How Safe Is that Flight? Auditors Question Airport Security

A government spat between Congress and the Transportation Safety Administration yesterday raised a question: Is the TSA trying to stonewall a congressional committee looking into reports suggesting the agency may be failing in its $7 billion-a-year mission to safeguard airports and air travel from terrorist threats?

At the start of Wednesday’s TSA: Are Airports Safe? hearing, House Oversight Committee Chairman Jason Chaffetz (R-UT ) immediately pointed out a glaring absence from the witness panel—the TSA.

Related: Poor Maintenance Could Make that Airport Scanner a Dud

Chaffetz said the committee had invited TSA acting administrator Melvin Carraway, but the agency offered a lower-level official in his place.

“The Department of Homeland Security objected to [Carraway’s] presence on the panel because they felt it was demeaning to have the acting director sit on the same panel as a private sector witness,” he said, referring to Raffi Fron, president of New Age Security Solutions, a company that provides security systems such as video surveillance.

The hearing was prompted by two separate but equally scathing watchdog reports that question the TSA’s ability to effectively screen passengers.

“Our audits have repeatedly found that human error— often a simple failure to follow protocol—poses significant vulnerabilities,” DHS’s IG John Roth said—adding that despite offering hundreds of recommendations the TSA has failed to assure that its mission is succeeding.

Related: Report Says TSA Wasted $1 Billion on Screening Program

DHS stood by its decision not to send its acting administrator. An agency official told The Fiscal Times that the department only participates in congressional hearing panels with other government agencies—not with private-sector witnesses in order to avoid conflicts of interest.

A spokesperson for the committee said that “witness invitations are not transferable” and that the “DHS does not dictate how we run our hearings.”

This isn’t the only roadblock the Oversight Committee has run into with the TSA. During the hearing, Chairman Chaffetz showed off a heavily redacted document he had requested from the agency—saying even members of Congress had “exceptional” difficulties getting information from them.

The committee spokesperson said House Oversight is currently looking into other ways the TSA has frustrated congressional inquiries—and what kinds of action can be taken.

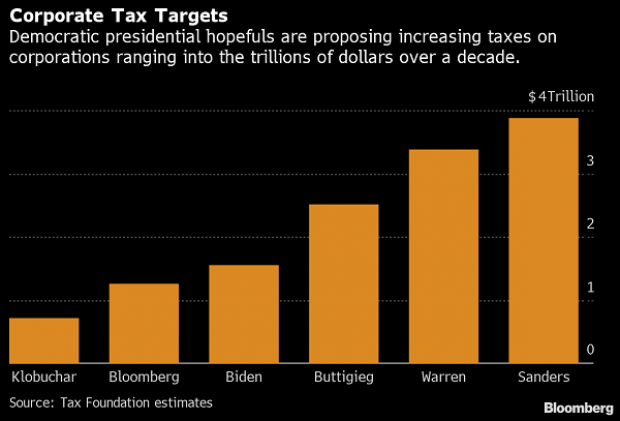

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

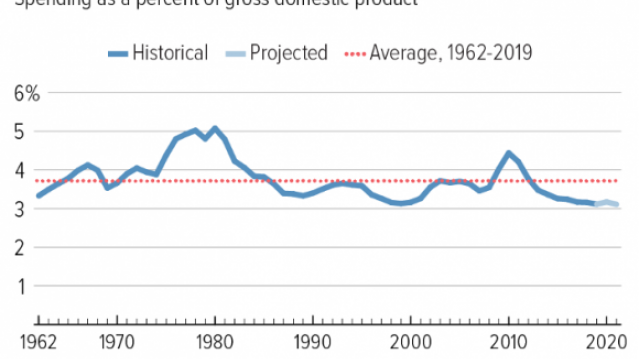

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

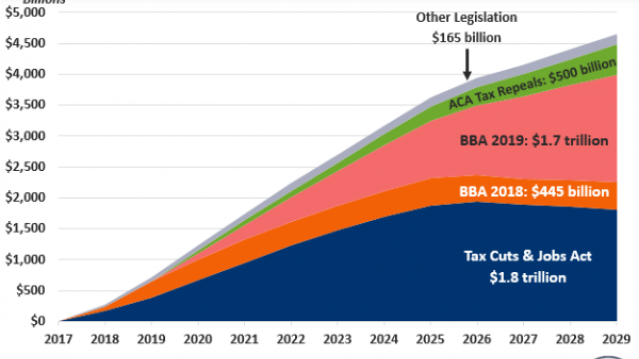

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

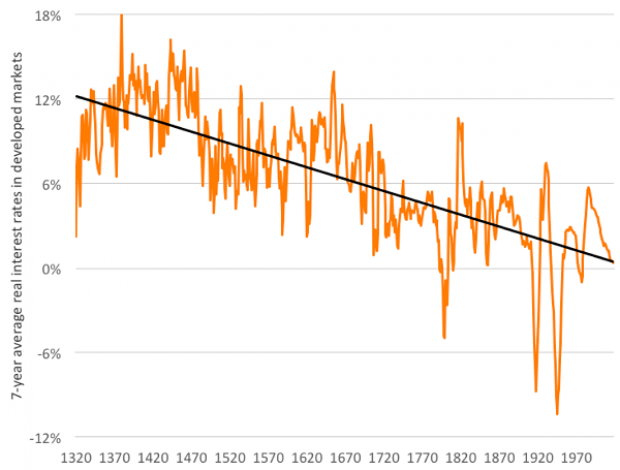

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

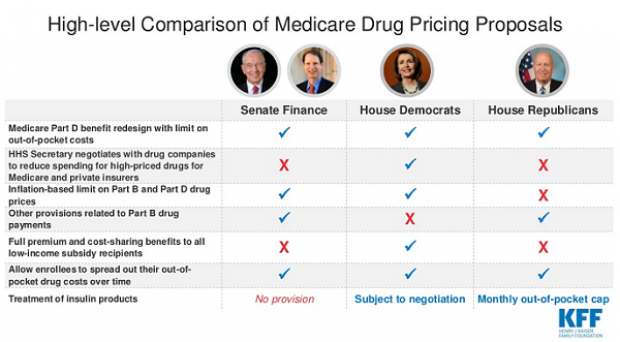

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.