The 848-page Dodd-Frank Wall Street Reform and Consumer Protection Act dedicates 149 words to framing a new disclosure about “pay versus performance” at public companies. Boards and management must deliver “a clear description” to shareholders of “the relationship between executive compensation actually paid and the financial performance of the issuer,” the law states.

Salvaged by Congress and the president from the greatest financial crisis since the Great Depression, the promise remains empty four years later. Nearly one-quarter of the Dodd-Frank law’s 398 rule-making requirements haven’t been proposed by federal regulators yet, according to the Davis Polk law firm’s Regulatory Tracker on financial reforms, including the expanded disclosure on performance and executive pay.

Related: The Man Pushing CEO Pay to the Stratosphere

As the Securities and Exchange Commission delays producing a new CEO-compensation dashboard, pro-business groups led by the Conference Board and executive-compensation consultant Ira Kay are campaigning to influence the definition of performance pay, and the meaning of “paid.” On April 14, six members of the Conference Board Working Group on Supplemental Pay Disclosure, including Kay, met with members of the SEC’s Division of Corporate Finance, including its director Keith Higgins and the chief of the Office of Rulemaking, Felicia Kung, according to an agency memorandum of the visit.

A recommendation shaped by Kay would ignore signing bonuses, pensions and perks — including company airplane, car, driver, club memberships and home security systems — along with out-of-the-money stock options when making pay-for-performance assessments, according to interviews with Kay and several other members of the Conference Board Working Group, and the group’s policy paper.

Under the proposed terms, three-quarters of the $15.8 million in compensation Schlumberger Ltd. awarded to Chief Executive Paal Kibsgaard in 2012 would have been excluded from his performance-pay total that year because most of the grant was tied up in options issued at a higher price than that at which the stock ended the year. Today, the same Schlumberger options would be in-the-money for about $12.5 million, lifting the cash value of his 2012 pay to $16.6 million.

The $940,201 in “above-market” interest Wal-Mart Stores credited to former CEO Michael Duke’s pension in fiscal 2014 ended in January wouldn’t count as performance pay, either. Schlumberger and Wal-Mart both are clients of Kay’s executive-compensation consulting firm, Pay Governance LLC, which advises the boards at about 10 percent of the Standard & Poor’s 500 companies.

SEC spokesman John Nester declined to comment on the Conference Board meeting or its proposals.

“This is not a piece commissioned by management or CEOs. It’s in the interests of investors and companies that are interested in these issues,” says attorney Jim Barrall, a member of the Conference Board working group, who co-chairs the Latham & Watkins law firm’s benefits and compensation practice in Los Angeles. “Clearly the agency needs to draft rules on pay versus performance. We hope they look at what we’ve done and I suspect they’re watching what we do.”

Best known for producing a widely followed consumer-confidence index, the Conference Board identifies itself as an objective, independent not-for-profit research organization “working in the public interest.” Yet its governing board of trustees is dominated by the chairmen and chief executives of global corporations. Not one member of the group’s panel on executive compensation was identified as a shareholder or independent director. Kay was its only executive-compensation consultant.

“If you’re stripping out pension valuations and other things, you’re cooking the books,” says Harvard Law School professor Jesse Fried, co-author of Pay without Performance: the Unfulfilled Promise of Executive Compensation.

Robin Ferracone, president of Los Angeles compensation consultant Farient Advisors, adds: “It will obfuscate the real relationship between pay and performance.” Ferracone co-chairs the National Association of Corporate Directors’ Executive Compensation Advisory Council, consisting of board compensation committee chairs and institutional investors. Three-quarters of NACD members surveyed last year said pay-for-performance analysis should include pension benefits, perks and other non-cash earnings, in contrast to the executive-led Conference Board framework.

Of the 250 largest U.S. public companies by market capitalization, only 37 voluntarily disclosed supplemental performance-pay tables last year, according to an analysis by compensation consultant Frederic W. Cook. Most companies stating an alternative number reported lower equity values for executives than appeared in the standard summary-compensation table, Cook found.

