It’s all forces to the deflation front now, except when the troops are fighting inflation. Either way, monetary policy is now the confirmed fashion as all three of the leading economies—Europe, Japan, and the U.S.—simultaneously put their faith in money supply to bring economies back into solid economic growth.

Just as the U.S. Federal Reserve steps back from its six years of quantitative easing, the Bank of Japan announces a hugely ambitious expansion of its QE program. The European Central Bank, being European, can’t quite make up its mind about its next step, even as the markets are clamoring for more than Mario “Whatever It Takes” Draghi, the ECB’s president, has so far done. Something’s going to happen in Europe soon, but we don’t know what just yet.

All in the course of a week. Where’s this story going?

Low interest rates, asset purchases, and monetary easing are weapons of mass well-being: They are good ways to get money out of banks and back into people’s hands, and hence to stimulate demand. But we can’t use easy money to buy our way out of falling demand and recession so long as fundamental economic imbalances go unaddressed—as they have in all three of the zones we’re talking about this week.

Related: Europe Faces Anti-Austerity Mutiny as Crisis Looms

In the U.S., the Fed’s decision to terminate its “QE3” asset purchases, announced last week, was a long time coming. Janet Yellen, bringing the Fed into politics as never before, made it abundantly clear she would not move until unemployment tipped below 6 percent.

It just has, for the first time since 2008, and is one of many signs that the U.S. recovery is consolidating. Time for the Fed to step back, the logic runs.

No, it isn’t. Narayana Kocherlakota, president of the Minneapolis Fed and the sole dissenter in the Fed board’s 9-to-1 decision last week was right. Inflation hawks notwithstanding, prices in the U.S. rose by a measly 1.5 percent over the past year. “The long time we’ve spent below the 2 percent [target] is creating its own momentum,” Kocherlakota told The Financial Times.

Translation: Confidence in the recovery among consumers and business investors is not yet strong enough to get us out of Recession Valley.

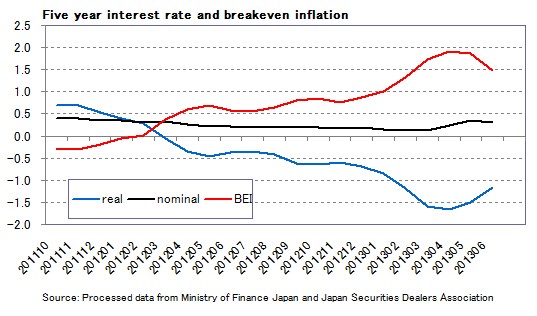

That is Japan’s problem, too. When Prime Minister Shinzo Abe and his central banker, Haruhiko Kuroda, unveiled their daring plan to inject massive funds in the economy last year, you heard applause in this space. Late last week they blew away the markets when they announced an even more powerful dose of Abenomics. As a proportion of GDP, the Japanese bond-buying program will now be four times larger than the Fed’s.

Related: How the Bank of Japan Triggered a U.S. Stock Rally

(Kuroda, incidentally, now shares Draghi’s middle name. “We will do whatever it takes to achieve our price target,” he said, referring to the 2 percent inflation goal Japan has also set.)

Abe and Kuroda are correct to stay the course. Ken Courtis, a longtime Japan watcher formerly of Goldman Sachs Tokyo and now chairman of a global commodities concern, sees the yen dropping to a startling 140 to 150 against the dollar, from 112 at the moment. Not surprisingly, big export stock such as Hitachi and Toyota led the 5 percent jump in the Nikkei average last Friday.

Once again, good stuff -- but not enough of it. Consumer prices are falling again, hit recently by an increase of 3 percentage points in Japan’s politically sensitive consumption tax.

“Relying on exceptional monetary policy and systematic increases in private and public sector debt, while avoiding deep structural reforms, is a strategy for failure,” Courtis wrote in The Globalist over the weekend. I don’t buy Ken’s list of reforms, but the thought certainly applies.

Now for those faint-of-heart Europeans. In the last few months Draghi has dropped interest rates to near-zero—and one, on deposits from banks, below zero. Two weeks ago the ECB began buying some types of bonds and will start purchases of asset-backed securities, or ABSs, by yearend.

So far it hasn’t been enough. Many people in the market want to see the ECB begin its own quantitative easing program.

Let’s hope they get their way.

Related: Fed Ends QE3 Signaling Confidence in the Economy

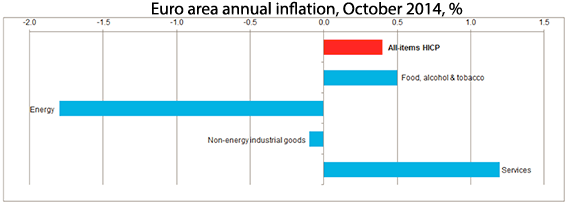

It’s a hard call for the moment. There’s a rate-setting meeting due this Thursday, and the odds are that Draghi will use the October inflation report—it came in at 0.4 percent, up from 0.3 percent in September—to duck the fight with Europe’s inflation hawks and leave rates alone for now.

Europe shapes up as a similar case. Draghi is right, and the inflation-obsessed Bundesbank is fighting the wrong war. But Draghi can’t win the eurozone’s fight against deflation by himself, just as no other central banker will win his or hers.

In my view, the elephant in the room no one wants to talk about is the drastic drift toward income inequality that proceeds apace as we speak. Somebody should distribute free copies of Thomas Piketty’s Capital in the twenty-First Century, to any economic policy planner who wants one.

It is simple arithmetic that recovery strategies reliant on monetary policy will be of limited success so long as wages are not rising. Look at the inflation-adjusted numbers: U.S. wages have been flat for 35 years; in the eurozone, they are increasing at even less than the inflation rate. Ken Courtis estimates that wages in Japan will drop 9 percent between 2013 and end-2015.

Netting it out, you get floods of liquidity, but it flows into the markets or corporate treasuries, where it sits until CEOs are confident consumer demand will sustain such that they should invest in new equipment. And demand ticks up marginally, if at all, until people can earn more.

Related: Why Hasn’t the Unemployment Rate Fallen in Half the States?

This is why job numbers cannot be taken at face value. The jobless rate in the U.S. is back to pre-recession levels, fine, but every reader of this column knows people, sometimes many, who are back to work in lower-paying positions. (I just bought a piece of clothing at Hammacher-Schlemmer from a floor salesman who used to be a chemicals executive covering a big chunk of the Northeast. Tell me what you think his outgoings look like these days.)

Everyone in Europe, the U.S., and Japan, from the 1 percenters on down, would be better off if we had a politics that set ideologies aside and made rebalancing our economies a priority.

Then our various easy-money efforts would power us on but good. And the threat of inflation—cake relative to deflation’s dangers—would return to haunt us to our perverse delight.

Top Reads from The Fiscal Times: