With the debt ceiling/budget cage match over for now, the nation's attention has turned squarely back to the Affordable Care Act (ACA). So we’ve gone from one mess to another.

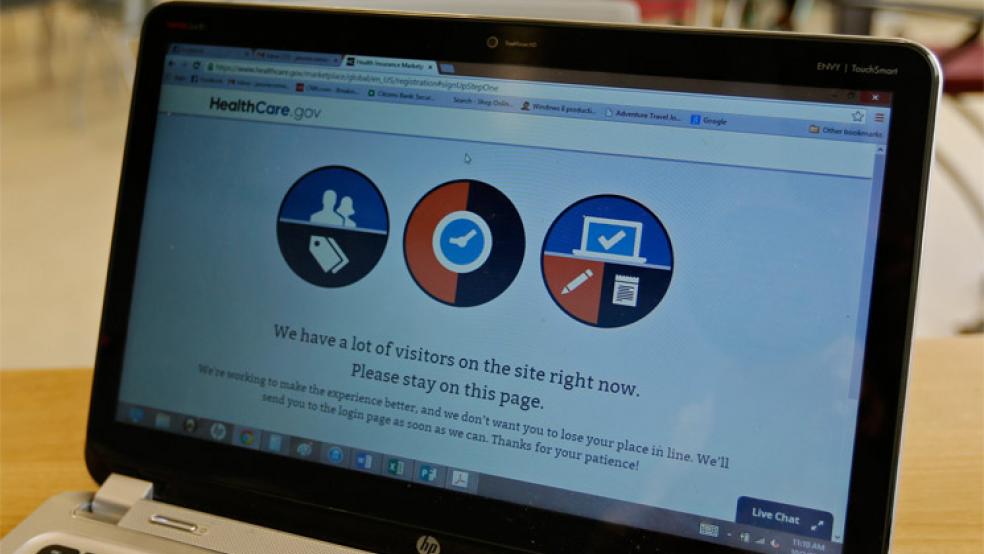

Facing new poll numbers that suggest that nearly three quarters of uninsured Americans are not aware of the online insurance exchanges, the Obama Administration has a tough, uphill battle. It must not only fix a buggy website – and quickly – but convince nearly 30 million Americans that they can use it to find affordable health plans.

To date, about half a million Americans have applied for insurance through the online marketplaces, although the government isn't saying how many have been able to get through the ongoing technical problems to actually buy a plan. Yesterday, President Obama said he would concentrate on fixing the snafus.

“The website has been too slow, people have been getting stuck during the application process,” Obama said on Monday. “And I think it’s fair to say that nobody is more frustrated by that than I am – precisely because the product is good, I want the cash registers to work. I want the checkout lines to be smooth. So I want people to be able to get this great product. And there’s no excuse for the problems, and these problems are getting fixed.”

Let’s take the president at his word and assume the website problems get sorted out, and fairly soon. How will Americans know if Obamacare is a success or failure? Here are four benchmarks:

Will the Government Exchanges Be Competitive with Private-Sector Prices?

Although at the ACA's political inception, President Obama didn't guarantee that prices would be lower, the presumption was that you could save money through the state and federal exchanges. If even the cheapest "bronze" plans aren't competitive with what's offered outside of the exchanges – and through employers – then savvy health consumers will avoid the system.

The results, to date, are mixed and muddied since so few people have been able to even file applications online. Remember that no public options were introduced into the program. That means no large single-payer, national program such as Medicare was allowed to compete with private insurers, which, in theory, would compete with each other on prices in the state exchanges. If exchange policies prove to be costlier than non-exchange policies, then that will certainly damage the political viability of the ACA.

Gary Alt, a Pleasanton, California-based financial planner who's trying to insure himself and his office staff, wrote to me with what might be called sticker shock. "My premium is higher through Covered California, our state’s insurance exchange," Alt wrote. "What’s confusing is that one of our employees, in his late 20’s, also compared his current premium to the exchange, and found his premium would be 60 percent higher than his current private insurance."

