For the stock market, perception is reality.

So despite the fact that the Dow Jones Industrial Average is still mired in a trading range near the 18,000 level it first reached in December — an eight-month long stasis — the focus is on the surge in the Nasdaq Composite to its third straight record close on Monday.

This latest high was mainly driven by better-than-expected earnings from Google (GOOG) last week. The search giant’s stock soared 16 percent on Friday after beating earnings per share estimates by 4 percent thanks to widening profit margins — an area of concern for investors recently — as well as a rise in paid ad clicks. Optimism is also building for results from Apple (AAPL) after the close on Tuesday.

But beneath the surface, the situation is more vulnerable than it seems: By one measure, the Nasdaq is getting ahead of itself in a way not seen since just days before the dot-com bubble burst.

Related: Boomers, It's Time to Cash Out of This Bubble

Greece is "fixed" for now, so let's talk about the fundamentals. Earnings expectations overall remain challenging. According to FactSet data, the S&P 500's blended earnings growth rate for the second quarter improved but remains at -3.7 percent vs. -4.4 percent last week and the 4.5 percent decline expected at the end of the quarter.

Apple, because of its huge market capitalization and weighting in the major averages, will obviously be the center of attention this week. The company is expected to report earnings of $1.80 per share compared to $1.28 last year. It's also expected to be the largest contributor to earnings growth for the Information Technology sector for the second quarter.

Without that lift from the team in Cupertino, overall earnings for the sector would decline 6 percent over last year, according to FactSet data. The performance is driven largely by the success of the last two iPhone refreshes — raising the stakes for the "iPhone 6S" lineup later this year.

An uptick in consumer price inflation on Friday has also increased the odds the Federal Reserve will raise interest rates for the first time since 2006 come September. This is likely to impact the stock market by raising the cash discount rate and slowing the flow of debt-funded corporate buyback programs, a major source of buying support for stocks in recent years.

On Monday, St. Louis Federal Reserve President James Bullard said there was more than a 50 percent chance of a September rate hike. He added that he is worried investors have been "reaching for yield" in this low rate environment — scrambling for higher returns by making questionable investment decisions.

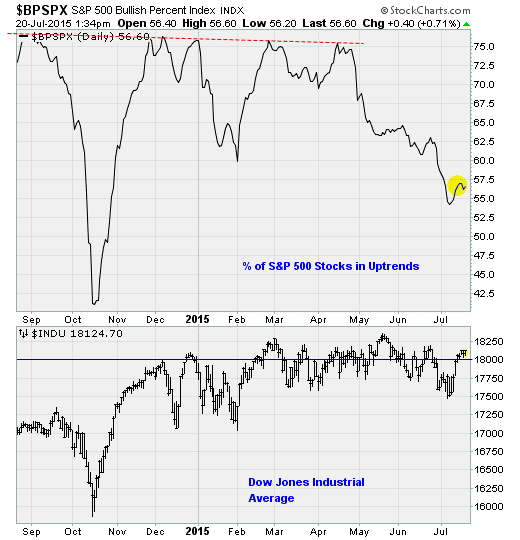

Technically, breadth remains a point of concern. The chart above shows how the percentage of S&P 500 stocks in uptrends remains depressed and well off the highs seen as recently as April — 56 percent now vs. 75 percent then — while stock prices remain largely unaffected. This is a sign of narrow buying interest. And it's a sign of underlying vulnerability.

Jason Goepfert at SentimenTrader notes that only a handful of stocks pushed the Nasdaq to its new highs; there were more declining issues than advancing ones on Friday, which is admittedly pretty odd.

On the Nasdaq 100, this was only the second time that the index was up 1 percent or more to a new 52-week high amid net declining issues. The other day was March 23, 2000, just days after the dot-com bubble peaked.

Related: Investors’ Cash Holdings Highest Since Lehman

No wonder then that according to the latest BofA Merrill Lynch Global Fund Manager Survey, cash levels jumped to 5.5 percent, the highest since December 2008 and prior to that, 2001. The investment pros are battening down the hatches.

Anthony Mirhaydari is founder of the Edge and Edge Pro investment advisory newsletters. A two-week and four-week free trial offer has been extended to readers of The Fiscal Times. Clink the links above to sign up.