When House Ways and Means Committee Chairman Dave Camp (R-MI) unveiled a proposal to overhaul the U.S. tax code two weeks ago, one of his primary goals was to cut some of the clutter out of the system, including the jungle of “tax expenditures” that have grown up within the system.

Tax expenditures refer to government effectively “spending” money through the tax code by not collecting taxes on certain benefits, or by excluding certain income from taxation. Examples include everything from the home mortgage interest deduction to the Earned Income Tax Credit. And a look at the Analytical Perspectives on the U.S. Budget, published by the administration yesterday, shows why Camp believes it’s a target-rich environment.

Related: Tackling the Holy Grail of Tax Reform: Loopholes

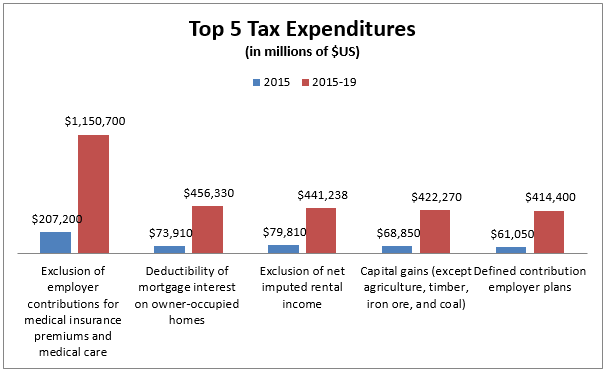

The administration projected that in fiscal 2015, tax expenditures will amount to $1.24 trillion in foregone revenue. In the five years between 2015 and 2019, they will cost the government $7.24 trillion.

To be sure, many tax expenditures are there for a reason – to encourage home ownership, raise the income of those near the poverty line, and for other desirable goals. But as the chart below shows, some of the most treasured tax exemptions in the code, including the mortgage interest deduction and the exclusion of employer contributions to employee health care programs, come at a significant cost to the Treasury – one that of goes unappreciated in debates about taxes and spending.