The Amazingly Stupid Things Smartphone Users Do While Driving

If you’re reading this while driving, put your phone down right now. This article — as engrossing as it is — will still be here when you reach your destination.

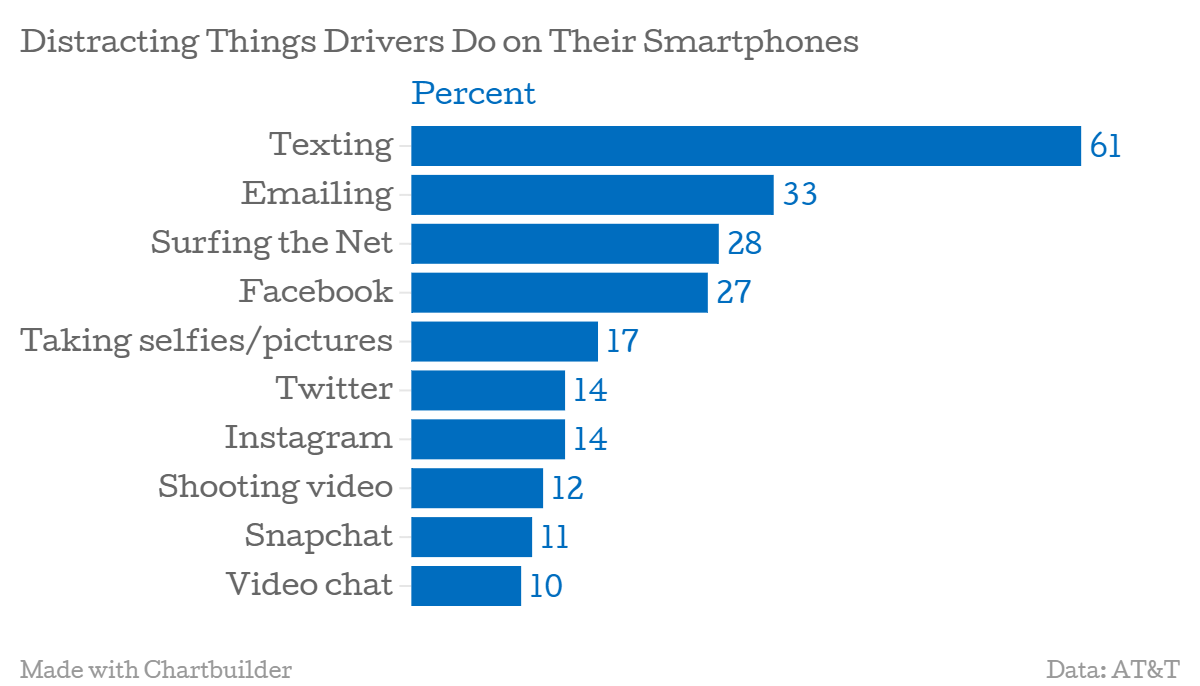

We provide that friendly bit of advice because, as The New York Times reported this morning, a whole bunch of motorists are occupying themselves with their smartphones — and distracting themselves from the road — in ways that go way beyond talking and texting, according to a new survey conducted by Braun Research for AT&T.

The pollsters surveyed 2,067 smartphone users who drive daily, and their findings should be frightening to anyone on the roads. More than six in 10 smartphone users surveyed say they text while driving. It gets scarier: Nearly 40 percent of smartphone users admit to checking in on social media while driving, with 27 percent admitting to using Facebook and another 14 percent saying they use Twitter and Instagram while behind the wheel. Of users who cop to posting on Twitter while driving, 30 percent say they do it “all the time.” Given those figures, it’s amazing that #TwitterAccident isn’t always trending.

Related: Here's How Much Likelier You Are to Be Killed in a Car Than on Amtrak

Some other troubling stats from the survey: 17 percent snap selfies or other pictures when in the driver’s seat and 12 percent shoot videos — with 27 percent of those videographers thinking they can do so safely. Astoundingly, 10 percent of drivers say they video chat while on the roads.

AT&T says it will expand its It Can Wait public service campaign about the dangers of distracted driving, which launched in 2010, to focus on hazards beyond just texting. But as Matt Richtel of the Times points out, the AT&T campaign and other efforts like it face a stiff challenge in trying to counter the social pressures and strongly ingrained habits that keep people constantly checking their phones.

Tough laws and widespread educational efforts have been effective at reducing drunk driving and encouraging use of seat belts. But we still have a way to go in getting drivers to understand that “mobile” doesn’t mean when you’re behind the wheel. Right now, 46 states and the District of Columbia have outlawed texting while driving. As you can see above, that hasn't helped much yet. Smartphone users still need to be convinced of the danger they pose — or face — if they use their devices while driving.

As Lori Lee, AT&T’s global marketing officer, put it: “For the sake of you and those around you, please keep your eyes on the road, not on your phone.”

Don’t Make This Surprisingly Common Credit Mistake

Checking your credit report regularly is a basic rule of personal finance. More than one in three Americans has failed to follow that rule — they’ve never looked at their report, according to a new study from Bankrate.com.

The report finds that 35 percent of all Americans have never reviewed their credit reports, and 14 percent check less than once a year. Senior citizens are the biggest slackers, with 44 percent saying they’ve never checked their report, followed by 41 percent of millennials.

Related: 5 Easy Ways to Ruin a Perfect Credit Score

Your credit report is the foundation of your credit score, a key number that landlords, employers and lenders use to measure financial responsibility. Having a good credit score is critical for financial success because it gets you access to lenders’ best rates and terms, which can save you thousands of dollars each year.

By law you are entitled to access your credit reports from each of the three major credit-reporting companies — Experian, TransUnion and Equifax — for free once every 12 months. You can do that at AnnualCreditReport.com.

The Bankrate survey found that about half of Americans have reviewed at least one of their credit reports within the past year, and a quarter of Americans review them more than once a year.

“Monitoring your credit goes well beyond scanning a three-digit number,” Bankrate credit card analyst Jeanine Skowronski said in a statement. “Americans need to thoroughly review their credit reports for errors or signs of fraud. They also need to understand what factors, like missed payments or high debt-to-credit ratios, are driving their credit score in order to improve it.”

If you don’t know what’s on your credit reports, now is a good time to find out.

Mother’s Day: Shop Tuesday for Best Deals

Looking to get a deal on a Mother’s Day gift this year? Shop this Tuesday.

That’s the day you’ll find the most coupons and discounts, according to an analysis by Savings.com of traffic and deals for Mother’s Day over the past five years. The best part, you don’t even need a coupon for many of the bargains, which tend to be heavily promoted.

One category where you’re less likely to save: Flowers. Savings.com found that prices have been steadily increasing for Mother’s Day bouquets, but purchasing a few days early from your supermarket or local florist will yield the best value. About two-thirds of consumers who plan to spend money for Mother’s Day will buy flowers, according to the National Retail Federation.

Families are planning to spend more than ever honoring their moms this year: The average American plans to shell out $172.63, up almost $10 from last year. That’s the highest amount since the NRF began its survey in 2003.

Related: What I Really Want for Mother’s Day: Priceless

The survey found that 80 percent of consumers would buy their mother a card. Mother’s Day is the third-largest card-sending holiday in the United States, with 120 million cards exchanged each year, according to Hallmark.

About a third of shoppers said they’d buy their mom clothing or apparel, and another they’d said they’d buy jewelry, according to the NRF

When it comes to shopping venues, department stores were the most popular destinations (cited by 33 percent of consumers), followed by specialty stores (28 percent) and discount stores (25 percent). A quarter of shoppers said they’d buy gifts online, down from 29 percent last year.

4 Reasons the Fed Won’t Raise Interest Rates in June

It is no surprise that the Fed didn’t take action on interest rates at the April Federal Open Market Committee meeting. The question of interest to the market is whether the Federal Reserve has revealed some clear signal in its statement about the timing of the future rate increase. Even though the Fed did not change its forward guidance on rate increases from the March statement, we can discern what the Fed has on its plate. Four aspects of the economy stand out:

Related: Bernanke Was Right—Interest Rates Aren’t Going Anywhere

- The latest GDP data show worse-than-expected growth at an annualized 0.2 percent during the first quarter of 2015, compared to 2.2 percent in the last quarter of 2014.

- The strong U.S. dollar has continued to weigh on exports. Net exports in the first quarter stayed unchanged (0.0 percent growth) year-over-year, compared with 18.6 percent growth in the fourth quarter of 2014.

- Inflation has continued to stay way below the central bank’s 2 percent target. The price index for personal consumption expenditure (PCE), the measure of inflation preferred by the Fed, showed a 0.3 percent year-over-year increase in the first quarter, much lower than the growth rate of 1.1 percent in the fourth quarter of last year. Core PCE inflation, which excludes volatile prices of food and energy, reached 1.3 percent, compared with 1.4 percent in the last quarter.

- The improvements in the labor market, the other mandate of the Federal Reserve besides inflation, also slowed. Only 126,000 employees were added to nonfarm payrolls in March, compared to 264,000 in February and 201,000 in January.

Related: Fed’s Downgrade of Economic Outlooks Signals Later Rates Lift-Off

In all, the U.S. economy is growing more slowly than anticipated with some headwinds that may last for a while, such as the strong dollar. Both measures of the Fed’s dual mandate, price stability and maximum employment, remain below the Fed’s target. Normally this would call for an accommodative monetary policy, postponing the rate increases until later in the year. Rather than starting rate increases at the June FOMC meeting, the liftoff in September instead is more likely.

This story originally appeared at the American Institute for Economic Research.

How IRS Protects ID Thieves

Millions of Americans have fallen victim to ID theft during tax season, when fraudsters file false returns in an attempt to steal other people’s refunds.

Victims face delays in getting their real refunds, and paperwork nightmares that can drag on for months. In an attempt to survey the damage, some have asked the IRS for a copy of the fake returns, but Bloomberg reports that the agency has denied such requests, despite consumer-protection regulations intended to help victims in these situations.

The rules protecting consumers apparently conflict with tax laws that prevent its agents from sharing bogus returns and impose a penalty of up to five years in prison and a $250,000 fine for IRS workers who violate that law. “Employees face the specter of felony charges for giving out private details — including, possibly, those of the identity thieves — to those who aren’t authorized,” according to Bloomberg.

Related: 3 Costly and Common Tax Scams to Avoid

Tax refund fraud has ballooned in recent years. While electronic filing has made the tedious process of filing taxes more bearable for consumers, it has also made it easier for criminals to scam the system by filing phony returns using stolen Social Security numbers. Scammers bilked the IRS out of $5.8 billion in fraudulent tax refunds in 2013, a number auditors expected would climb much higher in the most recent tax season. (Numbers haven’t yet been released for 2014 returns).

Electronic fraud became such a problem this year that TurboTax briefly suspended state returns for customers in February to deal with ID theft issues.

If the IRS is of limited help to victims, that’s all the more reason to make sure your information is protected. You can find some tips to reduce your risk of ID theft here.

Top Reads From The Fiscal Times:

- Found! 6,400 New Lois Lerner Emails on the IRS Targeting Scandal

- The Liberal Solution to America’s Big Spending Problem

- The Flawed F-35: Why the Pentagon Will Never Shoot It Down

DARPA Has Developed a Bullet That Can Turn in Mid-Air

The U.S. Department of Defense has developed a bullet that can change direction in mid-air to ensure it hits its targets.

DARPA’s self-steering bullet EXACTO (Extreme Accuracy Tasked Ordnance) adjust in flight to hit moving targets.

Called the Extreme Accuracy Tasked Ordnance (or EXACTO), the .50 caliber bullet is meant for use in combat in areas such as Afghanistan, where visibility and changes in wind and weather can throw bullets slightly off their course, according to an article in Popular Science.

How the ammunition works is, of course, secret. A video put out by DARPA shows the bullet adjusting its trajectory to hit a moving robot target.

"This live-fire demonstration from a standard rifle showed that EXACTO is able to hit moving and evading targets with extreme accuracy at sniper ranges unachievable with traditional rounds," said DARPA program manager Jerome Dunn, in a statement. "Fitting EXACTO's guidance capabilities into a small .50-caliber size is a major breakthrough and opens the door to what could be possible in future guided projectiles across all calibers."

Read the full article in Popular Science here.