Equities seem unshakeable.

It's been nearly four years since the S&P 500 has suffered a 10 percent correction — the third longest run since 1960. Investors are complacent, with Deutsche Bank Chief U.S. Equity Strategist David Bianco (one of Wall Street’s most bearish forecasters for much of 2014) now estimating we're moving into mania territory last seen in late 2007 and early 2008, based on the ratio of the price-to-earnings multiple and the CBOE Volatility Index. Valuations are high, with the Shiller cyclically adjusted price-to-earnings ratio at levels that were only seen during the 1929 and 2000 market bubbles.

By an alternative measure, the median price-to-earnings multiple for U.S. stocks, equities have never been this expensive in the post-war era. As I'll explain below, that makes this the perfect time for smart baby boomers to cash out.

Related: 7 Quirky Economic Indicators – from Dogs to Guns

Unless the global central banks have uncovered the policy equivalent of the philosopher's stone — creating wealth out of thin air — the boom will not last forever. Like death and taxes, the business cycle cannot be avoided. Economics is a social science; the study of man's propensity to make poor decisions when it comes to buying and selling, saving and borrowing.

Booms lead to malinvestment, overcapacity, narrowing profits, and eventually, default and losses. It's inevitable. The movement of interest rates can control the flow but cannot stem the tide. Otherwise, monetary debasement would've saved the Roman Empire instead of precipitating its fall.

This bull market will eventually end.

Timing is critical but impossible to predict. Will a Greek exit from the Eurozone trigger a crunch? What about the long awaited interest rate liftoff from the Federal Reserve? Or a Chinese debt-default problem, amid tightening margins, over-indebtedness and falling prices? How about the ongoing softness in U.S. GDP growth? Or the recent upward pressure on long-term interest rates as traders price in the rise of inflation and the potential end of the 30-year bull market in bonds?

Related: Bond Market Is Sending the Fed an Important Signal

The signs of froth are clear to those without rose colored glasses. Fed Chair Janet Yellen recently warned that stock valuations are "quite high" while former chairman Alan Greenspan said stocks are "without doubt extremely overvalued." Mark Cuban recently explained why the current bubble — led by private investors throwing money at app developers and small tech outfits — is worse than anything seen in 2000.

The debut of money-losing IPOs is at a level not seen since the dot-com boom. CB Insights currently lists 108 U.S. startups with a valuation of $1 billion or more — most of which are nowhere near profitability. Uber's valuation soared from $17 billion to $40 billion within six months as it changes gears from taxi industry disruption to a play on autonomous vehicles. Biotech and energy sector valuations have gone orbital.

Fundamentals just don't seem to matter anymore.

The chart above shows how the S&P 500 has been ignoring the collapse in U.S. economic data relative to expectations. The Citigroup Economic Surprise Index has dropped to lows not seen since 2011. The Fed's policy response logic — no growth equals more cheap money — has investors hypnotized…and ignoring the fact, noted by HSBC analysts, that the global economy could be headed for a new recession with central banks already at full throttle.

The Fed has had short-rates near 0 percent since 2008. Just imagine what would happen if central bankers lost their veil of omnipotence?

After all, the cost of credit was never the problem. A lack of demand fueled by the hollowing out of middle-class wages — and the reliance on credit and asset price inflation as Americans families struggled to stay ahead — has been and remains the gist of what ails us.

Demographics will bring this into sharp relief soon as boomers try to cash out for retirement and find jobless or underpaid/overindebted millennials unable or unwilling to buy their homes and their stock portfolios at current prices.

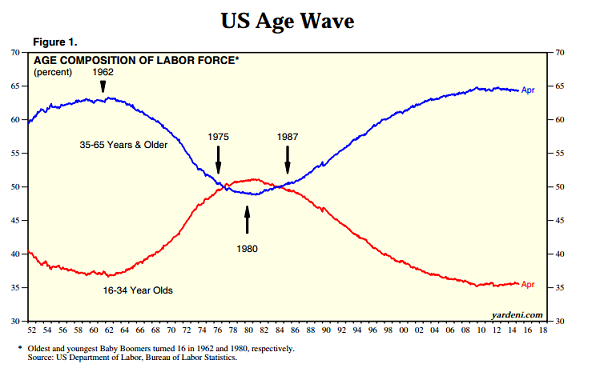

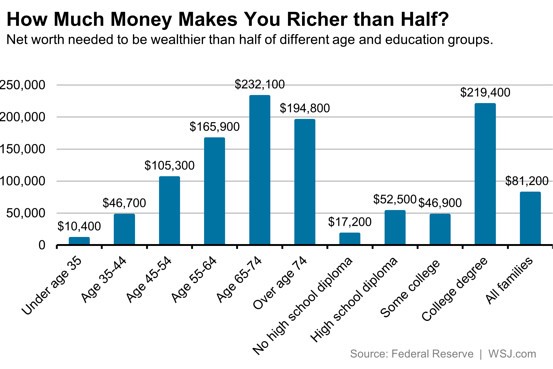

The chart above, from Yardeni Research, suggests the American "Age Wave" is about to withdraw as more boomers age out and the smaller Gen X cohort take their place. According to Pew Research, this is the year millennials will overtake boomers as the nation's largest living generation. The chart below, from The Wall Street Journal, sums up the problem: Millennials simply don't have the financial firepower to cash out Boomers. Not even close. The supply-demand imbalance suggests stock prices will need to fall in the years to come.

The smart money is already getting nervous, as evidenced by the recent pullback in market breadth.

Related: Why Even Rich Millennials Are Financially Insecure

Jason Goepfert at SentimenTrader notes that while the S&P 500 pushed to a new all-time closing high last Thursday, only 10 percent of its component stocks were trading at even a four-week high; and nearly 3 percent of its components were trading at a four-week low. The net difference of 7 percent is one of the weakest readings of the past 25 years.

All of this is coming as stocks push deeper into the weakest time of the year on a seasonal basis — "Sell in May" and all that — as summer approaches. Boomers, ask yourself: How much better can things get?

Top Reads from The Fiscal Times: