Be careful what you wish for, the saying goes … you just might get it.

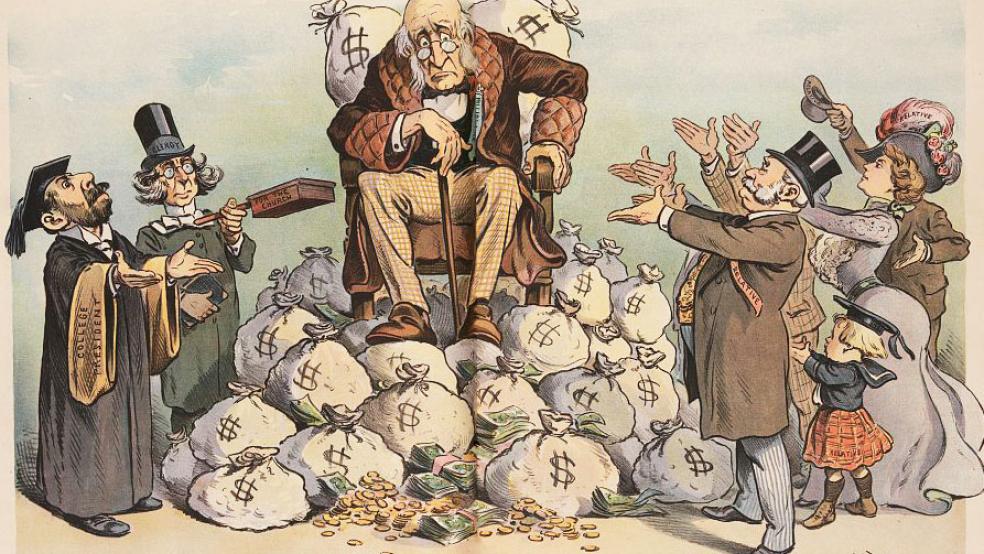

For decades, Americans on both sides of the aisle have argued that the country needs a new, citizen-driven approach to politics. Rather than having careerists for politicians, we should have outsiders with proven track records in the private sector serve for short periods of time. If they can run a business successfully, they can make government work.

The more successful the entrepreneur, the more successful the nation will be. Belief in that theory fueled the independent bids of H. Ross Perot in 1992 and 1996, and also the efforts to get Michael Bloomberg into the presidential race last year.

Related: Trump's Washington Hotel a Conflict of Interest: Democratic Lawmakers

Starting in 2017, America has the opportunity to test this theory at the highest possible level of both politics and wealth. Donald Trump will take office on January 20th, and leave his long career as a real-estate developer and resort mogul behind. Or more accurately, Trump will leave some of it behind – and that’s where the problems begin.

It has become customary for presidents to put their assets into a blind trust or other hands-off financial structure after first liquidating significant assets that might present a conflict of interest. Federal law requires executive branch officials to use blind trusts, but the separation-of-powers doctrine makes the applicability to the president and vice-president questionable at best. Still, those occupying the highest office have found it politically appropriate, at the very least, to put their personal financial interests at arms’ length from their policy decisions.

Barack Obama moved his assets into index funds and bonds with full disclosure in order to settle the question – but not a blind trust. In April 2010, more than a year after taking office, The Washington Post took notice on how the now-outgoing president “has rejected the approach taken by most of his predecessors in the modern era” by simply converting assets into Treasuries and widely diversified funds.

Related: Conflicts of Interest With Trump’s Businesses Are Already Occurring

The Post’s Michael Shear pointed out that then-mayor and multi-billionaire Bloomberg had not put his assets in a blind trust either. Bloomberg adviser Kenneth Gross dismissed the need for Obama to use a blind trust, arguing that his investments would have little to do with presidential policy. "He's got his money in exactly the kinds of investments that don't require a blind trust."

That didn’t keep Obama free of all allegations of potential conflicts of interest. A 2011 controversy at the FCC over spectrum allocations involving a venture firm called LightSquared reached the White House when a four-star Air Force general accused Obama’s aides of pressuring him into altering Congressional testimony in favor of the firm. Three months earlier, the Huffington Post had reported that several well-connected Democratic donors and officeholders had taken stakes in LightSquared, including “Obama himself” as “an early investor” who “remains close to other early investors.”

LightSquared eventually lost the fight long after the media lost the minimal interest it showed about the conflict of interest. It nonetheless demonstrates the political risks involved in refusing blind trusts. Obama’s predecessors utilized them as a ready shield against critics of their policies. And as recent coverage of the potential for conflicts between Trump’s personal finances and his responsibilities as president, the president-elect can’t count on media disinterest to shield him.

Related: Trump’s Kids Are on His Transition Team: A Serious Conflict of Interest?

Trump’s good business fortune makes it more difficult to resolve those potential conflicts. Where Obama’s assets were primarily investments that could easily be liquidated or converted, Trump’s holdings are primarily real estate in an empire that remains a personal and family business. Even if Trump was inclined to liquidate, it could take years to unwind his properties in a rational manner – and he’s clearly not inclined to liquidate. Like most men and women who build personal business empires, Trump wants to pass the business along to his children.

The conflict-of-interest issue will only get amplified as a result of Trump’s Cabinet picks, most of whom are top executives at firms such as Goldman Sachs and Exxon. Wilbur Ross, Trump’s nominee as Secretary of Commerce, is a billionaire investor whose position would directly impact his portfolio. Some have already begun to notice a pattern of benefit just from being mentioned as a potential member of the next administration. Federal laws and rules would apply to these officials, which is why the Trump team has begun to look at whether discretionary blind trusts could be used to satisfy the requirements – as well as Trump’s political needs.

A discretionary trust would allow Trump to retain ownership of the assets while being run by either a family member or a trusted third party. The principal benefit for Trump would be the elimination of the need to liquidate his assets, which a true blind trust would require in order to shield the president from questions about conflicts of interest. However, a discretionary trust allows the trustee to communicate with the owners about business matters, which would negate the political benefits of the trust for the Trumps – and probably fail to satisfy the legal requirements for Trump’s Cabinet to boot.

Related: Trump: Nobody but the Media Cares About Conflicts of Interest

Richard Painter, who served as George W. Bush’s ethics lawyer, told Politico that a discretionary trust would be “highly inappropriate,” and leaving existing assets in place while determining policy would constitute “a violation of at least the spirit of the rules.” That might still be a problem even if his children buy him out completely. In one potential demonstration of this futility, foreign governments have already begun toadying up to Trump through his resorts. We can expect more of these efforts after the inauguration. In short, we have a mess that won’t be quickly or easily resolved.

Will voters care enough about this to damage his political capital? So far it seems to have done little to dampen enthusiasm for Trump among his supporters, and a new NBC/Wall Street Journal poll suggests he’ll have a honeymoon with a broader range of voters as he takes office. After all, over sixty-two million voters voted for the businessman even with the potential for these conflicts already apparent, and they may be inclined to give Trump a pass – at least until they suffer some disillusion over his governing choices.

Related: Trump’s Massive Global Business Footprint Can Subvert US National Security

That may come sooner rather than later. Trump says he wants to “drain the swamp” and make dramatic changes in the way Washington does business. That’s precisely why Trump will need to put his interests into a blind trust – to protect himself from the potential backlash. If Trump alienates enough voters and members of Congress with his policies, those conflicts of interest will offer a very handy excuse to push for impeachment under the Emoluments Clause of the Constitution.

Voters gave Trump the presidency – but they don’t want Trump to give them the business. Trump has to choose whether he wants to be a mogul or be a president, and he needs to make that choice now.