Enormous attention already is devoted to the summary tables in companies’ annual proxy filings. Each of eight columns tells a distinct story about CEO pay in a single line: Salary; bonus; stock; options; non-equity incentive-plan compensation; changes in pension value and other retirement savings, identified as non-qualified deferred compensation; “all other compensation,” including perquisites; and total.

The $19.1 million that Kay’s client NextEra Energy awarded to former CEO Lewis Hay in 2012 included $1.4 million in salary; no bonus but $2.6 million in tax-deductible cash incentive pay, which is otherwise equivalent to a bonus; $5.7 million in retirement savings; and $403,422 in “other compensation,” including a leased car, home security, club memberships, medical and life insurance, and personal use of company aircraft. The total also included stock and options valued at $8.9 million.

Under current SEC-reporting guidelines, the valuation of a CEO’s equity grants are about 15 months old by the time they become public. One benefit of Kay’s approach is to give shareholders a more up-to-date reading of executive pay. In years when the stock market booms, and a company’s share price rises, the market quote for a CEO’s performance pay — calculated at year end — will appear much larger. During bear markets and corporate downturns, the pay totals will appear depressed.

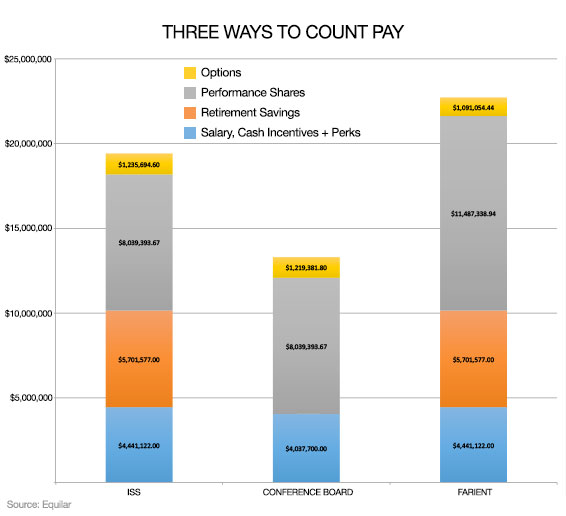

Under Kay and the Conference Board’s formula, NextEra would have reported $13.3 million in “realizable” pay for Hay last year, according to an analysis by Eric Hoffmann, a Farient vice president. That is much lower than the $22.7 million calculated by Farient.

Among differences, Kay and the Conference Board count the “target” value of performance shares as reported to shareholders. By comparison, Farient reports the market value of the shares as earned.

Variations in “target” and award can be significant, as the NextEra example shows. Farient pegs the market value of CEO Hay’s 166,026 performance shares earned at $11.5 million as of the last day of 2012, compared with the Conference Board’s $8 million market value of 116,193 shares targeted.

A Battle Rejoined

Dodd-Frank became an opportunity to rejoin the battle over pay definitions and disclosures waged in 2006, when the SEC last extensively revamped the summary table. Does “actually paid” refer to the $8 million target value of CEO Hay’s performance shares? Or should it count shares earned, whose market value as of Wednesday was $16.6 million? Was Schlumberger CEO Kibsgaard paid $15.8 million? Or should three-quarters be excluded because $10.9 million in options were temporarily out-of-the money, and almost another $1 million consisted of retirement savings and other pay?

Related: How Pork Giant Smithfield Larded CEO's Pay Package

Including pension-value changes in the summary compensation table would “create anomalies in reporting” based on executive age, tenure and plan design “rather than performance,” HR Policy Association President Jeffrey McGuiness, representing human resources executives at large corporations, stated in a letter to the SEC in April 2006. Stock awards, McGuiness added, are designed to reflect long-term, not one-year, performance. “Thus, it is misleading to include the total grant date fair value of these compensation elements in the table,” he wrote.

