Wall Street has been eerily quiet in recent months.

Sure, there has been excitement over the ups and downs of biotech stocks, the launch of Apple's smartwatch and earnings surprises, like the one from Microsoft (MSFT), or disappointments, like the one from Twitter (TWTR). Yet the general climate has been about as exciting as the Mayweather vs. Pacquiao fight. As in, not really that exciting at all.

That looks set to change.

The stasis in stocks has been created and maintained by what seems to be the only market-moving catalyst these days: The Federal Reserve. The last dramatic move was back in late October as Fed officials talked up the possibility of another round of bond-buying stimulus after the market tanked on Ebola fears. Since then, it's been a lot of back and forth on the timing of the Fed's first interest rate hike since 2006. June was seen as the soonest action would be taken.

Now the futures market doesn't expect a move until September at the earliest. Economic data has been missing analyst expectations at a pace not seen since 2011, including a disappointing March payroll report, a lack of solid wage inflation and below-target inflation. That has traders believing Fed Chair Janet Yellen and her cohorts will be forced to wait.

We'll know better on June 17, when the next Fed policy statement and economic projections are released, and when Yellen holds her quarterly press conference. But recent chatter suggests officials are concerned about macro weakness as well as the drag on the economy from the dollar's newfound strength — a factor that pushed the March trade deficit to its worst level in more than six years.

Related: Trade Gap Means the U.S. Economy Shrank in the First Quarter

Bond traders aren't waiting, pushing down Treasury bond prices and pushing up long-term yields as market-derived inflation expectations rise with a ferocity not seen since 2013. The 10-year yield is threatening to cross its 200-day moving average for the first time since early 2014, hitting 2.2 percent on Tuesday from a low of 1.7 percent in February. There has also been a lot of chatter about the rise in Eurozone government bond yields, with the German 10-year yield pushing above 0.5 percent after touching a record low of 0.05 percent less than two weeks ago. High-yield corporate bonds are looking vulnerable in all this. A selloff in this area will weigh on stocks in a big way via all kinds of linkages, such as the flow of debt-funded share buybacks and interest expense.

“We are witnessing the first, potentially major, signs of the air coming out of the bond bubble,” Peter Boockvar, chief market analyst at the Lindsey Group, wrote Tuesday. “The U.S. bond market is not waiting around for the Fed to hike rates, it is doing it themselves.” Commodities have also been doing well in recent weeks, corroborating the "inflation is coming" message of bonds.

Remember that bonds, overall, have been in a bull market going back more than 30 years — and that run could be set to end, not by the Fed's direct actions, but by the "success" of its desire to boost both growth and inflation.

Related: What’s Really Driving Stocks to Record Highs

Ironically, a rebound in inflation driven by a continuation of ultra-easy monetary policy — both here and across Asia and Europe — could drop stocks out of their comfort zone. That's because rising inflation expectations will keep lifting long-term interest rates even if the Fed holds short-term rates near zero into 2016. Remember, the Fed only maintains control of very short-term interest rates; long-term rates are still determined by the market.

The specter of higher inflation, which is the only thing that would stop the flow of cheap money stimulus at this point, is giving stock traders pause. Equity market breadth is breaking down here in an ominous way, setting up a potential short-term correction to test the December-February lows. As shown in the chart above, the percentage of S&P 500 stocks that are in uptrends has started to fall again, returning to levels not seen since February. That's a sign fewer and fewer stocks are supporting the market at current levels, indicative of underlying vulnerability and a lack of value.

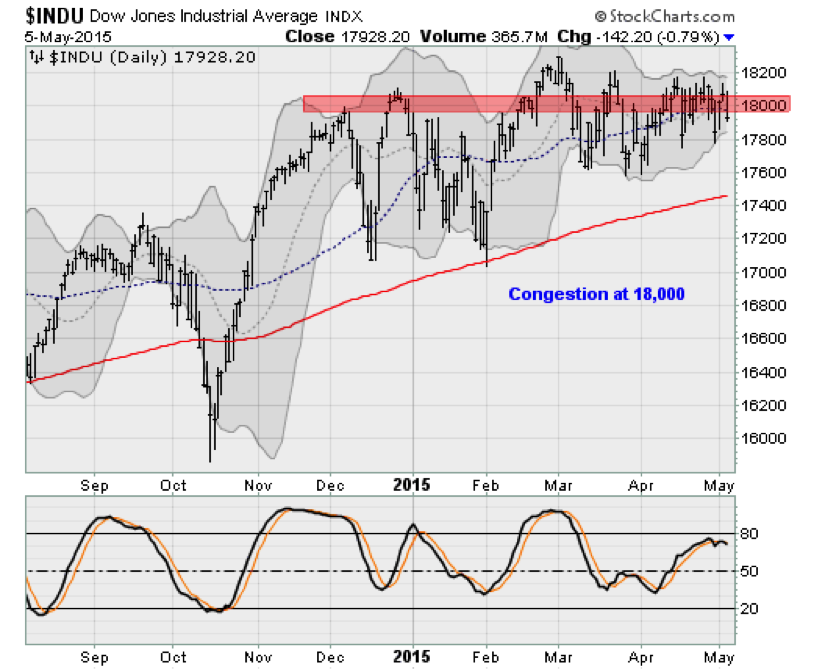

Technically, the Dow is at risk of dropping down and out of its tight three-month trading range, which is itself part of a long sideways pattern going back to the rebound out of last October's big selloff.

The 18,000 level — which was first passed to great fanfare back in December — has proved an intractable obstacle for the bulls. They've had six months to break free. Now, it looks like the stock bears are about to take control again as their cohorts in the bond market provide covering fire.

Top Reads from The Fiscal Times: