The fourth quarter earnings season has been rare disappointment so far.

For years, investors have expected nothing but good news. Management would do their best to lower expectations, only to provide upside surprises as the numbers were released. Corporate profits zoomed consistently to new record highs pretty much every quarter.

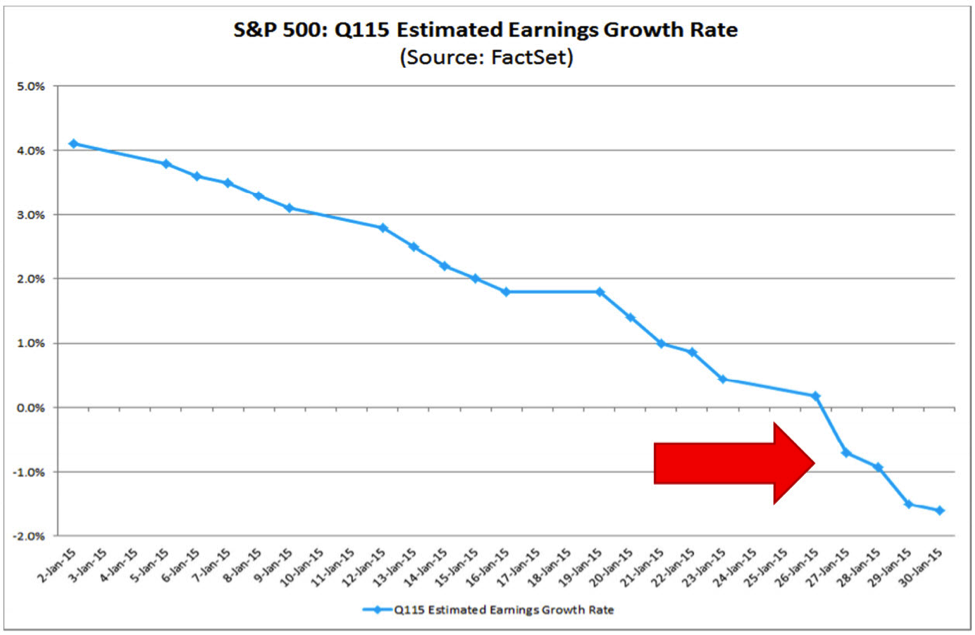

Maybe not this time. Analysts still expect the S&P 500 companies to post record earnings per share in 2015, but forecasts for the overall earnings growth rate for the fourth quarter have come down. The slowdown in earnings — and now, economic growth too — could cast a pall over the stock market's performance through the rest of 2015.

With nearly half of the S&P 500 companies having reported fourth-quarter earnings so far, the overall growth rate is 0.3 percent excluding Apple (NASDAQ: AAPL) and its exceptional results, according to FactSet. (Including Apple’s blowout quarter, the rate is 2.1 percent.) Unless earnings from an unusually high number of companies fall short of expectations in the coming weeks, the S&P 500 is still on track to post its eighth straight quarter of year-over-year earnings growth. But analysts now expect the streak to end there, as the outlook for the first quarter of 2015 has turned negative. Disappointing announcements by heavyweights like Microsoft (NASDAQ:MSFT), United Technologies (NYSE:UTX), Caterpillar (NYSE:CAT) and Procter & Gamble (NYSE:PG), among others, have weighed on results and 2015 expectations.

Related: 2015 Already Looks Like Trouble for the Markets

Slowdowns throughout Europe and Asia and a drag on foreign earnings from a stronger dollar have played a role, as has the nearly 60 percent decline in oil prices (and the resulting slowdown in energy sector capital expenditures). Tech companies have been hit by Microsoft's dour outlook on PC sales based on a downtrend in new Windows 7/8 licenses and the potential for an underwhelming reception for the upcoming Windows 10 release.

As a result, analysts are now looking for first-quarter S&P 500 earnings per share growth of just 0.1 percent, down from 4 percent at the start of the quarter, while revenues are expected to drop 1.9 percent vs. growth of 1.6 percent that was expected just a few weeks ago.

In other words, earnings are stalling.

Economic growth is slowing in the U.S. as well, with the first estimate of fourth-quarter GDP growing at a slower-than-expected 2.6 percent annualized rate, shy of the 3.2 percent consensus estimate and the 5 percent growth posted in Q3. A slowdown in business investment, no doubt related to the collapse in oil prices, was to blame, even as consumers picked up the pace of their spending.

All this presents a problem for stocks going forward.

Related: How Plunging Oil Prices Could Create Economic Upheaval

The combination of earning and how much investors are willing to pay to get exposure to those earnings forms the classic price-to-earnings multiple used to get a valuation on stocks. It provides a reference point for investors, telling them when a stock is cheap, when it's fairly valued and when it's overpriced.

Like so much in life, there are no hard and fast rules. Stocks that are expensive can get more expensive and stay that way for a long time, and vice versa. As a rough guide, a P/E multiple of 15 is considered fair value, but that will change, sometimes dramatically, based on the earnings growth rate and earnings volatility of a company.

So, all else equal, a stalling of earnings suggests that stock prices could hit a wall in the months to come — at least until earnings growth can reaccelerate.

That's the takeaway from research by Deutsche Bank strategist David Bianco. He sees S&P 500 earnings per share finishing near $117.50 for full-year 2014, which would mean that the market is trading at a multiple of 17.1 times earnings.

To get to his year-end S&P 500 target of 2,150, which represents a gain of about 7.5 percent from here, he forecasts earnings per share growth of about 3 percent this year. The gap between predicted stock market gains, and the slower pace of earnings growth, would push the P/E multiple to 17.8.

Not until 2016, under Bianco's outlook, would multiples start to come back down as earnings growth revs up and stock price gains slow slightly.

Related: The Dark Shadow Hanging Over the Economic Recovery

So, is this realistic?

Theoretically, there is nothing stopping stock prices from rising if people want to pay up regardless of valuations. Investor sentiment is always the "X' factor for which there is no model or tool to predict.

In reality, it will certainly depend on a number of hurdles being cleared. These include a resolution to the debt standoff in Europe between the new government in Greece and the hardliners in Germany, a lack of volatility should the Federal Reserve raise rates as expected later this year, no further escalation of the situation in Ukraine and stabilization in energy prices, among other factors. A continuation of recent U.S. job gains would be a precondition as well.

The good news is that research from Barclays Capital suggests that the recent collapse in energy prices could help juice GDP growth in the second half of the year — something that would help lift corporate earnings. They looked back at five similar episodes of oil price declines over the last 30 years and found that while typically associated at first with a slowdown in economic growth, a positive growth response followed with a two- to three-quarter lag.

Related: More Americans Say Thumbs Up on the Economy

The analysts are confident of this based on evidence that the oil price drop is largely a function of oversupply and thus is not indicative of a deeper collapse in global demand that could jeopardize an economic rebound going forward. This is based on the fact the crude oil's fall far outstrips pullbacks in agricultural, metals and mineral commodities.

Time will tell if this optimism on stocks, earnings and economic growth is well founded and develops into a second-half bounce. For now, though, the selling pressure that threatens to take stocks back to their mid-October lows looks set to continue in the short-term as the Q4 earnings season rolls on and the S&P 500 threatens to fall through support at its 125-day moving average, as shown above.

Top Reads from The Fiscal Times: