Billionaires: 10 Intriguing New Facts About Who’s Getting Rich Now

A new Chinese billionaire was created almost every week in the first quarter of 2015, according to a just-released report by UBS and PwC.

"Asia's billionaires make up 36 percent of self-made billionaire wealth, overtaking Europe for the first time and second only to the U.S.," said Antoinette Hoon, private banking advisory services partner for PwC in Hong Kong. “Looking forward, we expect the region to be the center of new billionaire wealth creation.”

Related: 6 Traits of an Emerging Millionaire: Are You One?

The report, which looked at data for 1,300 billionaires over 19 years, found – unsurprisingly -- that entrepreneurship is a powerful force for wealth creation. “Billionaires: Master architects of great wealth and lasting legacies" also noted that many billionaires are embracing philanthropy to build a legacy.

Here are 10 other findings of the report:

- 917 self-made billionaires generated more than $3.6 trillion of global wealth between 1995 and 2014.

- Of them, 23 percent launched their first business before age 30; 68 percent before turning 40.

- The second-highest number of self-made American billionaires (27.3 percent) in the last two decades came out of the tech sector.

- Finance produced 30 percent of U.S. billionaires, but they aren’t as rich as their counterparts in tech; their average net worth is $4.5 billion, compared with $7.8 billion for tech moneybags.

- In Europe and Asia, self-made billionaires mostly made their money in the consumer industry. Their wealth averages $5.7 billion. Tech entrepreneurs in Europe and Asia were the second-richest group with an average worth of $3.8 billion.

- More than two-thirds of global billionaires are over 60 years old and have more than one child.

- The average age of Asia billionaires is 57, 10 years younger than in the U.S. and Europe.

- About one fourth of Asian billionaires had impoverished childhoods, compared with 8 percent in the U.S. and 6 percent in Europe.

- 60 percent of self-made billionaires in the U.S. and Europe retain their businesses, 30 percent dispose of part of their business via an IPO or trade sale, with 10 percent selling outright.

- In Europe and Asia, billionaires are most likely to create a business dynasty, with 57 percent of European and 56 percent of Asian billionaire families, respectively, taking over the family business when the founder retires. In the U.S., just 36 percent of businesses remain family-run once the founder retires.

The IRS Gives Hurricane Harvey Victims a Break

The tax agency announced Monday that “victims in parts of Texas have until Jan. 31, 2018, to file certain individual and business tax returns and make certain tax payments.”

Fitch Sends a Warning on US Credit Rating

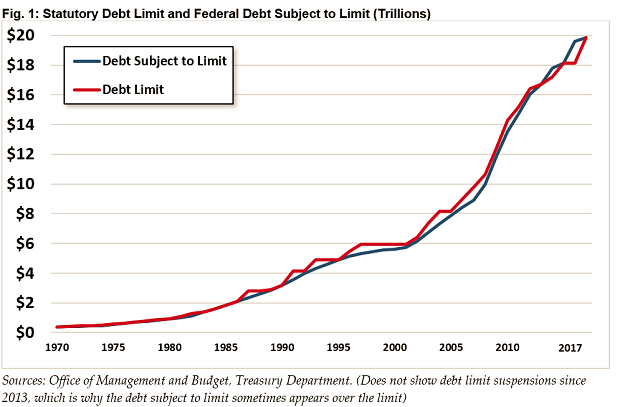

One of the three major credit ratings agencies warned Wednesday that a failure to raise the debt ceiling could result in a lower credit rating for the U.S.

Fitch Ratings currently assigns a AAA rating to U.S. debt, the highest level possible. However, a failure to raise the debt ceiling "may not be compatible with 'AAA' status," according to the agency.

If the U.S. cannot sell more debt after bumping up against the debt ceiling, it may not be able to make all of its interest payments on time and in full. The federal government could begin running out of cash as soon as October.

The debt ceiling is currently $19.9 trillion, and Treasury Secretary Steven Mnuchin has repeatedly urged Congress to raise the debt ceiling by September 29. A failure to do so could roil financial markets around the world, and ultimately increase the cost of servicing U.S. debt.

This is not the first time Congress has faced this problem. During an earlier debt ceiling showdown in 2011, Standard & Poor's reduced its rating on U.S. debt from its highest level to AA+. However, Fitch and Moody’s stuck with their top ratings.

Senators to Hold Hearings on a Bipartisan Fix for Health Care

Mark your calendars: Senate health committee Chairman Lamar Alexander (R-Tenn.) and Ranking Member Patty Murray (D-Wash.) announced today that they will hold bipartisan hearings on Sept. 6 and 7 focused on stabilizing premiums in the individual insurance market. The first hearing will be with state insurance commissioners; the second will be with governors.

In a statement, Alexander noted that 18 million Americans buy insurance on the individual market.

“My goal by the end of September is to give them peace of mind that they will be able to buy insurance at a reasonable price for the year 2018,” he said. “Unless Congress acts by September 27—when insurance companies must sign contracts with the federal government to sell insurance on the federal exchange in 2018— 9 million Americans in the individual market who receive no government help purchasing health insurance and whose premiums have already skyrocketed may see their premiums go up even more. Even those with subsidies in up to half our states may find themselves with zero options for buying health insurance on the Obamacare exchanges in 2018.”

McConnell: ‘Zero Chance’ the Debt Ceiling Will Be Breached

At an event in Kentucky to discuss tax reform, Senate Majority Leader Mitch McConnell and Treasury Secretary Steven Mnuchin insisted Monday that Congress will raise the debt ceiling by late next month, in time for the U.S. to avoid a default that could roil the global economy and markets.

Related: The Debt Ceiling — What It Is and Why We Should Care

The key quotes, per Roll Call:

McConnell: "There is zero chance — no chance — we won't raise the debt ceiling. No chance. America's not going to default. And we'll get the job done in conjunction with the secretary of the Treasury."

Mnuchin: “We’re going to get the debt ceiling passed. I think that everybody understands this is not a Republican issue, this is not a Democrat issue. We need to be able to pay our debts. This is about having a clean debt ceiling so that we can maintain the best credit, the reserve currency, and be focused on what we should be focusing on — so many other really important issues for the economy.”

Related: Here’s a Solution for the Annual Debt Ceiling Crisis — Get Rid of It

Mnuchin reiterated his “strong preference” for a “clean” increase to the debt limit — one without other policy proposals or spending cuts attached to it — but some House conservatives continue to press for such cuts.

Bonus McConnell quote on what tax breaks might be eliminated in tax reform: “I think there are only two things that the American people think are actually in the Constitution: The charitable deduction and the home mortgage interest deduction. So, if you’re worried about those two, you can breathe easy. For all the rest of you, there’s no point in doing tax reform unless we look at all of these preferences, and carried interest would be among them.”

Trump’s Travel and Family Size Squeeze Secret Service Budget

In an interview with USA Today, Secret Service Director Randolph "Tex" Alles said the agency is bumping up against federally mandated salary and overtime caps in executing its mission to protect the president and his family.

USA Today’s Kevin Johnson notes that 42 people in the Trump administration have Secret Service protection, including 18 of the president’s family members. Under President Obama, 31 people had such protection.

“The compensation crunch is so serious that the director has begun discussions with key lawmakers to raise the combined salary and overtime cap for agents, from $160,000 per year to $187,000 for at least the duration of Trump's first term,” Johnson reported.

Related: Which Former President Costs US the Most?

In a statement, Alles said the agency has the funding it needs for the rest of the fiscal year, which runs through Sept. 30, but estimated that 1,100 employees run into statutory pay caps as a result of overtime work during this calendar year.

“This issue is not one that can be attributed to the current Administration’s protection requirements alone, but rather has been an ongoing issue for nearly a decade due to an overall increase in operational tempo," Alles said in the statement.

Earlier: The Secret Service Won’t Get $60 Million More to Protect the Trumps