How IBM Is Making Your Passwords Useless

For years, quantum computing has been hailed as a technology that could change the way the modern world works, but a long-standing technical issue has kept that potential from being realized. Now, in a paper published in the journal Nature last week, IBM scientists have taken a big step (see how I avoided the temptation to make a pun there?) toward solving that problem — and while it could represent progress toward making quatum computers real, it also could mean that current cybersecurity standards will soon be much easier to crack. In other words, your passwords could be obsolete soon.

The power of quantum computing has some obvious appeal: The increase in processing power could speed up research, especially in big data applications. Problems with large datasets, or those that need many millions (or billions, or more) of simulations to develop a working theory, would be able to be run at speeds unthinkable today. This could mean giant leaps forward in medical research, where enhanced simulations can be used to test cancer treatments or work on the development of new vaccines for ebola, HIV, malaria and the other diseases. High-level physics labs like CERN could use the extra power to increase our understanding of the way the universe at large works.

But the most immediate impact for the regular person would be in the way your private information is kept safe. Current encryption relies on massively large prime numbers to encode your sensitive information. Using combinations of large prime numbers means that anyone trying to crack such encryption needs to attempt to factor at least one of those numbers to get into encrypted data. When you buy something from, say, Amazon, the connection between your computer and Amazon is encrypted using that basic system (it's more complicated than that, but that's the rough summary). The time it would take a digital computer to calculate these factors is essentially past the heat death of the universe. (Still, this won't help you if your password is password, or monkey, or 123456. Please, people, use a password manager.)

Quantum computing, however, increases processing speed and the actual nature of the computation so significantly that it reduces that time to nearly nothing, making current encryption much less secure.

The IBM researcher that could make that happen is complicated, and it requires some background explanation. For starters, while a "traditional" computing bit can be either a 0 or a 1, a quantum computing bit can have three (or infinite, depending on how you want to interpret the concept) states. More specifically, a qubit can be 0, 1, or both.

Up until now, the both part of that caused some problems in realizing the power of quantum computing.

Up until now, the both part of that caused some problems in realizing the power of quantum computing.

Apparently — and you'll have to take this on faith a bit, as it hurts my head to think about it — the both state can switch back to either 0 or 1 at any given point, and sometimes incorrectly, based on the logic in the programming. Think about when your phone freezes up for a second or two while you're matching tiles. This is its processor handling vast amounts of information and filtering out the operations that fail for any number of reasons, from buggy code to malware to basic electrical noise. When there are only the two binary states, this is a process that usually happens behind the scenes and quickly.

The hold-up with quantum computing up until now is that the vastly greater potential for errors has stymied attempts to identify and nullify them. One additional wrinkle in this reading quantum states is familiar to anyone with basic science fiction knowledge, or perhaps just the ailurophobics. What if the action of reading the qubit actually causes it to collapse to 0 or 1?

The very smart people at IBM think they've solved this. The actual technical explanation is involved, and well beyond my ability to fully follow, but the gist is that instead of just having the qubits arrayed in a lattice on their own, they are arranged such that neighbors essentially check each other, producing the ability to check the common read problems.

That opens the door to further quantum computing developments, including ones that will make your password a thing of the past. So, does this mean that you need to start hoarding gold? No, not yet. And hopefully before quantum computing reaches commercial, or even simply industrial/governmental levels, a better cyber security method will be in place. Or the robots will have already taken over. I for one welcome them.

The High Cost of Child Poverty

Childhood poverty cost $1.03 trillion in 2015, including the loss of economic productivity, increased spending on health care and increased crime rates, according to a recent study in the journal Social Work Research. That annual cost represents about 5.4 percent of U.S. GDP. “It is estimated that for every dollar spent on reducing childhood poverty, the country would save at least $7 with respect to the economic costs of poverty,” says Mark R. Rank, a co-author of the study and professor of social welfare at Washington University in St. Louis. (Futurity)

Do You Know What Your Tax Rate Is?

Complaining about taxes is a favorite American pastime, and the grumbling might reach its annual peak right about now, as tax day approaches. But new research from Michigan State University highlighted by the Money magazine website finds that Americans — or at least Michiganders — dramatically overstate their average tax rate.

