Despite Wednesday’s modest pullback, stocks have enjoyed an epic uptrend out of the Feb. 11 lows. The rise has been fueled by a powerful cocktail of hope. Initially, it was about a possible deal between OPEC and Russia to freeze crude oil supplies. More recently, it has been about the Federal Reserve backing off its previous rate hike forecast for 2016 even as evidence mounts that inflation is firming as labor market gains continue.

Now, with the index is up more than 13 percent from its recent low, there is evidence market insiders have grown increasingly nervous about the uptrend's staying power. This comes as the Dow Jones Industrial Average bumps up against an epic resistance level near 18,000 -- a level it has been contending with, off and on, since 2014.

Related: Here's Why the Crude Oil Rally Won't Last

Before Tuesday’s small decline — an understandable reaction to the overnight terror attack in Brussels — the Dow had rallied for seven consecutive sessions and 13 of the last 15 trading days. That's its best performance in more than year.

Yet according to Jason Goepfert at SentimenTrader, while this tends to be a good sign for the long-term performance of the stock market, it's a different story for the short-term outlook. Historically, the Dow fell more often than it rose in the two weeks that followed such a run, and it posted an average return of -0.3 percent.

Another indication of the overbought conditions is the fact that, for just the second time since 1990, all 30 of the individual stock components of the Dow Jones Industrial Average are trading above their short- and medium-term moving averages. Again, this tends to be a long-term positive but short-term negative.

On a fundamental basis, there is plenty to worry about.

The promised meeting between OPEC and Russia on a supply freeze has been pushed into April while the Iranians continue to demand a return to pre-sanctions output levels. With core inflation on the rise, economists up and down Wall Street are warning that the Fed's reluctance to raise interest rates so far this year will prove short-lived. And in a few weeks, the first-quarter earnings season will kick off with analysts expecting an 8.4 percent year-over-year decline in S&P 500 earnings, according to FactSet —which would represent the first four consecutive quarters of declining profitability since the recession ended.

Related: Why the Fed Might Still Shock Wall Street

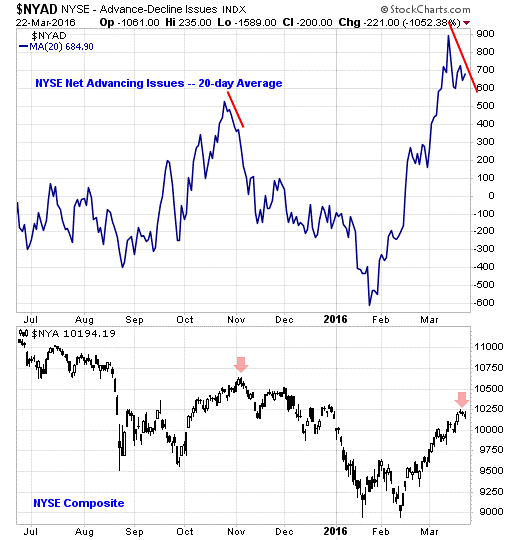

On a technical basis, there is plenty to worry about too. Breadth, or the number of stocks participating to the upside, has been eroding for weeks. There were 200 net declining issues on the NYSE on Tuesday, below the high of near 2,000 set last week but continuing a pattern of narrowing buying interest.

The chart below compares the 20-day moving average of the NYSE net advancing issues line vs. the NYSE Composite. So-called "negative divergences" like the one we're seeing now often precede market pullbacks.

No wonder then that traders are ramping up their bets on an increase in market volatility and lower stock prices. Goepfert notes that a historic surge of money has been flowing into funds that track the CBOE Volatility Index (VIX) over the past 20 days. He notes that when these traders have bet heavily on a rise in volatility in the past, "they have usually been correct."

Prior occurrences since 2013 have resulted in declines of 2.5 percent, 2.6 percent and 1.9 percent for the S&P 500 in the weeks that followed.

New research from Bank of America Merrill Lynch reveals that the bank’s clients — especially institutional and private client traders — have been aggressively selling into the rally. The bank's clients have been net sellers for eight consecutive weeks for a total of $1.4 billion. That's the longest streak since the October-December period in 2010.

At the same time, corporate buyback activity fueled by debt and balance sheet leveraging has increased to a two-year high.

Related: Here’s Why China’s Not the Global Economy’s Problem

The takeaway: With stocks overbought and corporate executives busily bidding up their own stock prices to boost earnings-per-share metrics in the face of a lull in profitability, market insiders are preparing for another downturn in prices. Prepare accordingly.

Anthony Mirhaydari is founder of the Edge and Edge Pro investment advisory newsletters. A two-week and four-week free trial offer has been extended to Fiscal Times readers.