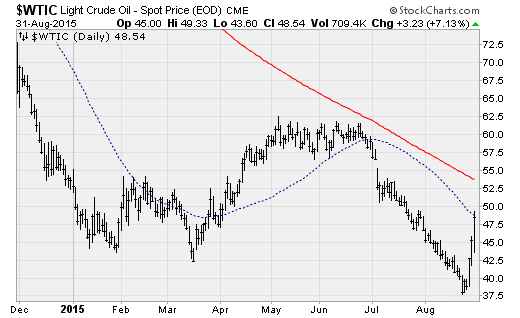

Crude oil has enjoyed an epic reversal in recent days, with West Texas Intermediate rallying from a low of $37.75 during last week's market volatility to close above $47 a barrel on Monday — a rebound of nearly 28 percent.

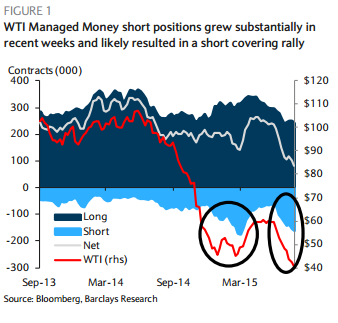

Since falling out of a multi-month trading range in late June, the black stuff had suffered a 39 percent decline driven by a combination of supply and demand issues. On the supply side, the ongoing price war between U.S. shale producers and Saudi Arabia, as well as elevated inventories, were the main factors. On the demand side, the approach of the end of the peak summer driving season, concerns over China and refinery outages were to blame — in what looks like a prototypical short-covering surge.

Related: The Troubling Truth Revealed by the Stock Market’s Nosedive

Is the surge of the past week a sign the fundamentals are starting to change? Or is this another price rebound destined to fade?

Monday's 11-plus percent intraday swing — the biggest bounce since 1990 — was spurred by reports that OPEC officials are growing concerned about continuing price pressure, which they blame on higher production and market speculation, and getting worried that future investment will be slowed by lower prices. They claim to be prepared to talk with all crude producers about the market situation as long as talks take place "on a level playing field."

Also playing a role was revised U.S. government data showing that domestic production was lower than previously reported in the first half of the year. The Energy Information Administration said production was just below 9.3 million barrels per day in June, down by 100,000 barrels from its revised May figure. This is down nearly 250,000 barrels a day from what the EIA had estimated a few weeks ago.

But Citigroup analysts say those fears won’t make this a lasting run.

For one, the OPEC headline in their judgment was a "gross misrepresentation" of the cartel's bulletin statement. With nearly all OPEC officials still on holiday along with a lack of further reporting on any actual policy change, Citi’s analysts suggest nothing substantive has happened in Riyadh.

Related: 6 Reasons Gas Prices Could Fall Below $2 a Gallon

Furthermore, they don't believe any non-OPEC producer would want to commit to a production target with the sheiks in the first place. Both Russia and Mexico — the likely candidates for such an arrangement — have issues. Russian production is ramping up because of a weak ruble while Mexico is trying to push through energy sector reforms. And U.S. oilmen view the Saudis as mortal enemies. Plus, regulators would frown upon any production arrangement anyway.

If there won’t be any talks, there likely won’t be any production cut. OPEC would be the loser in any unilateral cut. The U.S. rig count increase in the third quarter of the year, after the oil price bounce of the previous quarter, shows the resiliency of the American shale oil patch, with talent and equipment still in place. Citigroup believes that it will take years of low prices to take away the threat of a quick U.S. production rebound in response to higher prices.

On top of all that, OPEC has an internal problem, with more than 1.5 million barrels a day of incremental supply due to come online over the next 15 months from Iran and Iraq.

Analyst Miswin Mahesh and team at Barclays Capital also worry prices could come under new pressure from an acceleration of crude inventory building later this year. They highlight the risk that OPEC fails to cut production fast enough to offset broader-than-usual refinery maintenance shutdowns due to start in late September.

Once the short-term rebound fizzles out, potentially in the context of the Federal Reserve’s September decision on hiking interest rates, oil should cheapen once again and continue to dampen the inflation outlook heading into 2016. If the Fed holds fire in its Sept. 17 policy announcement, renewed crude oil weakness could very well help push rate hikes into 2016.