Crude oil prices are tumbled 2.9 percent Wednesday to close at $36.76 a barrel after inventory data released Tuesday afternoon showed a stockpile build of 2.9 million barrels, far ahead of expectations.

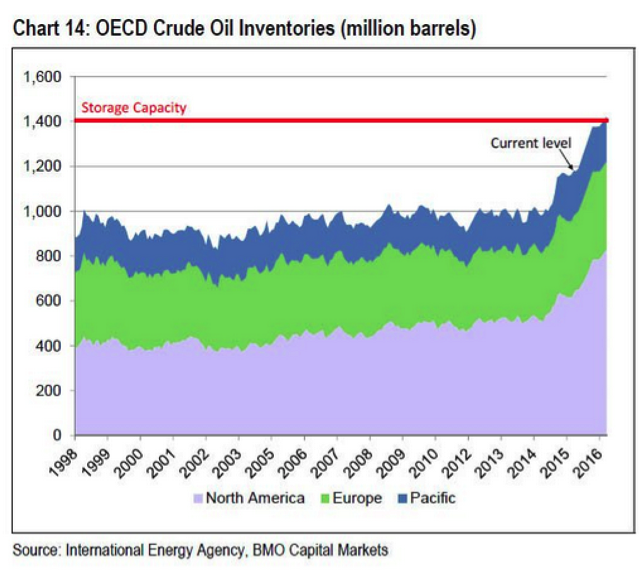

Adding additional pressure were comments from Saudi Arabia's energy minister that his country's oil output strategy is "reliable" and won't be changed. Other wrinkles include rising U.S. oil production and the fact that global crude storage is quickly approaching capacity. Seasonally, stockpiles tend to drop at the end of the year and rise in the first few weeks of the New Year due to tax implications.

A repeat in early 2016 could well push crude oil to fresh closing lows not seen since the early 2000s. While that's great for American drivers, the costs to investors, oil workers, OPEC countries and others are starting to mount and make this a potentially destabilizing force for the global financial system.

Related: 10 Things That Will Cost Less in 2016

Remember that deflation mixed with high indebtedness is the stuff of nightmares since it precipitates the debt-default spiral economist Irving Fisher warned of in the maw of the Great Depression.

That's exactly what's threatening the U.S. shale industry, and by extension, the entire U.S. bond market. The Barclays High Yield Bond ETF (JNK) recently traded down to levels first reached in 2012 and is down more than 11 percent from its 2014 high — a stomach punch wiping away years of dividend payouts for conservative fixed-income investors.

Energy stocks as represented by the Energy Select SPDR (XLE) are down 38 percent from their 2014 highs. And because of the drag from the decline in energy sector profits, S&P 500 earnings growth is on track for a third consecutive quarterly decline — something not seen since the financial crisis.

A "tank tops" — a situation where oil storage capacity is maxed out — is looking increasingly likely. According to Goldman Sachs analysts, avoiding this outcome will require rapid production cuts driven by financial stress and funding cuts for the weaker shale players.

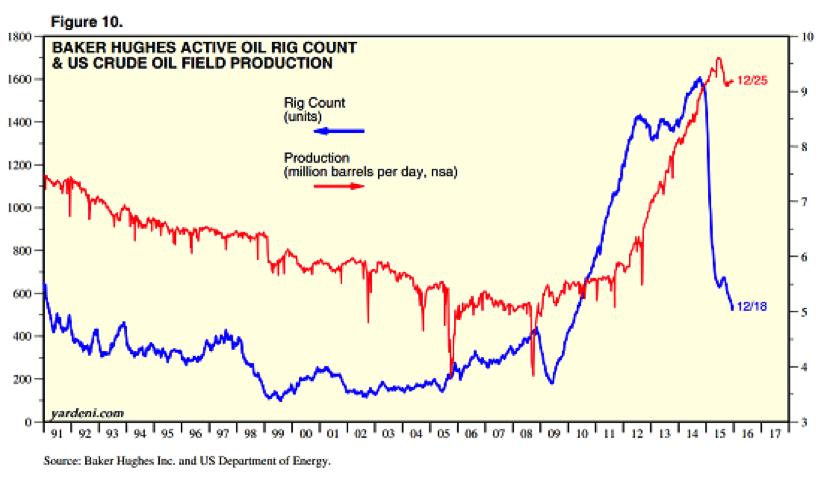

That's just not happening. While U.S. drilling rig counts have fallen sharply, production is barely off its recent high as shale producers have focused on low-cost wells. As credit costs rise, thanks to the Federal Reserve's rate hikes, the incentive will be for U.S. producers to pump even more — despite the lower per barrel price — to try to cover increasingly expensive financing costs.

Goldman's warning: Oil may need to fall to near $20 a barrel to force production cuts. Defaults and bankruptcies will follow, further widening junk bond spreads in the energy industry, further increasing credit costs and accelerating the pump-more-to-survive dynamic.

The International Monetary Fund also called attention to the $20-a-barrel level by warning the return of Iranian crude oil to world markets — a consequence of the end of economic sanctions — could push prices down by $5 to $15 from current levels.

Related: As OPEC Loses Control, There’s a New Power in the Oil Market

Many are already feeling the heat. Homeowners in the U.S. shale oil regions of Texas and North Dakota are watching in horror as sales slump and prices drift lower. Saudi Arabia, under budgetary pressure, is risking social unrest by dialing back its welfare state with measures like raising price-controlled fuel prices by 50 percent.

Unless global energy demand accelerates even faster than it already is, the extra supply will push energy inventories to the brim. Tank topping will dump millions of barrels that could've been sold down the futures curve into the cash market, swamping prices.

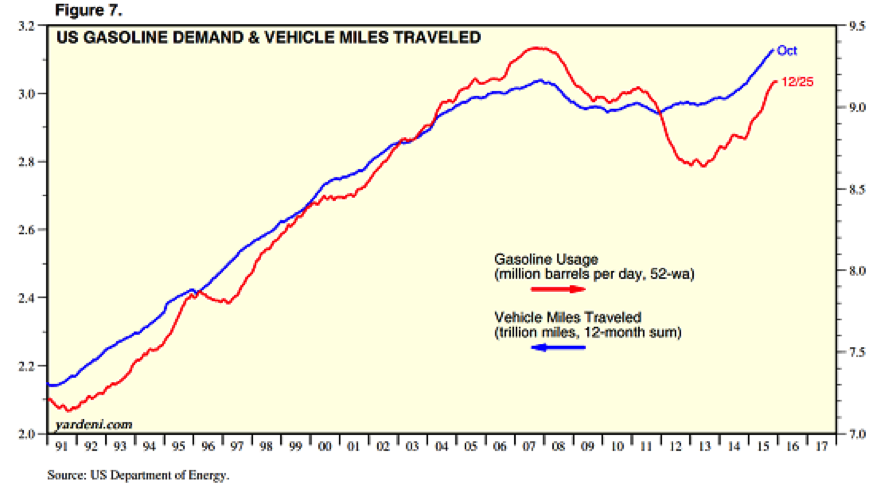

The thing is: Cheaper prices have already encouraged American (as well as Chinese) drivers to indulge in road trips and increase their gasoline consumption.

But more stringent vehicle efficiency standards and an emphasis on hybrid electrics and battery electrics have lessened the impact. Gasoline usage, as shown above, has lagged behind the increase in vehicle miles traveled.

As a result, the world is simply awash in energy, a consequence of the push to fight climate change coinciding with the shale revolution. Financial markets, hurt by falling prices for energy stocks and bonds, will suffer the consequences as this becomes increasingly clear in the months to come.