President Obama has long bemoaned the fact that China and other trade rivals have left the U.S. in the dust when it comes to building their highways, bridges and other infrastructure –investments vital to the long-term health of their economies.

“If they [China] need to build some stuff, they can build it. And over time, that wears away our advantage competitively,” the president said in a speech to business leaders last December to rally Congress in support of highway and infrastructure spending.

Unlike the U.S., developing countries like China, India and other areas in Asia and Africa are at the early stages of building national highway systems, including bridges and tunnels. Their investment should be substantial. But in some cases, what they are building eclipses America’s 60-year old systems in design, material, and technology.

Related: Obama Wants Long-Term Infrastructure Plan, Not Keystone

The American Society of Civil Engineers pegs the U.S. infrastructure spending gap at $125 billion a year just to maintain and repair highways and bridges. In a report card, the civil engineers group gave the nation’s infrastructure the unfortunately low grade of D+, noting a tremendous backlog and a desperate need for modernization.

Former Treasury Secretary Lawrence Summers recently noted that total federal, state and local government investments in infrastructure is just enough to cover repairs and upgrades of bridges, roads, airports and rails. There’s practically nothing left for expansion.

That means the “net” increase in spending for new projects as a percentage of the overall economy is roughly zero. Essentially the U.S. is just running in place trying to deal with the mounting demands for new job-generating infrastructure.

David Wessel, director of the Hutchins Center on Fiscal and Monetary Policy at the Brookings Institution, wrote this week he could hardly believe Summers’ assertion. He decided to check the numbers to determine whether the Harvard economics professor was “hyping the data” to make his point.

Related: $1 Trillion for Infrastructure: Where’s the Money?

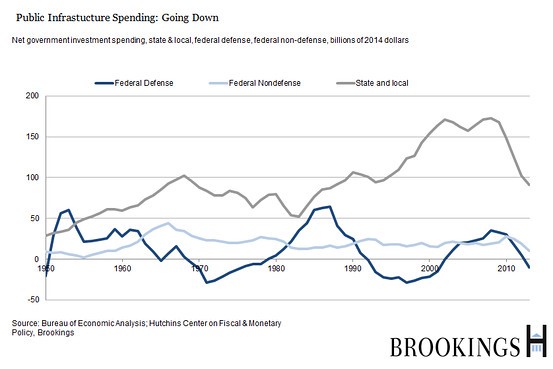

What Wessel found buried in a mountain of data compiled by the Bureau of Economic Analysis largely backs up Summers: Net federal public investment spending for defense and non-defense in 2013 – the latest year for which data are available – works out to roughly zero.

“Non-defense investment spending, which was nearly 1 percent of GDP in the mid-1960s – and hasn’t come close to that since – was about $9.8 billion in 2013, or a paltry 0.6 percent of GDP,” Wessel wrote. “Mr. Summers wasn’t exaggerating.”

As the chart below shows, the majority of government investment in the U.S. is done at the state and local level and not by the federal government. State and local spending soared in the housing boom years before the financial crisis, Wessel said, when those governments were flush with cash – and it collapsed in 2010.

A December 2013 Congressional Budget Office study on federal investments further documented the sorry trend. In 2010, the federal government spent $63 billion in inflation-adjusted dollars – or 0.4 percent of GDP – on physical capital for transportation by highway, mass transit, rail, water and air, according to the CBO.

That year, states and localities invested $68 billion for the same purposes, which also worked out to be 0.4 percent of the overall economy.

Related: Governors Join Obama in Infrastructure Spending Plea

With time running out this spring on a temporary spending patch for the troubled federal Highway Trust Fund, Congress and the Obama administration are still far apart on a new long-term program for restoring and expanding the nation’s infrastructure.

One big question is how the Republican-controlled Congress and the Democratic administration will come up with the money to finance future spending. There’s a more important question as well: Will lawmakers and Obama ultimately decide to let the country limp along for another few years by financing the bare necessities for maintaining the existing system – or will they go bold and somehow get beyond a net investment of zero?

Top Reads from The Fiscal Times: