The Waldorf’s Presidential Suite Isn’t Very Presidential Anymore

Months after the Waldorf Astoria was sold to a Chinese company, the State Department is abandoning a decades-long tradition of putting up U.S. diplomats at the storied hotel on New York’s Park Avenue.

This fall President Obama and state department officials will not be staying at the Waldorf for the opening of the U.N. General Assembly and will check into the New York Palace Hotel instead.

According to the New York Post, “every U.S. president since Herbert Hoover” has stayed in the presidential suite at the Waldorf when visiting New York, including President Obama. Presidential artifacts in the suite include President Jimmy Carter’s eagle desk set, one of President John F. Kennedy’s rocking chairs, a gold oval mirror from Ronald Reagan, and the personal desk of General Douglas MacArthur. The hotel is the site of Chinese history as well. On his first historic trip to the U.S. in 1974, Chinese leader Deng Xiaoping stayed at the Waldorf and attended a banquet given in his honor by then Secretary of State Henry Kissinger.

Related: U.S. Reviews Waldorf Astoria Sale to Chinese Firm

The $1.95 billion sale of the 47-story tower to the Beijing-based Anbang Insurance Group first raised eyebrows in Washington last October. Even though the previous owner, Hilton Worldwide Holdings, will continue to manage the hotel for the next 100 years, news of a “major renovation” sparked fears of possible Chinese cyber-espionage and surveillance.

Those fears were further heightened earlier this month when U.S. officials blamed Chinese hackers for a massive cyberattack targeting the U.S. Office of Personnel Management, exposing sensitive information about 4 million current and former federal workers. China has denied any involvement.

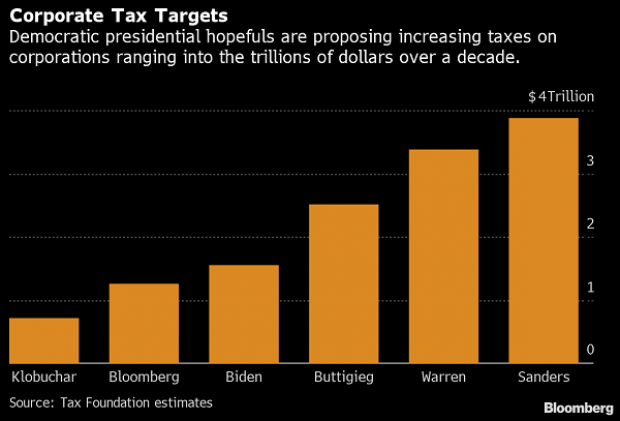

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

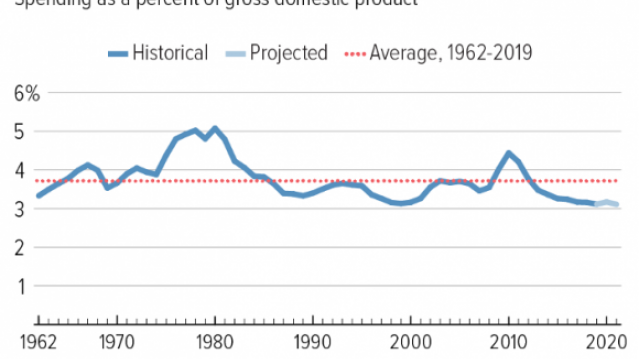

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

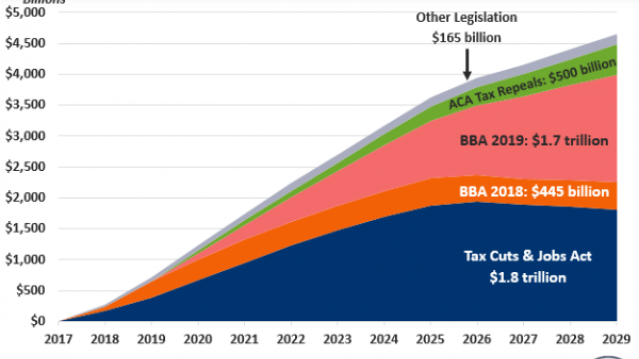

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

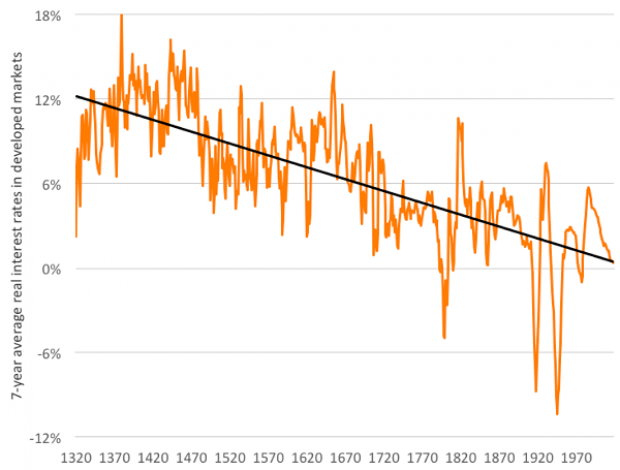

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

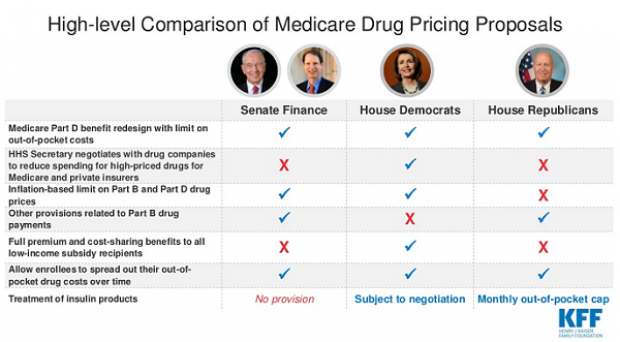

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.