Something incredible is underway: Long-term interest rates are collapsing in a big way.

German 10-year yields moved into negative territory this week for the first time ever. U.S. 10-year yields have dropped back to 2012 lows. According to Fitch, the volume of global government bonds trading with negative yield has crossed the $10 trillion mark for the first time — representing about 20 percent of the total.

Normally, consumers would consider cheaper credit a good thing. But as a barometer of the health of the economy and global financial system, it's a scary sign something's not right. Stocks remain more or less stable, with the Dow Jones Industrial Average just below the 18,000 level it's been contending with for three years. That could soon change.

10 Year Treasury Rate data by YCharts

Yield curves, or the difference between short- and long-term yields, have inverted in Japan and elsewhere — one of the strongest pre-recession warnings signals in existence. Inflation expectations, also derived from bond market pricing, are dropping fast. Traders are voting with real money that a serious slowdown is coming.

Related: Stocks Are Dangerously Expensive Right Now

To be sure, a number of catalysts are weighing on sentiment, including the risk of a British exit from the European Union ("Brexit"), uneven global economic data, an ongoing corporate earnings recession, currency volatility worldwide and a growing sense that central banks are losing control of the situation.

Wednesday's Federal Reserve announcements confirmed a growing realization that Chair Janet Yellen and her cohorts are in a policy trap.

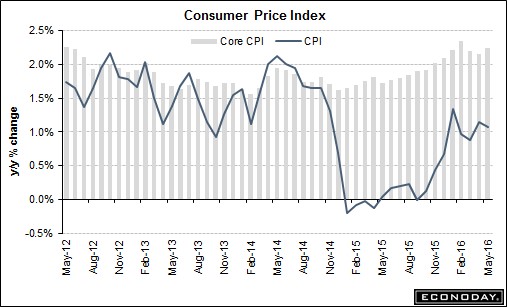

On one hand, despite a soft May payroll report, the labor market continues to tighten and early indications of wage inflation are emerging. Moreover, the rally in oil prices off of the February low and strength in home prices have boosted overall inflation levels. And GDP growth is on track to rebound in the second quarter after a soft start to the year.

On the other hand, markets remain extremely fragile. And the Fed knows it. Officials lowered their "dot plot" interest rate forecast to bring it into closer alignment with where the futures market is. While two 0.25 percent rate hikes are still expected for 2016, a number of individual policymakers lowered their personal forecasts for the year. Estimates for 2017 and 2018 were lowered as well.

Related: The US Economy May Be in Better Shape Than You Think

While the Fed news would normally be just the thing to get traders excited about the prospect of lower interest rates for longer, the mood seems to have changed. Now, there is fear that despite all the aggressiveness of central banks over the last few years — including negative interest rates in Japan and much of Europe — the business cycle continues to grind through a slowdown as S&P 500 earnings have fallen for four consecutive quarters.

Stepping back, the Fed's decision to raise rates last December for the first time since 2006 is looking increasingly like the one-and-done policy mistake by the Bank of Japan back in 2000, when rates were taken from 0 percent to 0.25 percent before being cut back to 0.15 percent seven months later.

Bank of America Merrill Lynch economists believe the Fed is kidding itself with the two-hikes-in-2016 forecast and are looking for a one-and-done hike likely toward the end of the year. If inflation becomes a clear threat, driven by easier year-over-year energy inflation comparisons and ongoing job market tightening, the Fed's dovish bias will be challenged in a way we haven't seen yet.

Related: El-Erian Says the Global Economy Needs Governments to Step Up

It didn't have to be this way: The Fed could've tightened more aggressively when stocks and the economy were chugging higher in 2013 and 2014. Instead, they waited too long, missed their window of opportunity and are left with their credibility in tatters as their proclamations of being "data dependent" fall increasingly flat.

Now we face the nightmare scenario of a stagflation scenario with elevated developed economy debt-to-GDP ratios, demographically driven labor market tightness, ongoing declines in profitability, higher inflation as the energy price collapse fades and central banks fresh out of stimulus options.

Already, the European Central Bank is buying single-name corporate bonds while the Japanese are aggressively buying equities. Both have already deployed negative policy rates.

My guess is that officials will manage to barely hold things in stasis until after the U.S. presidential election. Then things will get ugly. The turn could come sooner if the British vote to extricate themselves from the Brussels bureaucracy later this month.

Noted bearish strategist Albert Edwards at Societe Generale believes that that downturn in the Fed's own Labor Market Conditions Index suggests a new recession is about five months away, based on historical trends. The result, in Edwards' estimation, will be a drop in U.S. 10-year yields to -1 percent and a stock market drop below the 2009 lows.

That would be a hell of a mess for either a President Donald Trump or President Hillary Clinton to clean up.