Stocks continue to hit new highs, with the Dow Jones industrial average approaching 16,000 and the S&P 500 on the cusp of 1,800 – both marks that have never been hit before.

Janet Yellen, the nominee to succeed Ben Bernanke as head of the Federal Reserve, told the Senate Banking Committee Thursday that the run-up has not reached bubble territory. "Stock prices have risen pretty robustly," she said. "But I think that if you look at traditional valuation measures, you would not see stock prices in territory that suggests bubble-like conditions."

Related: 4 Risks That Cloud the Outlook for Commodities

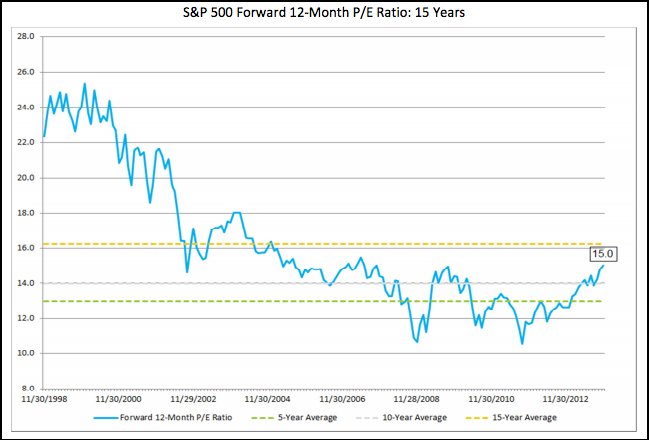

Based on Thursday’s closing price, the S&P 500 now trades at 15 times estimated earnings for the next 12 months, the highest such multiple since September 2009, according to FactSet.

“With the forward P/E ratio well above the 5-year and 10-year averages, one could argue that the index may now be overvalued,” John Butters, FactSet’s senior research analyst, wrote Friday. “On the other hand, the current forward 12-month P/E ratio is still well below the 15-year average (16.2).”

With stocks at those heights, is it time to just close up shop for the year right now and sit tight in anticipation that the market will cool? Here are some points to ponder.

Quantitative easing continues to serve as a prop for both stock and bond markets. Remember the selloffs that followed the end to the first two rounds of quantitative easing? Well, we may well have a big shock in store for us when the Fed finally decides to ease off its bond-buying this time around.

Although QE3 isn’t (yet) the longest-lived of the Federal Reserve’s three rounds of quantitative easing (that title still belongs to the 19-month-long first round), if things progress the way Wall Street expects, QE3 will match the length and exceed the size of QE1 in dollar terms.

We can’t expect that the withdrawal of that support – however gradual – will be pain free. For more than a year, the Fed’s monthly $85 billion purchases of mortgage-backed securities have kept interest rates at low levels and created additional demand for riskier securities that to some extent has been underpinned by those artificial interest rates.

Until the unwinding begins, we won’t know just how much of this year’s big stock market rally can be attributed to fundamental factors (the prospect of higher corporate profits and revenues) and how much is due to investors chasing stock market returns because the alternatives just aren’t all that appealing.

Even the somewhat stronger jobs data released late last week, however, probably won’t be enough to change the minds of Fed policymakers, and the pundits strongly favor scenarios in which tapering is deferred until next spring. But for now, this is a great reminder that it’s time to rebalance your portfolio.

Portfolio rebalancing is one of those little tricks that savvy investors use to minimize their risk of underperforming. (Another one is keeping an eye on fees: Above-average fees can turn a market-beating return into something that’s deeply depressing.)

True, just because the market has set a string of record highs doesn’t mean that it’s about to turn turtle. But it does suggest that your allocation to stocks may now be far higher than you had intended – and gives you a way to force yourself to pocket at least some of those profits by selling down to whatever limit you had previously imposed. For instance, if you had decided that you wanted 65 percent of your assets invested in stocks, and the rally has taken it to 71 percent, this would be the time to sell until you’re back at 65 percent. Sure, the market may go higher still – that’s great news for the 65 percent that you’ll still have invested – but if things go awry for any reason, you won’t have more than you planned at risk.

Instead of worrying about bubbles and trying to time your exit and re-entry into the market, I’d suggest taking a step back and thinking about longer-term issues. Did corporate earnings come in on target? Are the opportunities in the bond market fully priced into yields right now, or are there pockets of value? How comfortable do you feel about the idea of shifting some of your assets into other parts of the global stock market that haven’t kept pace with the S&P 500?

Those topics – and the investment decisions that flow from them – will never make into the headlines the same way as Twitter’s IPO and the monthly jobs data. But odds are that they’ll be much more significant in shaping your portfolio’s returns and determining your ability to outlive your savings.

Top Reads from The Fiscal Times: