The Justice Department isn’t as dogged as it says it is, at least when it comes to cracking down on mortgage fraud.

So states a new report from the Justice Department's Office of the Inspector General, which takes a long hard look at DOJ's efforts to combat mortgage fraud in the wake of the 2008 financial crisis — a crisis that had its roots in an out-of-control mortgage industry.

The department may have said that mortgage fraud was a high priority. The reality was quite different, as the report found “that the FBI did not rank mortgage fraud among its highest ranked priority white collar crimes." Instead, the Inspector General says, "the FBI ranked mortgage fraud as the lowest ranked criminal threat in its lowest crime category." The Federal Bureau of Investigation is, of course, part of the Justice Department.

Specifically, though the FBI received $196 million in funding from 2009 through 2011 to investigate mortgage fraud, the number of agents actually working on such crimes dropped, as did the number of pending investigations.

The Inspector General also found mortgage fraud to be a "low priority, or not listed as a priority" for FBI field offices in Miami, New York, Baltimore and Los Angeles.

Lies, Damned Lies, and Statistics

Perhaps the most damning finding to emerge from the Inspector General’s audit concerns a highly publicized October 2012 press conference at which Justice officials touted the success of the FBI-led Distressed Homeowner's Initiative.

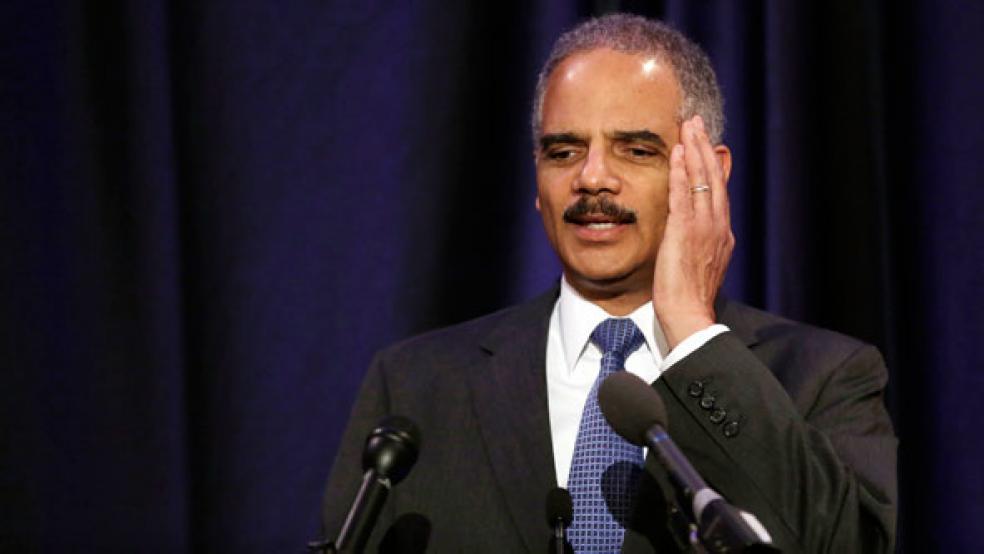

At the press conference, Attorney General Eric Holder reported that 530 people had been charged with mortgage fraud in the previous year, including 172 executives, and that 110 civil cases had been filed.

All told, the efforts were said to involve 73,000 "homeowner victims" with total losses of $1 billion. But in November 2012, when the OIG asked for the data that backed these claims up, department officials said they had concerns over the accuracy of their statistics. DOJ officials later said that "numerous significant errors and inaccuracies existed with the information."

Over the succeeding months the Inspector General’s auditors dogged Justice officials about their efforts to correct the data, while the DOJ continued issuing press releases using the same flawed data.

In the end, the Justice Department admitted it had overstated the success of the Distressed Homeowner's Initiative at the October 2012 press conference, and released updated statistics: 107 people were charged with mortgage fraud, not 507. Losses totaled $95 million, not $1 billion. Not exactly rounding errors.

The Inspector General's report offers seven remedies for the problems found in the audit, mostly dealing with how the department collects and handles its data. It further asked that the DOJ update any instances of flawed data in the public record.

The Justice Department officially concurred with all seven of the OIG's recommendations, though its spokesperson has insisted that the mortgage fraud task force has made significant progress, nearly doubling the number of indictments and more than doubling the number of convictions. “Even in a time of constrained budget resources, the department has dedicated significant manpower and funding to combating mortgage fraud,” the spokeswoman said.

Per the audit, the DOJ lived up to its own billing in combatting mortgage fraud in two instances. That’s small consolation for distressed homeowners.

Top Reads from The Fiscal Times: