Why That Annoying Fraud Alert Is Still a Good Thing

As credit card fraud has skyrocketed, issuers suspecting suspicious activity have become increasingly vigilant – sometime maybe too vigilant.

In many cases, fraud alerts are preventing consumers from making legitimate purchases. More than two-thirds of Americans who have received a fraudulent activity alert from their credit or debit card issuers have received at least one that’s inaccurate, according to a new study from CreditCards.com.

Still, card issuers have good reason to be cautious. This week, credit card scoring and analytics firm FICO said that the number of attacks on debit cards used at ATMs hit the highest level in 20 years during the first quarter of 2014

Related: How to Beat Credit and Debit Card ID Thieves

Americans remain extremely concerned about their personal data when shopping in stores, so many accept the inaccurate fraud alerts as a necessary hassle. “Most consumers we have spoken with seem to be okay with this trend,” CreditCards.com senior industry analyst Matt Schulz said in a statement.

You can avoid having your card blocked from legitimate purchases by calling your issuer or visiting their Web site to let them know you’ll be traveling, since purchases made from a new geographic area often send a red flag to card companies. Some issuers also offer text message alerts, so you can quickly and easily unblock a card for your transactions.

If you think you’ve been a victim of fraud (or if your cards have been physically lost or stolen), call your issuer immediately – most have 24/7 call centers dedicated to fraud.

It’s Official: No Government Shutdown – for Now

President Trump signed a short-term continuing resolution today to fund the federal government through Friday, December 22.

Bloomberg called the maneuver “a monumental piece of can kicking,” which is no doubt the case, but at least you’ll be able to visit your favorite national park over the weekend.

Here's to small victories!

Greenspan Has a Warning About the GOP Tax Plan

The Republican tax cuts won’t do much for economic growth, former Federal Reserve Chair Alan Greenspan told CNBC Wednesday, but they will damage the country’s fiscal situation while creating the threat of stagflation. "This is a terrible fiscal situation we've got ourselves into," Greenspan said. "The administration is doing tax cuts and a spending decrease, but he's doing them in the wrong order. What we need right now is to focus totally on reducing the debt."

The US Economy Hits a Sweet Spot

“The U.S. economy is running at its full potential for the first time in a decade, a new milestone for an expansion now in its ninth year,” The Wall Street Journal reports. But the milestone was reached, in part, because the Congressional Budget Office has, over the last 10 years, downgraded its estimate of the economy’s potential output. “Some economists think more slack remains in the job market than October’s 4.1% unemployment rate would suggest. Also, economic output is still well below its potential level based on estimates produced a decade ago by the CBO.”

The New York Times Drums Up Opposition to the Tax Bill

The New York Times editorial board took to Twitter Wednesday “to urge the Senate to reject a tax bill that hurts the middle class & the nation's fiscal health.”

Using the hashtag #thetaxbillshurts, the NYT Opinion account posted phone numbers for Sens. Susan Collins, Bob Corker, Jeff Flake, James Lankford, John McCain, Lisa Murkowski and Jerry Moran. It urged readers to call the senators and encourage them to oppose the bill.

In an editorial published Tuesday night, the Times wrote that “Republican senators have a choice. They can follow the will of their donors and vote to take money from the middle class and give it to the wealthiest people in the world. Or they can vote no, to protect the public and the financial health of the government.”

Like what you're reading? Sign up for our free newsletter.

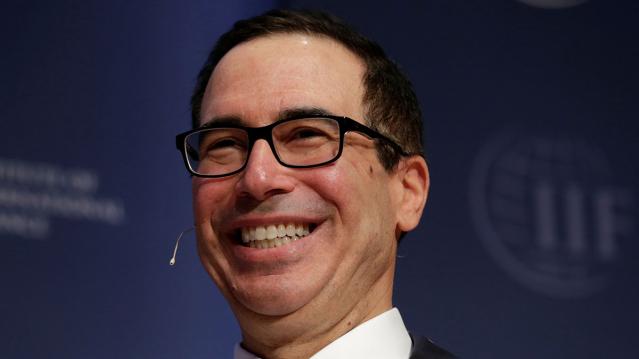

Can Trump Succeed Where Mnuchin and Cohn Have Flopped?

President Trump met with members of the Senate Finance Committee Monday and is scheduled to attend Senate Republicans’ weekly policy lunch and make a personal push for the tax plan on Tuesday. Will he be a more effective salesman than surrogates in his administration?

Politico’s Annie Karni and Eliana Johnson report that both Democrats and Republicans say Mnuchin and chief economic adviser Gary Cohn have repeatedly botched their tax pitches, “in part due to their own backgrounds” as wealthy Goldman Sachs alums. “House Speaker Paul Ryan earlier this month asked the White House not to send Mnuchin to the Hill to talk with Republican lawmakers about the bill, according to two people familiar with the discussions — though Ryan has praised the Treasury secretary’s ability to improve the legislation itself,” Karni and Johnson write.