemployment insurance.

• Confusion about whether an individual was laid off from work, and therefore is entitled to benefits, or was fired for cause or resigned.

• Controversy over whether a beneficiary is fully meeting a requirement to be searching for work.

.

The work search requirement was probably the biggest factor contributing to Louisiana’s towering overpayment rate, although state officials more recently have addressed that problem by using new computer software.

Compounding these problems was the tidal wave of demand for benefits in the past two or three years as more and more people lost their jobs in the recession. Many beleaguered state officials were saddled with antiquated computer technology and inadequate federal and state funding to handle all the administrative and tracking tasks required to verify their massive claims.

“The states are really, really struggling with lack of administrative funding, outmoded information technology and the decline in the number of people they can hire and retain,” said Richard Hobbie, executive director of the National Association of State Workforce Agencies, an advocacy group for state unemployment insurance officials. “When the Great Recession hit, they were really swamped, and some of these overpayment increases are due much more as a result of the Great Recession than fraud.”

But there is little doubt that fraud was behind the brazen rip-off of the District of Columbia’s unemployment insurance program. While there is no evidence of a mass conspiracy or collusion to defraud the economic assistance program, literally hundreds of workers from a dozen or more city agencies cheated the system over the past several years.

Mallory, a veteran human resources and business strategy consultant, began a rigorous review of the District’s unemployment insurance program last spring shortly after she was elevated to the post of employment services director in the new administration of Democratic Mayor Vincent Gray. One of the tools that she and her aides used was the federal “National Directory of New Hires” – a useful database to crosscheck the employment status of unemployment insurance applicants. She also obtained federal grants to upgrade the city’s computer technology. “As a result of that, we are able to do more checks and do them in real time,” she explained.

Mallory and her staff were soon uncovering troubling signs of fraudulent activities. The investigation initially found that about 130 current or former D.C. employees might have defrauded the city government by collecting unemployment benefits while still working for the District or cashing checks they were not entitled to. The number of suspects soon grew, and Mallory confirmed last week that as many as 300 are being investigated for possible wrongdoing.

Early this month, the U.S. Attorney’s Office obtained its first criminal conviction. Danika Washington, 36, a Department of Consumer and Regulatory Affairs employee, pleaded guilty in D.C. Superior Court to second-degree fraud. Washington admitted to illegally obtaining $18,341 in unemployment checks over a one-year period, between October 2008 and September 2009, while employed by the city, according to court documents. She faces up to three years in prison after promising to make restitution.

Meanwhile, D.C. Attorney General Irv Nathan has begun preparing a series of civil suits to go after the lost funds. “The attorney general’s office will be seeking to recover as much of this ill-gotten gain as we can -- either through litigation or through some kind of repayment agreement,” said Ted Gest, a spokesman for Nathan.