In a survey of 978 adults in the Wolverine State, almost 220 people said they didn’t know what percentage of their income went to federal taxes. Of the people who did provide an answer, almost 85 percent overstated their actual rate, sometimes by a large margin. On average, those taxpayers said they pay 25.5 percent of their income in federal taxes. But the study’s authors estimated that their actual average tax rate was just under 14 percent.

The large number of people who didn’t want to venture a guess as to their tax rate and the even larger number who were wildly off both suggest to the researchers “that a very substantial portion of the population is uninformed or misinformed about average federal income-tax rates.”

Why don’t we know what we’re paying?

Part of the answer may be that our tax system is complicated and many of us rely on professionals or specialized software to prepare our filings. Money’s Ian Salisbury notes that taxpayers in the survey who relied on that kind of help tended to be further off in their estimates, after controlling for other factors.

Also, many people likely don’t understand the different types of taxes they pay. While the survey asked specifically about federal taxes, the tax rates people provided more closely matched their total tax rate, including federal, state, local and payroll taxes.

But our politics likely play a role here as well. People who believe that taxes on households like theirs should be lower and those who believe tax dollars are spent ineffectively tended to overstate their tax rates more.

“Since the time of Ronald Reagan, American[s] have been inundated with messages about how high taxes are,” one of the study’s authors told Salisbury. “The notion they are too high has become deeply ingrained.”

Wealthy Investors Are Worried About Washington, and the Debt

A new survey by the Spectrem Group, a market research firm, finds that almost 80 percent of investors with net worth between $100,000 and $25 million (not including their home) say that the U.S. political environment is their biggest concern, followed by government gridlock (76 percent) and the national debt (75 percent).

Trump’s Push to Reverse Parts of $1.3 Trillion Spending Bill May Be DOA

At least two key Republican senators are unlikely to support an effort to roll back parts of the $1.3. trillion spending bill passed by Congress last month, The Washington Post’s Mike DeBonis reported Monday evening. While aides to President Trump are working with House Majority Leader Kevin McCarthy (R-CA) on a package of spending cuts, Sens. Susan Collins (R-ME) and Lisa Murkowski (R-AK) expressed opposition to the idea, meaning a rescission bill might not be able to get a simple majority vote in the Senate. And Roll Call reports that other Republican senators have expressed significant skepticism, too. “It’s going nowhere,” Sen. Lindsey Graham said.

Goldman Sees Profit in the Tax Cuts

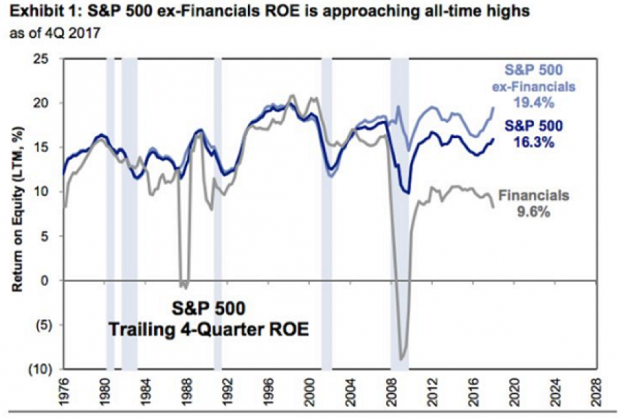

David Kostin, chief U.S. equity strategist at Goldman Sachs, said in a note to clients Friday cited by CNBC that companies in the S&P 500 can expect to see a boost in return on equity (ROE) thanks to the tax cuts. Return on equity should hit the highest level since 2007, Kostin said, providing a strong tailwind for stock prices even as uncertainty grows about possible conflicts over trade.

Return on equity, defined as the amount of net income returned as a percentage of shareholders’ equity, rose to 16.3 percent in 2016, and Kostin is forecasting an increase to 17.6 percent in 2018. "The reduction in the corporate tax rate alone will boost ROE by roughly 70 [basis points], outweighing margin pressures from rising labor, commodity, and borrow costs," Kostin wrote.