Beset by the revolution in electronic communications and the increasing market share of private-label package delivery services like FedEx, the U.S. Postal Service has been struggling financially for many years. The price of a stamp may have just gone up by three cents, but with fewer and fewer Americans sending snail mail, the USPS needs to do more to shore up its finances. Now, a new report from its inspector general suggests one way the agency could rake in up to $8.9 billion in annual revenue: by getting into the banking business.

To be clear, the USPS is not looking to become a bank, per se. Under the proposal, it would not seek a bank charter and would not offer many of the products, such as mortgage loans and certificates of deposit, which traditional banks do. It would only look to offer services such as check-cashing, prepaid debit cards and small loans. The aim would be to compete in the world of non-bank financial services, populated by check-cashing stores, payday lenders and pre-paid card vendors.

The primary market for such services are the “unbanked” and “underbanked” – that is, people who do not have a bank account or who are, for any number of reasons, inadequately served by their existing bank.

The idea isn’t as far-fetched as it might seem at first glance. The USPS currently takes in more than $100 million in revenue each year from its existing postal money order offerings. Postal services in Europe and other countries offer a large suite of financial services – in Italy, Switzerland and New Zealand, for example, more than two-thirds of the postal services’ profits comes from helping people make financial transactions.

Related: Banks Let Predatory Lenders Drain Customer Accounts

Convincing consumers to trust their finances to the USPS would, of course, be key to the program’s success, and there is reason to believe it could actually be a selling point. In the wake of the financial crisis, banks continue to poll poorly, and recent data breaches at Target and other retailers have caused consumers to be increasingly concerned about their financial privacy. In a series of polls conducted over more than a decade, the USPS has consistently ranked as one of the most trusted companies in the U.S. when it comes to protecting consumer privacy.

Related: Credit Card Hack Attacks Reach a Tipping Point

The proposal envisions the Postal Service offering a number of products that would compete directly with the often exorbitantly expensive services currently available from others in the non-bank financial services field.

Consumers could cash a check at the Post Office with the option to put the money on a reloadable prepaid “Postal Card” that could be used to withdraw money from ATM machines or make purchases online or at stores. The proposal also suggests placing surcharge-free ATMs in the 35,000 post offices nationwide, and developing online services that would allow consumers to pay their bills electronically and manage the money on their Postal Card account.

The USPS would likely partner with one or more banks, which would provide the Postal Card users access to the payments system, and assure that money stored on the card accounts is protected by deposit insurance.

In recent years, traditional banks have essentially stopped making small-dollar loans to consumers because they are not cost-effective, and payday lenders, who often charge 300 to 500 percent annualized interest, have filled the gap. Even over the course of just a few months, borrowers often pay more in fees and interest costs than the original loan amount.

The Postal Service envisions a small-dollar loan program with interest rates in the range of 28 percent, which would be profitable without trapping borrowers in a cycle of recurring debt.

Related: Breaking Up the Big Banks – Here’s How to Do It

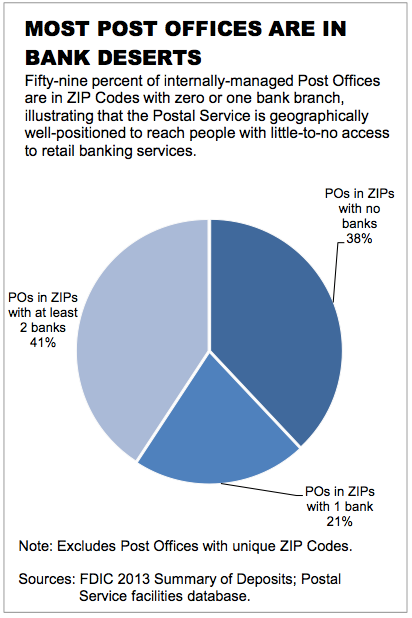

Bankers, predictably, are not happy about the idea of competing with the Postal Service in the payments sphere – especially given that while banks have been closing branches at the rate of thousands per year, the USPS maintains a bricks-and-mortar presence in virtually every town in the country.

“Worst idea ever,” Camden Fine, president and CEO of Independent Community Bankers of America, a trade group representing community banks, wrote on Twitter. “If USPS does half as good a job at running banking sector as they have the mail system most of our citizens will be broke within 10 yrs.”

The IG report, though, is upbeat about the prospect of the USPS as a player in financial services.

“As the Postal Service continues to look for new ways to serve the citizens of the 21st century,” the report said, “non- bank financial services may be the ‘killer app’ for diversifying its revenue base.”

Top Reads from The Fiscal Times