Did Airlines Collude to Keep Air Fares High?

For months now, oil and gas prices have been dropping—and that includes jet fuel. So why haven’t airline ticket prices dropped as well? That’s one of the questions the Justice Department wants answered as it investigates the possibility of collusion among carriers to keep airfares high.

The DOJ also wants to know if companies conspired to limit the number of available seats in order to drive prices up. Yesterday, the Associated Press broke the news that major U.S. carriers had received a letter demanding copies of all communications the airlines had with each other, Wall Street analysts, and major shareholders about their plans for passenger-carrying capacity, going back to January 2010. The civil antitrust investigation is focusing on whether airlines illegally indicated to each other how quickly they would add new flights, routes, and extra seats in an effort to prop up ticket prices.

Related: 6 Sneaky Fees That Are Making Airlines a Bundle

Just minutes after the news broke, stocks of the major U.S. airlines fell four to five percent, with the S&P 500 airlines index off more than four percent. Until now, the U.S. airline industry had been enjoying record profits, due to increasing numbers of Americans flying and a huge drop in the price of jet fuel. In April, the price of jet fuel was $1.94 per gallon, a decrease of 34 percent from the previous year.

The investigation marks a notable shift for the Justice Department, which approved the merger of American Airlines and US Airways back in November 2013, despite previously blocking it over concerns that the airlines would collude on fares. The probe could signal a more aggressive approach on antitrust enforcement, under the strong leadership of Loretta Lynch, who was confirmed in April.

Justice Department spokesperson Emily Pierce confirmed that the department was investigating potential “unlawful coordination” among some airlines.

Just two weeks ago, U.S. Senator Richard Blumenthal (D-CT) urged the Justice Department to investigate what he called “anti-competitive, anti-consumer conduct and misuse of market power in the airline industry.”

Related: United Airlines Bullish on First Quarter from Lower Fuel Costs

Since 2008, various mergers have resulted in four major airlines (down from nine)—American, Delta, Southwest, and United—controlling about 80 percent of all domestic air travel. All four airlines have confirmed that they received the letter and that they were cooperating with the investigation.

According to Bureau of Transportation Statistics, the average domestic airfare rose 13 percent from 2009 to 2014 (adjusted for inflation). The average domestic flight last year cost $391. In the past year alone, airlines received an additional $3.6 billion from bag fees and another $3 billion from reservation-change fees. All of the major airlines—American Airlines, United Continental Holdings, Delta Air Lines, Southwest Airlines, JetBlue Airways, and Alaska Air Group—posted record profits with a consolidated net income of over $3 billion during the first quarter of 2015.

GOP Tax Cuts Getting Less Popular, Poll Finds

Friday marked the six-month anniversary of President Trump’s signing the Republican tax overhaul into law, and public opinion of the law is moving in the wrong direction for the GOP. A Monmouth University survey conducted earlier this month found that 34 percent of the public approves of the tax reform passed by Republicans late last year, while 41 percent disapprove. Approval has fallen by 6 points since late April and disapproval has slipped 3 points. The percentage of people who aren’t sure how they feel about the plan has risen from 16 percent in April to 24 percent this month.

Other findings from the poll of 806 U.S. adults:

- 19 percent approve of the job Congress is doing; 67 percent disapprove

- 40 percent say the country is heading in the right direction, up from 33 percent in April

- Democrats hold a 7-point edge in a generic House ballot

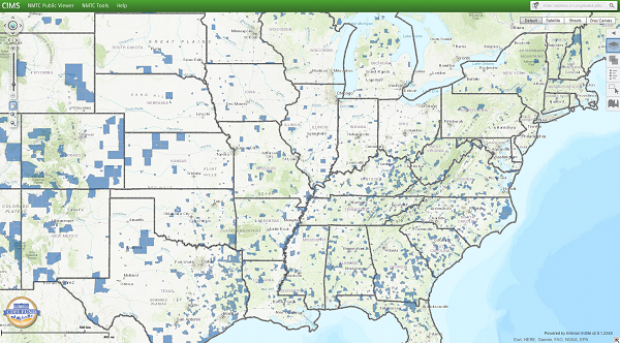

Special Tax Break Zones Defined for All 50 States

The U.S. Treasury has approved the final group of opportunity zones, which offer tax incentives for investments made in low-income areas. The zones were created by the tax law signed in December.

Bill Lucia of Route Fifty has some details: “Treasury says that nearly 35 million people live in the designated zones and that census tracts in the zones have an average poverty rate of about 32 percent based on figures from 2011 to 2015, compared to a rate of 17 percent for the average U.S. census tract.”

Click here to explore the dynamic map of the zones on the U.S. Treasury website.

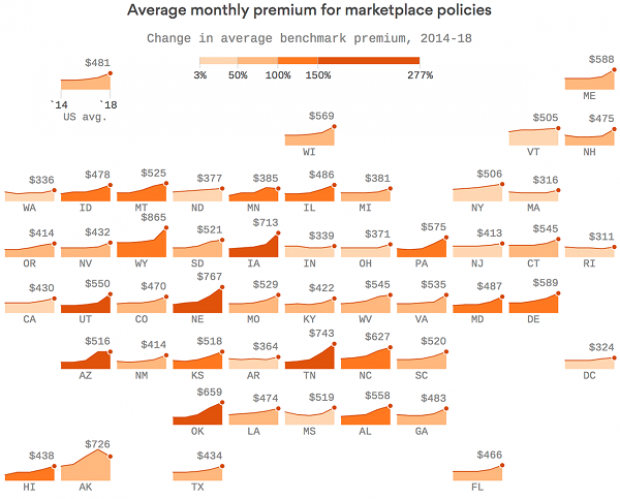

Map of the Day: Affordable Care Act Premiums Since 2014

Axios breaks down how monthly premiums on benchmark Affordable Care Act policies have risen state by state since 2014. The average increase: $481.

Obamacare Repeal Would Lead to 17.1 Million More Uninsured in 2019: Study

A new analysis by the Urban Institute finds that if the Affordable Care Act were eliminated entirely, the number of uninsured would rise by 17.1 million — or 50 percent — in 2019. The study also found that federal spending would be reduced by almost $147 billion next year if the ACA were fully repealed.

Your Tax Dollars at Work

Mick Mulvaney has been running the Consumer Financial Protection Bureau since last November, and by all accounts the South Carolina conservative is none too happy with the agency charged with protecting citizens from fraud in the financial industry. The Hill recently wrote up “five ways Mulvaney is cracking down on his own agency,” and they include dropping cases against payday lenders, dismissing three advisory boards and an effort to rebrand the operation as the Bureau of Consumer Financial Protection — a move critics say is intended to deemphasize the consumer part of the agency’s mission.

Mulvaney recently scored a small victory on the last point, changing the sign in the agency’s building to the new initials. “The Consumer Financial Protection Bureau does not exist,” Mulvaney told Congress in April, and now he’s proven the point, at least when it comes to the sign in his lobby (h/t to Vox and thanks to Alan Zibel of Public Citizen for the photo, via Twitter).