This may come as a surprise, but they're still making things in the Midwest.

While much has been made of the decline in American manufacturing since 2001, especially in the years since the Great Recession, there's still strength in the sector, according to data from the National Association of Manufacturers (NAM).

The lower Midwestern states of Indiana, Ohio and Illinois lead the nation in manufacturing, according to CNBC's analysis of NAM's data. Through a combination of regulatory changes, expanding direct foreign investment and the adaptation to new technologies, Indiana in particular has emerged as the best state in the U.S. for manufacturing. At the end of 2014, Indiana was home to 8,485 manufacturers employing 515,526 workers, according to the Bureau of Labor Statistics.

The sector, valued at $95.3 billion, made up 30 percent of the state's GSP in 2014, according to the Economic Policy Institute, roughly the same rate as in the mid-'90s. But it's not your grandfather's dirty plants pumping out sheets of steel under the smoggy sky of Gary anymore.

"Indiana has always been a big manufacturing state," said Patrick Kiely, president and chief executive of the Indiana Manufacturers Association. "We've always been thought of as the old smokestack state, while in fact that's really not the case anymore."

Indiana's manufacturing sector has gained strength in recent years, thanks in part to policy changes, like becoming a right-to-work state in 2012 and decreasing the corporate income tax rate. In July it's scheduled to drop to a flat 6.5 percent. Additionally, Indiana has become a target for direct foreign investment, and more than 300 Japanese companies have set up shop since the mid 1980s, including automakers Toyota and Honda, Kiely said.

Motor vehicles and parts still make up a big portion of Indiana's manufacturing output—$15.5 billion in 2012. But the state also has fast-growing capacity in pharmaceuticals and medical devices. Indianapolis-based pharma giant Eli Lilly last year opened an expanded insulin-manufacturing facility in Indiana, adding 100 skilled positions, and medical device company Zimmer Holdings agreed to purchase Biomet for $13.4 billion. The corporate headquarters for the combined company will remain in Warsaw, Indiana.

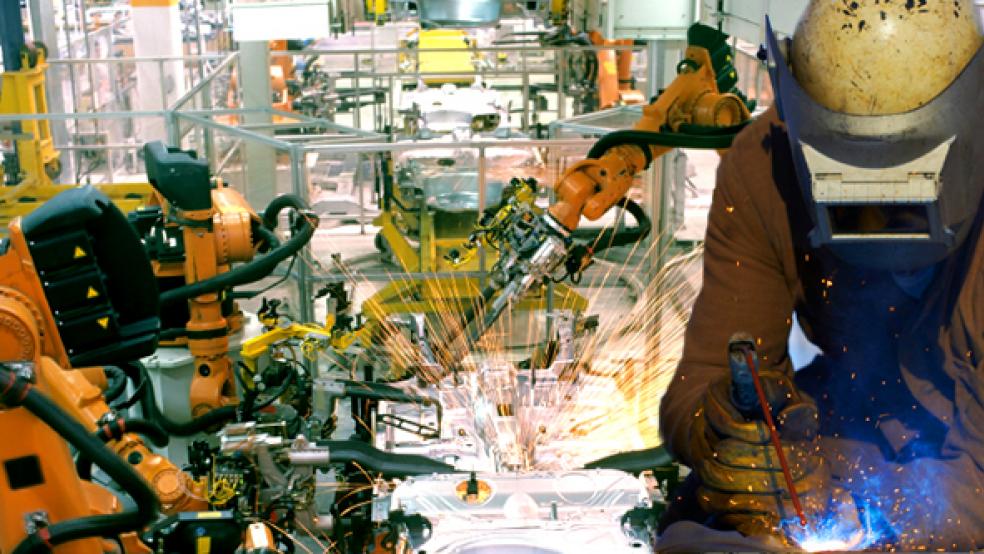

Chemical products now make up the largest portion of Indiana's manufacturing output, at $27.3 billion. But even the plants that produce car parts and fabricated metals are filled with high-tech automation and machinery. "There's more modern electronics technology in one of those facilities than you're going to see almost anywhere on Earth," Kiely said.

Other regions picking up steam

Indiana added 19,700 manufacturing jobs to the books between January 2014 and April of this year, according to the Bureau of Labor Statistics. That's behind only Michigan and Ohio, which added 26,900 and 22,600, respectively.

Read More: Debunking 3 big myths about manufacturing jobs

In its analysis, CNBC ranked the states based on six manufacturing statistics, including overall output, share of GSP and total exports. The states were then ranked based on this aggregate total. Indiana tops the rankings in share of GSP and the portion of employment in manufacturing, with 17 percent.

Read More: America's Top States for Business 2015: Our methodology

The Midwest may still be the hands-on heartland, but other regions hold their own in manufacturing and are picking up steam.

"The Southeast is gaining some ground," said Chad Moutray, chief economist at NAM. "There's a lot of investment in the auto sector in the Southeast."

In terms of gross output, California—which ranked fifth in CNBC's analysis—is the country's manufacturing workhorse, producing $239 billion in goods in 2013. That's nearly 12 percent of the nation's overall manufacturing output. Texas, which largely produces petroleum and coal as well as chemical products, tops the exporters list with $261.1 billion in 2013.

Read More: State incentives: Business boon or corporate welfare?

Still, there are clouds on the horizon, due in large part to a weak dollar and China's economic slowdown, Moutray said. NAM's annual outlook survey showed that manufacturers expect exports to grow by just 0.4 percent in the next year, down from 0.9 percent in March.

The nascent doom of the Trans-Pacific Partnership, too, could be bad news for American manufacturers.

"The Asian market is going to be growing tremendously over the next decade or so," Moutray said. "Anytime you're able to lower trade barriers, that's going to be a win-win for U.S. manufacturers."

This piece originally appeared in CNBC.com