It wasn't supposed to be like this. The unemployment rate has fallen to 5.3 percent. Survey data show businesses are having a harder time finding workers. By various metrics, the labor market is tightening.

The last piece of the economic puzzle — an acceleration of wage inflation — seemed just around the corner.

Yet on Friday, economists were shocked that the Employment Cost Index report for the second quarter showed its weakest growth — at 0.2 percent quarter over quarter — in the 33-year history of the report. On an annual basis, wages and salaries are growing at just a 2.1 percent rate.

Related: You’re Richer Than You Think. Really.

This dramatic slowdown in wage inflation, which admittedly could be a one-off fluke, flies in the face of other data showing a rapid reduction in labor market slack. Weekly jobless claims fell to 255,000 during the week of July 18, the lowest since November 1973. Job openings totaled 5.4 million in May, the highest on record. And the ratio of unemployed workers to job openings in May was 1.6, the lowest since September 2007.

Moreover, survey data cited by Deutsche Bank show that companies have been planning to raise worker compensation at a pace that would suggest wages should be growing at closer to a 3 percent annual rate.

In looking for an explanation for the dissonance, Oxford Economics notes that the ECI was boosted in the first quarter by strong bonus payouts. Still, the slowdown is enough to question whether the Federal Reserve will move ahead with rate hikes at its September policy meeting.

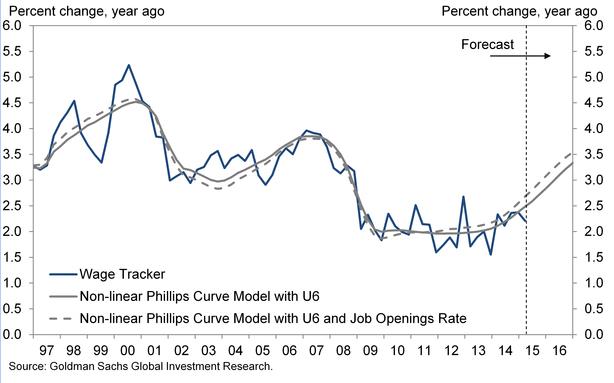

For clues, Oxford’s analysts suggest keeping an eye on the Atlanta Fed's wage growth tracker for clues as to whether this slowdown in pay raises is actually happening. The measure currently suggests wages are growing at a 3.2 percent annual rate. Perhaps this explains why St. Louis Fed President James Bullard said on Friday afternoon that he was not concerned about the weak reading in the Q2 ECI report and that the economy is in good enough shape for a possible September rate liftoff.

Related: The Pain the Job Numbers Don’t Show

Jim O'Sullivan, chief U.S. economist at High Frequency Economics, believes some of the slowdown can be blamed on volatile commission pay. Wages for private workers excluding incentive pay occupations grew at a 2.0 percent annual rate, an increase from the 1.8 percent rate seen last year. Given that wages are a lagging indicator, and the unemployment rate is still trending lower, higher pay is likely still in the pipeline. Earlier this month, Jan Hatzius, chief economist at Goldman Sachs, estimated that wage growth will reach upwards of 3 percent by the end of the year and the economy will hit its full-employment level of about 3.5 percent by the middle of 2016.

We'll know more about the labor market situation when the July jobs report is released on Friday. Until then, let us know in the comments below if you’ve seen any indication that higher pay is on the way.