Live by the CBO, die by the CBO.

For the second time this month, the independent economic analysts in the legislative branch have delivered a body blow to the Obama administration’s key domestic policies. First, the Congressional Budget Office – often cited by the White House for its more sympathetic analyses of the Affordable Care Act – concluded the law would result in the net loss of the equivalent of 2.5 million full-time workers, setting up the US for slower growth even as Obamacare and other entitlement programs need more workers producing more income to survive. Republicans on the Senate Budget Committee pointed out that it would cut one trillion dollars in compensation from the economy over the next decade.

Democrats pushed back by criticizing early reactions that mischaracterized the CBO report on Obamacare’s impact as job losses (rather than jobs that would otherwise have been created), and claiming success in fighting “job lock.” The White House jumped on that argument, claiming that the CBO report meant “greater job mobility and entrepreneurship.”

Related: Grim Deficit Outlook in New CBO Report

The loss of production and income, however, is net, which means that even with arguably lower barriers to job mobility, the US economy will see less production and “entrepreneurship.”

Even that fig leaf was stripped away in the latest CBO report on President Obama’s economic agenda. Obama had demanded that Congress act on his proposal to increase the federal minimum wage by 39 percent over the next two years, moving it from its current $7.25 an hour to $10.10 by 2016.

The President made it a central part of his State of the Union address, and a key element in his overall theme of “income inequality” in the US. Republicans pushed back, calling the proposal a job killer and yet another burden on businesses in an already-stagnant economy.

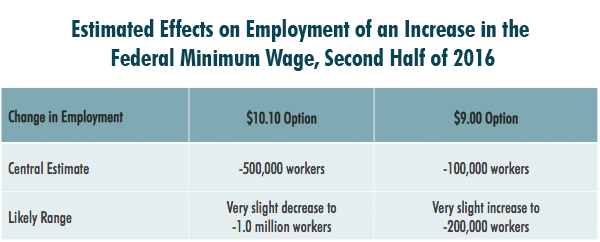

The CBO unequivocally supports that conclusion. Implementing the large minimum-wage increase would cost the economy up to one million jobs, not over a decade but by the end of 2016, thanks to the cost to businesses for the labor. The CBO offered a range of job losses, with 500,000 being the central estimate that it endorsed as its final analysis. A smaller proposal to hike the minimum to 9 percent would cost 100,000 jobs in the same period.

The White House, sensing political disaster, struck back. Betsey Stevenson, a member of Obama’s economic team, suggested that the CBO was ignorant of recent economics. The chair of the Council of Economic Advisers, Jason Furman, declared, “Zero is a perfectly reasonable estimate of the impact.” CBO director Doug Elmendorf took a swipe at Obama’s analysts, noting that the difference between the White House and the CBO was that “most other economists don’t have to put numbers behind the words of their evaluations.”

Related: CBO—Interest Rates Will Spike to 100 Percent of GDP

It doesn’t take economic training to understand that increasing the cost of labor will make it less attractive to businesses, especially those who operate with labor at or near the minimum wage as a starting point – retailers, food service, hospitality, and even entry-level clerical work. Businesses whose labor force would get impacted by minimum wage increases would have to either (a) raise prices on their goods and services, or (b) reduce staffing to meet the higher cost.

Most of these firms operate on smaller margins already in highly competitive industries, where price increases are not realistic options. Anyone who has had to work within a budget in the private sector would already know this.

Furman, however, gave the private sector some words of wisdom in how businesses can ignore a massive increase in labor costs. In a conference call from the White House on Tuesday, he told businesses that hiking the wage “increases motivation,” which would offer “overall benefits for productivity.”

Therefore, Furman advises businesses that they have other options. “The other margins on which firms can adjust -- for example, reduced profits -- mean that there is substantial literature that has found little or no employment impact on the minimum wage,” Furman told reporters.

This is one of the most revealing statements made by this administration about its economic policy and its worldview. Their vision of an American economy is not one in which wealth gets created in a dynamic environment and creates jobs and opportunities that in turn create more wealth, jobs, and opportunities. This White House sees the economy as a static, zero-sum game in which investors and business owners simply should be told to accept “reduced profits” while government shapes the markets to their own purposes.

Related: White House Attacks CBO Over Minimum Wage Report

There are a number of problems with telling investors and owners to accept lower returns on their use of capital. First, they will be less inclined to put that capital to use in the US economy and more inclined to look elsewhere. Second, the businesses that will get the most impact by a government-mandated increase in starting labor costs of up to 39 percent are the businesses that usually don’t make a large margin in the first place; they don’t have much profit to lose before the business stops being profitable enough to continue.

The CBO report also addresses that in another key sense: buying power. While the nominal value of income would rise, so would the prices, while opportunities would decline. “The increased earnings for some workers would be accompanied by reductions in real (inflation-adjusted) income for the people who became jobless because of the minimum-wage increase, for business owners, and for consumers facing higher prices,” the CBO concluded.

For consumers already facing rapidly increasing prices in the marketplace, especially in grocery stores where minimum-wage hikes would create an additional inflationary pressure, this will create an even bigger squeeze on stagnant buying power during the so-called recovery.

Related: Obamacare Will Insure Fewer People, Reduce Workforce--CBO

A third CBO report shows the effect of Obama’s economic policies. As TFT’s Eric Pianin noted earlier this month, economic growth for the next decade looks suspiciously like the stagnation we’ve seen for the last five years. After a period of GDP growth in the 3 percent range, we’ll drop back into the 2 percent range in 2017 and stay there for seven years. That’s not accounting for the depressing impact of Obamacare and the loss of hundreds of thousands of jobs from a minimum-wage increase, the latter of which will act to increase the deficit over the same period of time.

Wages have stalled in the economy, but it’s not from the stasis in the minimum wage, which was last increased in 2009. It comes from economic, regulatory, and tax policies that tell investors that they should expect less return on their capital and penalize them for expansion. If minimum-wage increases solved the wage-stagnation problem, the 2007-9 increases should have worked. Instead, it constricted the labor markets for the people with the most need and contributed to entry-level job lockout.

In order to drive real wages and buying power up, we need policies that incentivize both investors and workers, rather than celebrating disincentives. We need to stop penalizing investment and increasing the costs of labor, rather than attempt to tell people how wonderful higher labor costs and expanded regulatory burdens will be for their businesses. We will end stagnation when we stop embracing it as the ideal.

Top Reads from The Fiscal Times: