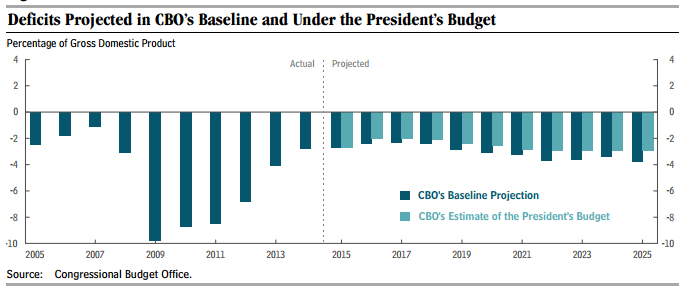

President Obama’s proposed 2016 budget would trim federal deficits by $1.2 trillion over the coming 10 years when compared to current law, the Congressional Budget Office said Thursday.

That’s not to say that total debt would come down from its current, historically high levels. The analysis found that if current law were left unchanged, the U.S. government’s fiscal deficits would total $7.2 trillion between 2016 and 2025. If the president’s budget were enacted, the country would instead add $6 trillion to the national debt as increased spending is offset by higher revenue from the president’s proposed tax increases on top earners.

Related: The Federal Debt Is About to Become a Big Issue Again

The report estimates that the president’s budget would have little effect on the federal deficit in 2015 and would reduce the deficits relative to the current baseline every year from 2016 to 2025. Annual deficits would climb to $801 billion by 2025, compared to the current projection of $1.04 trillion. Public debt as a share of the economy would stay almost exactly where it is today, edging down from 74.1 percent in 2014 to a projected 73.1 percent in 2025.

The largest driver of savings in the president’s budget is a dramatic cut in money directed to Afghanistan and other foreign military endeavors through the Overseas Contingency Operations fund. If current law were extended, that fund would be allocated $74 billion a year, with adjustments for inflation. The Obama budget foresees a cut to $58 billion in 2016, and then $27 billion a year going forward. That accounts for $532 billion in savings — nearly half of the difference between the president’s 10-year deficit and current law.

CBO also projects that the president’s plan to close tax loopholes and eliminate some deductions and exclusions would bring in an additional $526 billion in revenue over 10 years. Proposed changes to the Medicare program would net out to $240 billion in reduced spending over 10 years. Comprehensive immigration reform would generate a net reduction of another $158 billion.

Related: 3 Reasons Why Americans Would Pay More Taxes

The savings are offset in part by increased discretionary spending of $371 billion over 10 years, and boosted by a reduction in net interest costs relative to current projections.

A key point in most of the descriptions here is that they represent a “net” effect on the budget. For example, Obama’s proposal would generate some $1.8 trillion in additional revenue for the government through changes to the tax code and other laws. However, hundreds of billions of those dollars would wind up not in federal coffers, but redistributed back to other taxpayers through changes in allowable deductions, tax credits and other programs.

Of course, the president’s budget request in never adopted as written. In fact, it is ritually declared “dead on arrival” by the president’s political opponents, after which Congress tries — and, lately at least, usually fails — to adopt a budget resolution of its own.

On Wednesday, before the CBO report was released, Senate Budget Committee Chairman Mike Enzi (R-WY) delivered remarks at a hearing that suggested that Obama’s budget, which adds to the deficit every year — just less than current law would — is going to be a particularly hard sell with the GOP.

Related: 70 Percent of Americans Don’t Know the Woman Pulling Their Purse Strings

“Over the past six years, we have learned that wasteful Washington spending doesn’t solve problems, it only side-steps them,” he said. “By spending responsibly and putting our fiscal books in order in a balanced and responsible way, we can restore the trust that we have broken with the American people.”

He added, “A balanced budget is essential for strong economic growth and job creation….This is not only possible, it is doable and it is what the American people want and deserve.”

Top Reads from The Fiscal Times: