6 Traits of an Emerging Millionaire: Are You One?

It’s not just Wall Street bankers, hedge fund traders and corporate raiders who will join the one percent. Nope. By now you may have heard that the new look of affluence in America is kind of… girly. The 7th Fidelity Millionaire Outlook found that today’s emerging high rollers are 66 percent female and 25 percent non-white.

The Fidelity Outlook identified 6 wealth-building traits that multi-millionaires have in common: Their starting point—a mere $250,000 in assets.

Related: Americans Are About to Get a Nice Fat Pay Raise

1 Time Horizon: On average, emerging affluent investors are just 40 years of age with 27 years left before they reach the normal retirement age of 67. Only one percent of the emerging affluent is retired.

2. Career: Many of the emerging affluent have pursued similar professions to today’s millionaires, including information technology, finance and accounting. While they might be at lower-level positions than millionaires, they have a number of years in front of them to move up the ladder.

3. Income: At $125,000, the median annual household income for the emerging affluent is 2.5X the median U.S. household income8 and is nearing the income of today’s millionaires ($200,000 for those still employed).

Related: The 10 Best States for Taxes in 2015

4. Self-Made Status: Approximately eight in 10 emerging affluent investors have earned or increased their assets on their own, a trait they share with millionaires and deca-millionaires.

5. Long-Term Focus: The emerging affluent share millionaires’ long-term focus, with three in four of both groups focused on the long-term growth of their assets, and three in 10 focused on supporting the lifestyle they want in retirement.

6. Investing Style: Similar to deca-millionaires, the emerging affluent display a willingness to invest aggressively to help maximize returns, as well as a willingness to set aside a significant portion of their portfolio for riskier investments that promise a bigger payoff. The emerging affluent and deca-millionaires were also most likely to describe themselves as “self-directed” investors, seeking hands-on involvement with their investments.

Top Reads from The Fiscal Times:

- The 10 Worst States For Paying Taxes

- 6 Popular Social Security Myths Busted

- The Worst States For Retirement in 2015

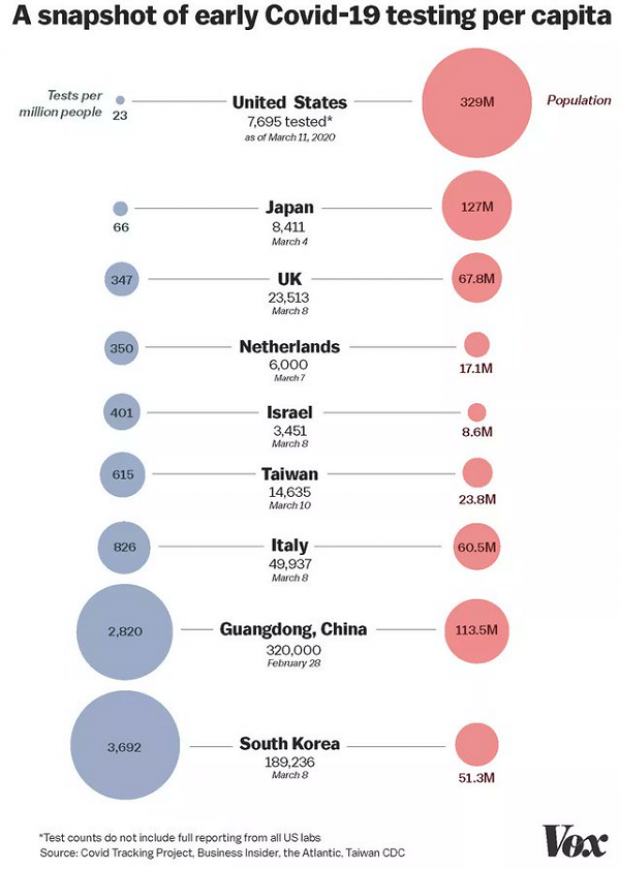

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”