Be prepared to pay more for your chocolate this season.

Candy and chocolate manufacturers, including Mars and Hershey, have been raising prices as the global consumption of cocoa has outpaced production. Chocoholics shouldn’t double book their therapists yet, however. There’s not likely going to be a shortage any time soon.

The International Cocoa Organization (ICCO) said in June it sees a deficit of 30,000 tons in the current 2013-2014 time frame – about 100,000 tons lower than its forecast at the start of the season. It predicted that the deficit for next season (2014-2015) should also hover around 100,000 tons.

Related: 13 Great Holiday Gifts for Work

“Production will decline and demand will continue to increase,” said Laurent Pipitone, director of economics and statistics at the ICCO during the second World Cocoa Conference, held in Amsterdam.

Demand for cocoa has been on the rise, especially as North American consumers opt for the healthier dark chocolate, which has a higher cocoa content. Yet supply has been shrinking for several reasons:

- A growing taste for chocolate and therefore higher demand from China.

- Dry weather in West Africa, the main cocoa production region.

- A deadly fungus called frosty pod.

- And to a lesser extent, Ebola, as harvesting and shipping of cocoa in Guinea, Liberia and Sierra Leone have been seriously curtailed because of the disease’s impact on the population there.

As a result, the price of cocoa has been risen this year, although it fell last month. In October, the ICCO daily price averaged $3,101 per ton, down by $120 compared to the average price in the previous month.

Related: 9 Reasons You’re Paying More for Groceries

The rising price of cocoa has in turn prompted major chocolate manufacturers to increase their prices. Mars Inc., which makes M&M’s and Snickers, announced in July it would raise prices by an average of 7 percent to offset rising costs, for its first increase in three years. The move followed Hershey’s by a few days.

Cocoa Revenues:

Source: Index Mundi

However, there’s hope that the deficit could shrink in the next few years.

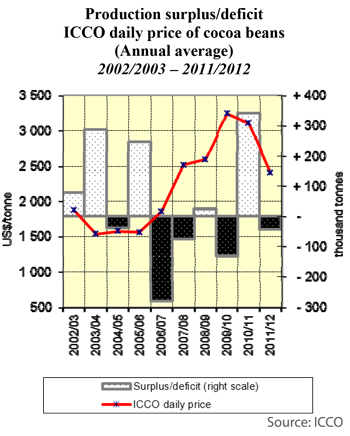

The surplus and deficit of cocoa has historically heavily fluctuated. In the 10 years between 2002 and 2012, cocoa prices fell as low as $1,534 per ton in the 2003-2004 season, when the world cocoa economy experienced a surplus of 287,000 tons, and as high as $3,246 per ton in the 2009-2010 season, when a deficit of 132,000 occurred, according to ICCO.

The cocoa economy even returned to having a surplus the following season (2010-2011), despite political unrest in Ivory Coast, the world’s top producer.

Related: Chocolate Lovers, Get Ready to Pay More

If weather conditions in West Africa continue to improve as they did in October, the situation could get better still. In addition, the frosty pod fungus that has supposedly devastated cocoa crops is actually found only in South America, where just 13 percent of the world’s cocoa is produced.

As to the impact of Ebola, ICCO noted in October that combined production in the three West African countries impacted by Ebola represents only 0.7 percent of global output and is likely to have a minor bearing on the global cocoa market.

At the same time, while demand for cocoa in North America has increased in the third quarter of 2014, it fell both in Europe and Asia compared with the previous year.

Related: Pizza Chains Try Spicing Up an American Staple

Additionally, ICCO noted at the June conference that a structural supply deficit in the cocoa market can be reversed if farmers diversify their farms.

“If we want to increase the incomes of cocoa farmers, we have to think in terms of associating cocoa with other crops, and we have to make sure these crops are grown in an intensive way, using inputs, pesticides and fertilizers,” said ICCO executive director Jean-Marc Anga at the second World Cocoa Conference.

Ghana, the world’s second largest exporter behind Ivory Coast, will soon begin to distribute free fertilizer to cocoa farmers to boost crop yields.

Top Reads from The Fiscal Times: