As the stock market selloff deepened this week, one-time high fliers such as Disney (DIS), Apple (AAPL) and Tesla Motors (TSLA) are joining the growing list of stocks tipping into downtrends.

After Thursday’s losses, 121 members of the S&P 500 are now down more than 20 percent from their highs, qualifying for their own individual bear markets. As I write this, the selloff is continuing on Friday, with the Dow down another 122 points.

One-time bastions that held the indexes aloft, despite the multi-month deterioration in market breadth measures, are beginning to buckle under the pressure. Just look at biotech stocks: The iShares Nasdaq Biotech ETF (IBB) closed below its 50-day moving average for the first time since early May.

If stocks like Amazon (AMZN), Facebook (FB) and Microsoft (MSFT) succumb to the selling, watch out below. Currently, only 52 percent of the stocks in the S&P 500 are in uptrends, well off the high of 75 percent seen in April.

Related: U.S. Stocks Can’t Keep Shrugging Off Global Pressures

Don't think the hype can die? Just take a gander at what's happening with Keurig Green Mountain (GMCR), which dropped another 30 percent Thursday and has fallen nearly 70 percent from the highs set late last year on disappointment with its 2.0 machine.

Aside from disappointing earnings, traders are growing increasingly nervous about the specter of higher interest rates. Friday's non-farm payrolls report came in as expected with 215,000 jobs created and the unemployment rate holding steady at 5.3 percent (but driven more by job gains rather than those dropping out of the labor force, which is a better result). Given all the evidence of continued tightening in the labor market, this further raises expectations that the Federal Reserve will raise interest rates for the first time since 2006 in its Sept. 17 policy announcement.

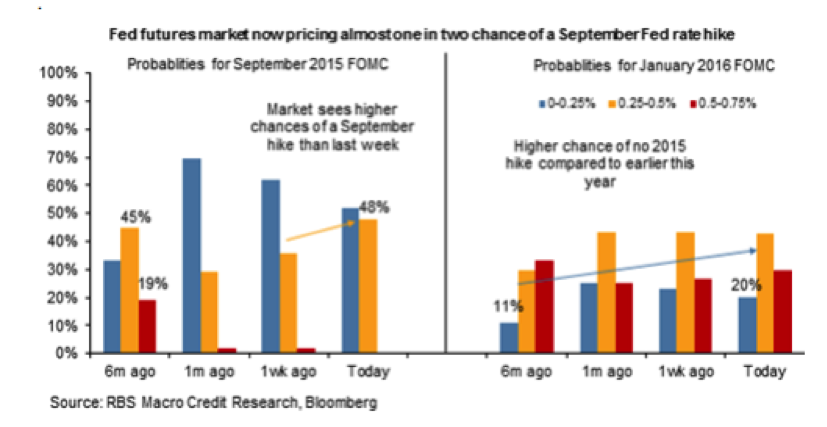

The futures market has been downplaying the chances of a September rate liftoff, but the flow of economic data and comments from Fed officials has forced a reevaluation. Folks realized, as shown in the chart above from RBS, that they were opening the door to a big negative surprise if Fed Chair Janet Yellen actually pulled the plug on eight years of 0 percent interest rates.

Related: The Job Market Is Hot…So Where’s Your Raise?

The increasing preparation for a rate hike explains the general sense of malaise in the financial markets in recent weeks, with commodities, high-yield bonds and foreign stocks taking the brunt of the damage so far. But the contagion is spreading as investors feel the sting of fear.

Similar to the rout in Chinese markets, driven by margin calls and forced selling, a Fed-fueled turnabout could get ugly in a hurry as years of low volatility — courtesy of the true faith in the omnipotence of Fed policymakers in protecting stock market gains — have squeezed mutual fund cash levels to extreme lows.

Fund redemption requests would result in forced selling into an illiquid market dominated by predatory high-frequency trading algorithms. Remember that market history teaches us volatility cannot be contained, only delayed. Like a spring compressed, periods of market calm store up potential energy that can explode at any time.

Anthony Mirhaydari is founder of the Edge and Edge Pro investment advisory newsletters. A two-week and four-week free trial offer has been extended to The Fiscal Times readers. Clink the links above to sign up.