The death of television has been forecast for years. The growing cadre of cord-cutters opting for on-demand Internet video spells certain doom for the traditional cable bundle.

The average American home now gets 189 TV channels — up from 129 in 2008 — but consistently watches only about 17 of them, according to Nielsen. So why pay for the whole package? Last year, U.S. cable, satellite and telecom companies lost 251,000 TV subscribers, the first full-year decline.

The explosion of mobile viewing has helped drive the continued growth in online-original video. A study released last month by the Internet Advertising Bureau found that online-original videos have surpassed news, sports and daytime TV in terms of audience preference.

Related: Yahoo Joins the 3-Ring Circus of Original Web Video

If all that wasn’t enough, upstart Aereo might, just might, fundamentally change the economics of broadcast television. A looming Supreme Court decision on the legality of the company’s business model threatens to undermine the lucrative retransmission fees that networks and their local affiliates get from cable providers.

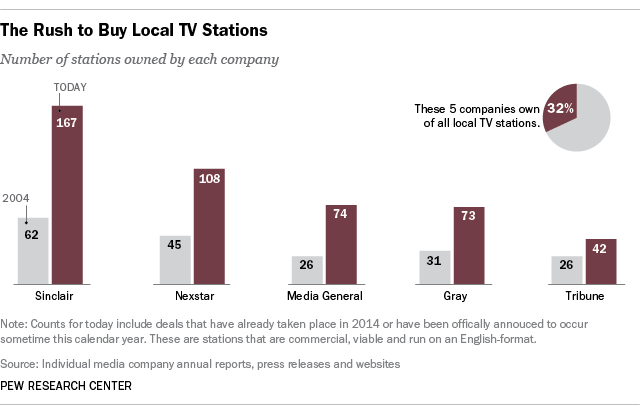

The challenges the industry face have resulted in further consolidation in the industry — and if the TV business is really on the fritz, it hasn’t prevented companies that own local TV stations from “dramatically expanding” in recent years, as a new Pew Research Center report finds.

“A decade ago, the number of stations owned by what are now the five largest local TV companies was 190. Today, that number is 464,” Pew’s Katerina Eva Matsa writes. “In 2013, alone, about 300 full-power local TV stations changed hands, at a cost of more than $8 billion. That is 195 more stations sold than in 2012 and more than four times the dollar value of the deals made in 2012.”

The end result: five companies — Sinclair Broadcast Group, Nexstar Broadcasting, Media General, Gray Television and The Tribune Co. — now own 32 percent of the approximately 1,400 local TV stations in the U.S.

It isn’t just fear of the grim reaper’s sickle driving the consolidation, or the promise of reduced overhead costs — there are new opportunities from increased scale, as well. “There are really a couple of booming revenue streams in local television that are behind this,” says Mark Jurkowitz, associate director of the Pew research Center’s Journalism Project.

One is the dramatic growth in those retransmission fees, which totaled $3.3 billion in 2013 and are projected to climb to $7.6 billion by 2019, according to SNL Kagan. The more stations a media company operates, the more leverage it has when pushing for higher fees. Those rising fees make local TV look much more appealing than the dying newspaper businesses that had once been at the core of companies like Media General and Tribune. Media General sold off most of its newspapers in 2012, and Tribune plans to spin off its newspapers later this year. Similarly, News Corp. divided itself into two companies, separating its print publishing from faster-growing film and television.

The other key revenue stream for local TV stations, Jurkowitz says, is political advertising enabled by the Supreme Court’s 2010 Citizens United ruling. “The Supreme Court decision, which paved the way for a flood of advertising money to come in, has been a huge windfall for local television in particular, because in many ways the most effective medium for advertising in political campaigns is local television, and if we’re talking national elections, local television in battleground states.”

In the 2012 election, a record $3.1 billion was spent on political ads on local TV. “There’s no reason to believe that’s not going to continue to grow,” Jurkowitz says. Stations in battleground states have become especially hot properties.

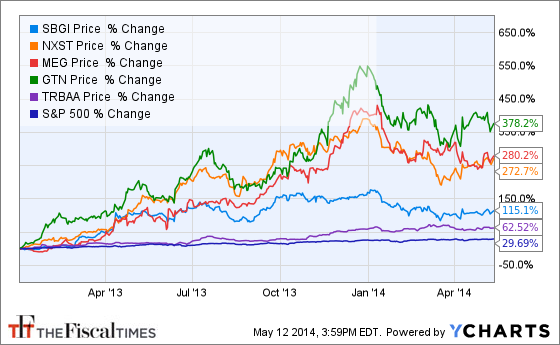

The growth in fees and and potential for skyrocketing ad spending has sent the stock prices of those five largest players soaring.

The benefits to consumers are not nearly as apparent. Cable operators and the Federal Communications Commission have argued that the higher retransmission fees will result in larger bills for subscribers. The FCC earlier this year cracked down on the increasingly popular practice of local TV stations in the same market forming operating partnerships in order to win higher retransmission fees. Broadcasters have countered that tightening regulations on local TV stations won’t reduce consumers’ cable bills.

And if you ask consumers how much negative political TV they can tolerate, and their answer is likely to be almost none—unless it comes in a Netflix package called “House of Cards.”

Top Reads from The Fiscal Times: