Looking to Buy a Home? Do This First

Buying a home is stressful enough without getting blindsided with a higher-than-expected rate on your mortgage — or outright rejection — due to a low credit score or errors on your credit report.

Even so, only half of recent home buyers said they checked their credit report early on in the homebuying process, according to a report released by Experian.

That can make for some nerve-wracked meetings with lenders. About a third of those surveyed said that their credit score surprised them, and a fifth of buyers said their score was lower than expected. Fourteen percent of homebuyers found something negative on their credit report that they didn’t know about.

Related: Why Your Credit Score Is the Most Important Number in Your Life

A low credit score can have costly consequences. A borrower with a FICO score of 760, for example, would pay $1,360 per month on a $300,000 loan, while a borrower with a score of 759 would pay $1,397 per month on the same loan. That difference will add up to more than $10,000 over the life of a 30-year mortgage.

Forty-five percent of future homebuyers surveyed by Experian said that they had delayed purchasing a home in order to work on their credit and qualify for better rates.

If your score is lower than expected, first check the report for errors and contact the credit bureaus about correcting them. If you’ve been dinged for a single missed payment, call your credit card company to see if it will remove the incident from your reports. Then focus on making on-time payments and paying down any high balances to get your debt-to-income ratio below 25 percent.

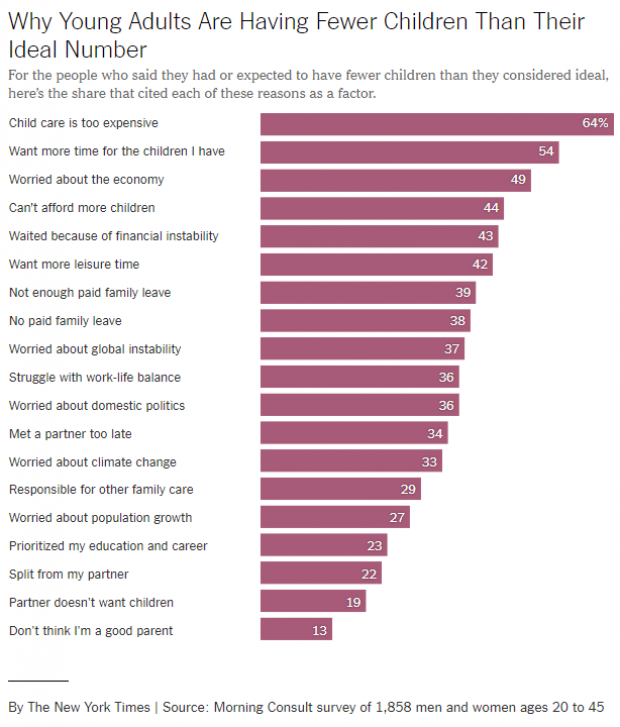

Chart of the Day: Why US Fertility Rates Are Falling

U.S. fertility rates have fallen to record lows for two straight years. “Because the fertility rate subtly shapes many major issues of the day — including immigration, education, housing, the labor supply, the social safety net and support for working families — there’s a lot of concern about why today’s young adults aren’t having as many children,” Claire Cain Miller explains at The New York Times’ Upshot. “So we asked them.”

Here are some results of the Times’ survey, conducted with Morning Consult. Read the full Times story for more details.

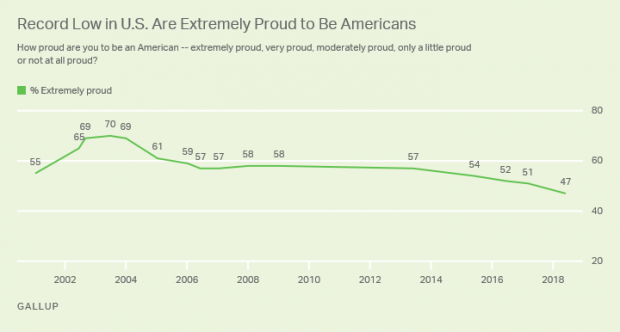

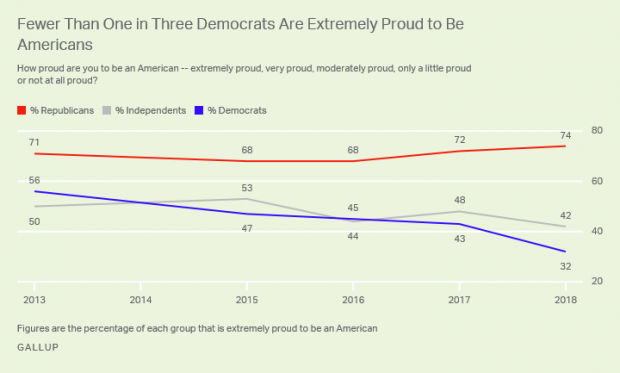

A Record Low 47% of US Adults Say They're 'Extremely Proud' to Be American

Gallup says that, for the first time in the 18 years it’s been asking U.S. adults how proud they are to be Americans, fewer than half say they are "extremely proud." Just 47 percent now say they’re extremely proud, down from 70 percent in 2003.

Another 25 percent say they’re “very proud” — but the combined 72 percent who say they’re extremely or very proud is also the lowest Gallup has recorded. Pride levels among liberals and Democrats have plunged since 2017. Overall, 74 percent of Republicans and just 32 percent of Democrats call themselves “extremely proud” to be American.

Pfizer Has Raised Prices on 100 of Its Products

Weeks after President Trump said that drugmakers were about to implement “voluntary massive drops in prices” — reductions that have yet to materialize — Pfizer has raised prices on 100 of its products, The Financial Times’s David Crow reports:

“The increases were effective as of July 1 and in most cases were more than 9 per cent — well above the rate of inflation in the US, which is running at about 2 per cent. … Pfizer, the largest standalone drugmaker in the US, did decrease the prices of five products by between 16 per cent and 44 per cent, according to the figures.”

Crow notes that Pfizer also raised prices on many of its medicines in January, meaning that some prices have been hiked by nearly 20 percent this year. The drugmaker said that it was only changing prices on 10 percent of its medicines and that list prices did not reflect what most patients or insurers actually paid. The net price increase after rebates and discounts was expected to be in the “low single digits,” the company told the FT.

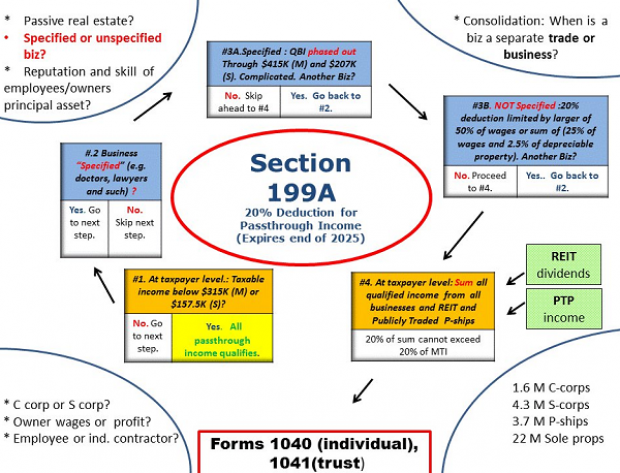

Chart of the Day: Pass-Through Tax Deductions Made Easy

The Republican tax overhaul was supposed to simplify the tax code, but most experts say it fell well short of the goal. Martin Sullivan, chief economist at Tax Analysts, tweeted out a chart of the analysis required to determine whether income qualifies for the passthrough tax deduction of 20 percent, and as you’ll see, it’s anything but simple.

A Conservative Bashes GOP Dysfunction on Spending Cuts

Brian Riedl, a senior fellow at the conservative Manhattan Institute, offers a blistering critique of congressional Republican’s problems cutting spending:

Since the Republicans took the House in 2011, nearly every annual budget blueprint has promised to balance the budget within a decade with anywhere from $5 trillion to $8 trillion in spending cuts. And yet, you may have noticed, the budget has not moved towards balance. This is because the budget merely sets a broad fiscal goal. To actually cut spending, Congress must follow up with specific legislation to reform Medicare, Medicaid, and all the other targeted programs. In reality, most lawmakers who pass these budgets have no intention whatsoever of cutting this spending. As soon as the budget is passed, the targets are forgotten. The spending-cut legislation is never even drafted, much less voted on.

The annual budget exercise is thus a cynical exercise in symbolism. Congress calculates how much spending must be cut over ten years to balance the budget. Then they pass legislation setting a goal of cutting that amount. Then they move on to other business. It’s like a baseball team announcing that they voted to win the next World Series, and then not showing up to play the season.

Read the full piece at National Review.