The SEC overruled McGuiness, making it possible for the $940,201 in “above market” interest Wal-Mart paid into the CEO’s retirement savings in fiscal 2014 to be viewed in the compensation table. Even that number understates the $23.4 million in gains on CEO Duke’s retirement, including $4 million in investment earnings and $317,688 in company contributions, both disclosed elsewhere in the proxy.

At the time Duke stepped down as CEO in January, his $140 million retirement bankroll was nearly 10,000 times the average balance in the company’s 401(k) savings plan as of the end of fiscal 2011, according to Department of Labor data.

Ira Kay

Proving the debate was never settled, Kay and a former partner at the Watson Wyatt & Co. consulting firm twice wrote to the SEC in 2009 asking regulators to “reconsider” the post-2006 summary compensation table. In particular, they objected to the requirement companies show “the fair value of grants made for the year, rather than the cost recorded on the financial statement for the year.”

Kay, Watson’s compensation practice director, and Steve Seelig, compensation counsel, attached an article they’d written stating that while “Corporate America tolerated this approach for the 2007 and 2008 proxy seasons,” when stock values climbed, thus understating the value of the equity grants, the 2009 proxies would “greatly overstate the value” and thereby inflame public opinion.

In a follow-up letter, Kay and Seelig proposed a “realizable pay” formula for stock awards to be inserted in the summary compensation table, where it would produce a new — often lower — payment total.

After Dodd-Frank’s passage, Kay wrote to the SEC again, calling on the agency to adopt a realizable-pay analysis to inform “say-on-pay” resolutions — another legacy of the post-financial crisis law that gives shareholders a non-binding up-or-down vote on executive compensation. Kay and two partners at the newly formed Pay Governance consulting firm, John England and Richard Meischeid, outlined a three-year performance horizon for the analysis, which would mitigate the dramatic effect of one-year swings in stock and options values. Securities regulators again tabled moves to supplement or reshape the summary compensation total. But the battle over reporting CEO pay went on.

Defining Pay Terms

The Conference Board mission on supplemental-pay disclosure was to standardize two widely used but loosely defined measures of management compensation known as “realizable pay” and “realized pay.”

Though sounding much alike, the meanings are different when used by companies in presentations to shareholders. While realizable pay can be understood as a market quote for executive compensation, realized pay is sometimes referred to as W-2 income because it is designed to capture all or most in-the-pocket compensation in a given year, including salary, bonus, vested stock awards and exercised options. Former NextEra CEO Hay’s realized pay in 2012 was $33 million, almost double the total reported in the summary compensation table, according to the analysis by Farient’s Hoffmann.

“No hidden agendas. We just wanted a working definition,” says Donna Dabney, executive director of the Conference Board’s Governance Center, who assembled the working group. It endorsed a realized-pay definition advanced by the HR Policy Association, which had two representatives on the 12-member panel, and a realizable-pay formula similar to one Kay promoted to clients and regulators for years. Dabney’s ex-boss, Alcoa CEO Klaus Kleinfeld, was a Conference Board trustee from 2010 through 2012. Alcoa’s compensation committee employs Kay as its independent advisor.

“This perverse outcome flies in the face of investors’ decades-long efforts to promote performance based pay,” counters Jeff Mahoney, general counsel to the Council of Institutional Investors, whose employee and union plan members oversee assets of $3 trillion. In a letter to the SEC last August that does not identify the Conference Board plan specifically, Mahoney wrote that the proposed exclusions “would have the unintended consequence of encouraging companies to game the system” by decreasing pay subject to disclosure, and increasing components not part of the analysis.

While the public hasn’t played much part in the Conference Board’s effort to inform the debate, the organization is hosting a two-day conference on performance pay this month, sponsored by Pay Governance. The group also solicits comments at its website, the way the SEC would had the agency proposed its own rule under Dodd-Frank. The SEC imposes no limits on the number of times the public can weigh in or at what length nor any cost, while the Conference Board is charging up to $2,845 to attend its presentation in New York and is limiting public comments to 150 characters, 10 more than Twitter allows.

Top Reads from The Fiscal Times: