As is so often the case, the stakes will be high for stocks when the Fed makes its latest policy announcement on Wednesday. One gets the feeling that the next move in stocks will be a 10 percent swing, up or down, depending on whether the Fed raises interest rates — or, more likely, whether it teases a June hike.

Clearly, the market response to the December rate hike, the first since 2006, didn't go as planned. The Dow Jones Industrial Average lost more than 13 percent in the weeks that followed.

Related: Are Stock Market Bears About to Get Clobbered Again?

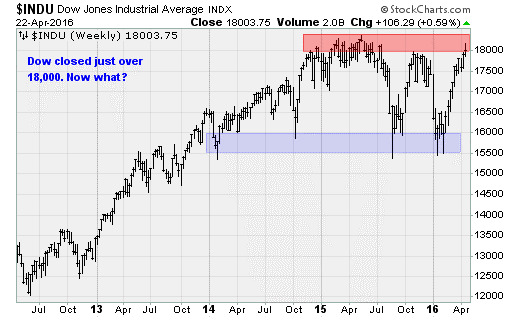

Since then, the Fed has aggressively walked back its rate hike expectations for the year: From four 0.25 percent hikes in December to just two now, closer to the futures market’s forecast for a "one and done" rate hike late this year. And that's helped push the Dow back over the 18,000 level for the first time since July, to within a few hundred points of record highs set nearly a year ago.

If the Fed is going to stick to its two-rate-hike forecast, April will need to open the door to action in June, especially given ongoing tightening in the labor market and a firming of core inflation. Energy prices have been a drag on inflation, but have recently stabilized. If prices hold near current levels above the $40-a-barrel threshold, energy prices will become a net contributor to higher inflation in less than four months.

Another factor is the upcoming presidential election. To avoid the perception of influencing voters, the Fed will want to make any moves now, go quiet during the summer and early fall and become active again at the end of the year. This suggests a move in June and again in December.

Related: Which Money Worries Keep You Up at Night?

Unfortunately, stocks don't seem ready to tolerate another increase in interest rates. Technical and fundamental headwinds remain.

The tech sector was hit with a series of earnings disappointments last week. Microsoft (MSFT) lost 7.2 percent on Friday after an earnings miss on Thursday night. Its efforts in the cloud and other areas aren't yet large enough to compensate for the weakness in the consumer PC market. Alphabet (GOOGL) lost 5.5 percent on a top- and bottom-line miss.

In other earnings news, GE (GE) lost 0.7 percent after reporting a 7 percent decline in organic orders and an 18 percent decline in organic equipment orders. Caterpillar (CAT) fell 0.4 percent after missing on earnings and revenues, reporting big drops sales to the construction, rail and energy sectors. Visa (V) lost 2.1 percent on a cut to its fiscal year revenue guidance, partially blamed on weakness in China. Starbucks (SBUX) lost 4.9 percent on comparable-store sales growth of 6 percent (vs. the 6.5 percent expected).

Related: How to See Through Corporate Earnings Accounting Tricks

Overall, the first-quarter S&P 500 earnings growth rate is expected to be -8.9 percent, which would mark the fourth consecutive quarter of falling profitability and represent the worse result since 2009.

Friday's PMI manufacturing flash activity index dropped to 50.8 vs. expectations for a 52.0 reading and a prior month reading of 51.4. Overall, the Bloomberg U.S. Macroeconomic Surprise Index, measuring how the data is coming in versus expectations — has dropped to 14-month lows. The Atlanta Fed's GDPNow tracking estimate of first-quarter U.S. GDP growth is at just 0.3 percent.

Technically, U.S. equities are contending with massive overhead resistance from a topping pattern that started back in 2014 amid narrowing breadth. With stocks from Apple (AAPL) to Amazon (AMZN) rolling over, there are fewer and fewer names holding the major averages aloft. Apple will report results on Tuesday and, as iPhone sales slow, it is expected to post its first year-over-year decline in earnings since 2013.

Related: Upside Limited for 2016 Even as Earnings Bottom

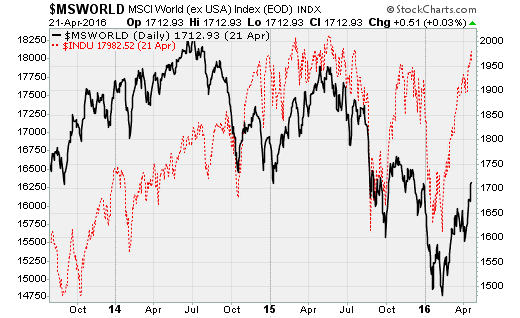

It's also worth mentioning that America is standing alone here, with stocks around the world much less ebullient, as shown in the chart below of the MSCI World (ex-USA) Index in black vs. the Dow Jones Industrial Average in red.

Investors would do well to stay cautious, as any breakout to fresh highs in U.S. stocks is singularly dependent on the Fed holding off on rate hikes until after Election Day — which risks an incipient rise in inflation and a more rapid pace of policy tightening in 2017 once a new administration is in the White House.