Charter to Buy Time Warner Cable: Winners and Losers

Charter Communications on Tuesday said it will acquire Time Warner Cable in a deal valued at more than $55 billion. Charter will also buy Bright House Networks, a smaller cable company, for $10.4 billion. The two deals combined will make Charter into the second-largest cable and broadband provider in the U.S., with about 24 million subscribers, behind only Comcast, which has about 27 million subscribers.

WINNERS

Time Warner shareholders: An extra $10 billion over the $45.2 billion Comcast had offered sure makes for a nice payday after the earlier deal got scrapped. “Time Warner Cable has succeeded in extracting a fantastic price for its shareholders, far exceeding our expectations,” Morningstar strategist Michael Hodel wrote Tuesday. Hedge fund managers John Paulson of Paulson & Co. and Chris Hohn of Children’s Investment Fund Management reportedly both had sizable holdings in Time Warner Cable.

Time Warner Cable subscribers: The company’s service is reviled by customers. Charter’s isn’t exactly beloved, either, and subscribers may not see any immediate changes, but Charter promises that the deal will translate into faster broadband for subscribers and more free public Wi-Fi. Whether it actually does or not, the deal seems to spell the end of the Time Warner Cable name. Subscribers won’t miss it.

John Malone: The Liberty Media billionaire finally gets the megadeal he’s been looking for to make Charter Communications into a major industry power. If the deals goes through, the company would become the second-largest cable and broadband provider in the country, with some 24 million total subscribers.

Related: Charter and Time Warner Cable Merger: It’s All About Broadband

LOSERS

Comcast: At least CEO Brian Rogers was graceful about the prospect of a larger competitor. "This deal makes all the sense in the world,” he said in a statement. “I would like to congratulate all the parties."

Television content providers: One rationale for the deal is that the scale of the combined company will afford it more leverage in its negotiations with programmers.

Cable customers and online video watchers? The proposed deal still concerns consumer advocates like those at public interest group Free Press. “The issue of the cable industry's power to harm online video competition, which is what ultimately sank Comcast’s consolidation plans, are very much at play in this deal,” said Derek Turner, research director for Free Press. “Ultimately, this merger is yet another example of the poor incentives Wall Street’s quarterly-result mentality creates. Charter would rather take on an enormous amount of debt to pay a premium for Time Warner Cable than build fiber infrastructure, improve service for its existing customers or bring competition into new communities.”

Why Craft Brewers Are Crying in Their Beer

It may be small beer compared to the problems faced by unemployed federal workers and the growing cost for the overall economy, but the ongoing government shutdown is putting a serious crimp in the craft brewing industry. Small-batch brewers tend to produce new products on a regular basis, The Wall Street Journal’s Ruth Simon says, but each new formulation and product label needs to be approved by the Treasury Department’s Alcohol and Tobacco Tax and Trade Bureau, which is currently closed. So it looks like you’ll have to wait a while to try the new version of Hemperor HPA from Colorado’s New Belgium Brewing, a hoppy brew that will include hemp seeds once the shutdown is over.

Number of the Day: $30 Billion

The amount spent on medical marketing reached $30 billion in 2016, up from $18 billion in 1997, according to a new analysis published in the Journal of the American Medical Association and highlighted by the Associated Press. The number of advertisements for prescription drugs appearing on television, newspapers, websites and elsewhere totaled 5 million in one year, accounting for $6 billion in marketing spending. Direct-to-consumer marketing grew the fastest, rising from $2 billion, or 12 percent of total marketing, to nearly $10 billion, or a third of spending. “Marketing drives more treatments, more testing” that patients don’t always need, Dr. Steven Woloshin, a Dartmouth College health policy expert and co-author of the study, told the AP.

70% of Registered Voters Want a Compromise to End the Shutdown

An overwhelming majority of registered voters say they want the president and Congress to “compromise to avoid prolonging the government shutdown” in a new The Hill-HarrisX poll. Seven in ten respondents said they preferred the parties reach some sort of deal to end the standoff, while 30 percent said it was more important to stick to principles, even if it means keeping parts of the government shutdown. Voters who “strongly approve” of Trump (a slim 21 percent of respondents) favored him sticking to his principles over the wall by a narrow 54 percent-46 percent margin. Voters who “somewhat approve” of the president favored a compromise solution by a 70-30 margin. Among Republicans overall, 61 percent said they wanted a compromise.

The survey of 1,000 registered voters was conducted January 5 and 6 and has a margin of error of 3.1 percentage points.

Share Buybacks Soar to Record $1 Trillion

Although there may be plenty of things in the GOP tax bill to complain about, critics can’t say it didn’t work – at least as far as stock buybacks go. TrimTabs Investment Research said Monday that U.S. companies have now announced $1 trillion in share buybacks in 2018, surpassing the record of $781 billion set in 2015. "It's no coincidence," said TrimTabs' David Santschi. "A lot of the buybacks are because of the tax law. Companies have more cash to pump up the stock price."

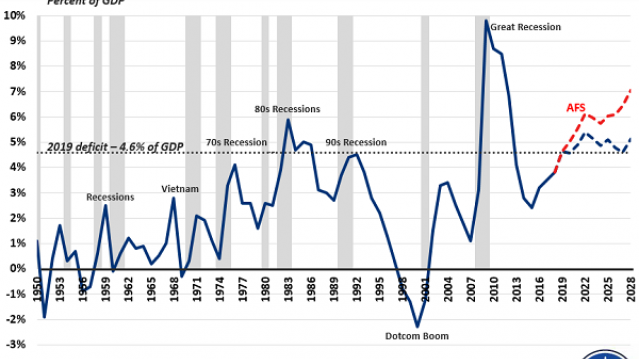

Chart of the Day: Deficits Rising

Budget deficits normally rise during recessions and fall when the economy is growing, but that’s not the case today. Deficits are rising sharply despite robust economic growth, increasing from $666 billion in 2017 to an estimated $970 billion in 2019, with $1 trillion annual deficits expected for years after that.

As the deficit hawks at the Committee for a Responsible Federal Budget point out in a blog post Thursday, “the deficit has never been this high when the economy was this strong … And never in modern U.S. history have deficits been so high outside of a war or recession (or their aftermath).” The chart above shows just how unusual the current deficit path is when measured as a percentage of GDP.