Apple, the totemic icon of high-tech’s promise of eternal growth, reports its first revenue decline in 13 years. The Eurozone is back from the brink. The U.S. economy may not be.

All this in the same week.

And let’s not forget the dollar, which just finished its worst week against the yen since 2008. Or the Dow Jones industrial average, which turned in its worst performance since “the February freakout,” as CNNMoney artfully put it.

Related: Investor Alert: How to See Through Corporate Earnings Smoke and Mirrors

Are we on the way to another global recession or still on the way out of one?

Optimists like Gavyn Davies acknowledge that the world economy is underperforming its long-term average for the third year running, but Davies wrote in the Financial Times on Sunday, “Global growth is somewhat better, especially in the emerging economies.” He headlined his blog, “Fading risks of global recession.”

And Robert Shiller, a Yale economics professor, says what you and I think matters. “Recessions aren’t caused merely by concrete changes in the markets,” Shiller argued in The New York Times on Sunday. “Beliefs and stories passed on by thousands of individuals are important factors, maybe even the main ones, in determining big shifts in the economy.”

Shiller suggests there’s more to economic wisdom than statistics will ever give us. If he’s right, we had better pay attention to what we see and what we hear.

Related: Which Money Worries Keep You Up at Night?

I was buying a bathroom fixture at Lowe’s on Saturday afternoon and the place was cavernously empty--more salespeople at my disposal than I’d have imagined a year ago (when you could never find anybody to help you). That’s a recession story, not a growth story.

The bright spot last week was Eurostat’s report that the Eurozone grew in the first quarter for the first time in a year and has at last surpassed its pre-2008 gross domestic product. Finally, we’re invited to conclude, Europe’s crisis is over and a bright future beckons.

But look at the number. Eurozone economies expanded by 0.6 percent. It’s hard to get excited; such a stat is an abstraction of little consequence on the ground.

In the same quarter, the American economy contracted by 0.7 percent, and that’s a lot less abstract. Halfway through the second quarter, the outlook remains very mixed.

Related: Buffett, a Clinton Supporter, Says Berkshire Will Thrive Even If Trump Wins

“Many analysts expect the GDP to expand roughly 2 percent in the second quarter,” The Washington Post reported Friday, “while the Federal Reserve Bank of Atlanta takes an even darker view, predicting an expansion of just 0.8 percent.”

The Post’s Chico Harlan went straight to the point. “Perhaps the biggest surprise of the past six months has been the muted pickup in consumer spending, which accounts for about two-thirds of the economy,” Harlan wrote. “Personal consumption grew 1.8 percent in the first quarter, but that’s well off the pace from the second half of 2014. Consumers, instead, have taken the money saved at the gasoline pump and used it to pay back debt or rebuild savings, according to government and credit card data.”

Market Signs

While we’re in the second-longest rally in Wall Street’s history, it’s been a terrible earnings season. And the biggest disappointments-- Microsoft, Google (via its listed parent, Alphabet), and Apple are high among them.

The end of Apple’s 13-year growth run was the biggest shocker to those who weren’t following Apple’s marketing strategy in China, where selling anything right now is an iffy proposition as the Chinese economy is on reset. Sales in the fiscal quarter ended March 31 fell 13 percent, to $50.6 billion. Net income was off 22 percent, to $10.5 billion.

Related: The End of an Era for Apple and the iPhone

There were, however, two very bright spots in the tech business. Amazon beat expectations, primarily because of their expanding cloud services (used by many government agencies, including the Defense Department).

And Facebook had a dazzling quarter, up 196 percent from the same period a year ago.

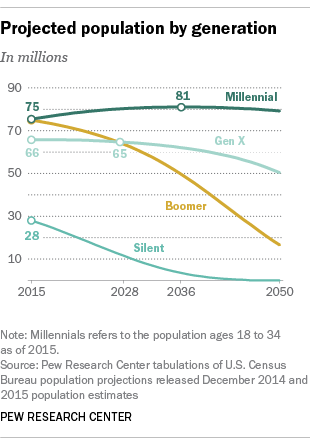

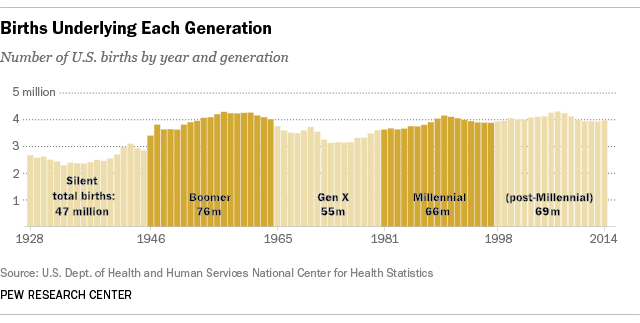

Even a few bright spots can’t kickstart consumer spending, which is also exacerbated by demographics. According to Pew Research and the U.S. Census Bureau, “Millennials, whom we define as those ages 18-34 in 2015, now number 75.4 million, surpassing the 74.9 million Baby Boomers (ages 51-69).

What’s important here is that the highest earning group—Gen X (ages 35-50)—is the smallest living generation at 55 million. When you add the 47 million low-spending silent generation on the top end, and the still in school 69 million on the low end, you can see the squeeze demographically on consumer spending.

I doubt anyone can say with certainty whether or not we’re in for another global recession. But it seems perfectly certain that it will depend on decisions taken soon.

The global economy has been given all there is to get out of low to negative interest rates, and it’s necessary to stimulate one way or another. Now the moment’s upon us: It’s time to stop talking and take the steps.

Economists, policy planners, and politicians will all have something to say. It’s the last we should worry about most, given that ideological preconceptions have been so prominently on display in Washington, London, Brussels, and nearly everywhere you look.