The bottom line is whether private insurers in the open market will still be competitive with the exchange-based companies. If the reverse is true, a tremendous amount of political capital will evaporate.

Will Customer Service Be Adequate?

The complaints about HealthCare.gov have been legion. I've tried nearly every day over the opening weeks and found that the toll-free helplines have been virtually useless and told me what I already knew: The system was down and inaccessible. One brave representative offered to take my application over the phone, "but it would take several hours." That didn't sound enticing to me.

When my cellphone died the other day, in contrast, even though the store manager was put on hold by his own company's customer service helpline, he was able to order me a new phone in 20 minutes. I had my new phone in two days. I've spent hours just trying to get past the log-in on HealthCare.gov, as have millions of others.

Marci Strang, a 59-year-old retired information technology trainer from Tucson, got the same run-around, including a dead-end referral to Experian, the credit-record company. She has a suggestion: "Provide an elevated technical support hot line staffed with IT website personnel for applicants when customer service in unable to resolve routine applicant issues," she wrote me in an email. "Since this process is so new, every possible method should be taken to get the system up and running efficiently and effectively. Proactively working through technical issues with the user will systematically improve the application process."

So far, the grade for the technical end of HealthCare.gov is an F. If the ACA is to be judged a success, the administration has to get rid of most of the bugs before people need to officially sign up, with Dec. 15 the deadline for getting coverage beginning Jan. 1. That's a pretty generous window, but closing fast.

Will Out of Pocket Costs Be Reasonable?

Even if you have health insurance through an employer and don't need to shop on the exchanges you may have noticed that your out-of-pocket costs have been climbing in recent years. In an effort to reduce their costs, employers have shifted more expenses to their employees. According to a recent AonHewitt survey, this year "average employee out-of-pocket costs, such as copayments, coinsurance and deductibles, increased 12.8 percent ($2,239) in 2013, compared to just 6.2 percent in 2012 ($1,984)." While the average health care premium rate increase for large employers in 2013 was 3.3 percent, the consultant reported, it was "down from 4.9 percent in 2012 and 8.5 percent in 2011."

When it comes to the exchanges, out-of-pocket costs will be a critical benchmark. For years, Americans obtaining policies on their own have had the option of buying "catastrophic" policies with high deductibles (mine is $6,000) that cover little outside of major medical expenses. If the out-of-pocket costs of even the least-expensive bronze plans exceed the premiums – or are not competitive with non-exchange policies – then that will be another black mark.

Will Those Who Need It Most Get Covered?

Those who desperately need coverage will either qualify for subsidies through the exchanges or Medicaid. But several governors who oppose the ACA have refused federal money to expand their Medicaid programs. As of this writing, 25 states have signed on to use the federal HealthCare.gov marketplace, but have not expanded Medicaid. The other 25 states, and the District of Columbia, either have a state-run exchange with Medicaid expansion or will move forward into the federal online exchange.

Still, it remains to be seen how many less-affluent Americans will fall through the cracks and not receive coverage. Will more states offer Medicaid? Much will depend upon the overall success of the state and federal exchanges. If they prove popular, accessible and low-cost, that will put considerable pressure on anti-ACA governors to accept Medicaid funds.

As I've noted in earlier pieces, dealing with HealthCare.gov system is not only annoying, it's a political powder keg. It will sink or swim based on its success as a consumer-driven product: Prices must be competitive, access must be easy and it should serve the needs of those who need it most.

Since the ACA is front and center in the nation's attention span, it would behoove the Department of Health and Human Services – and the White House – to organize a technical Navy Seals-like team of programmers for this “tech surge” to get the system up and running. The administration says it’s doing just that, though just who is on that team is being kept about as secret as the identities of the Seals.

This is not a fighter jet that's taking decades to develop, and it can’t be treated that way. People's lives are depending upon it.