Watch Lindsey Graham Destroy His Phone, Get a Bit of Revenge on Donald Trump

What do you do when Donald Trump gives out your cellphone number in a televised campaign rally? South Carolina Sen. Lindsey Graham, a Trump rival for the GOP presidential nomination, made the most of The Donald’s rude move by releasing a video in which he demolishes his phone (more than one, actually) by doing everything short of blowing it up.

Related: 7 Revelations from Donald Trump’s Financial Disclosure

The YouTube video, posted by IJ Review and titled “How to Destroy Your Phone With Sen. Lindsey Graham,” shows the senator smashing a Samsung flip phone in various ways — a golf club, a wooden sword, a cinder block — and also chopping it with a meat cleaver, putting it in a toaster oven with pizza bagels, dropping it in a blender with some Red Bull, lighting it on fire and dropping it from a rooftop.

“Or if all else fails, you can always give your number to The Donald,” Graham says toward the end of the 1:04 clip.

Related: The 2016 Presidential Election Is Already a Dumpster Fire

Graham isn’t exactly a technophile, so maybe he didn’t know he didn’t need to destroy his phone to get a new number (and there are much better ways to get rid of an old phone). More likely, though, the senator found a clever way to take advantage of the attention Trump provided for him and his campaign while also finally upgrading from his flip phone to a smartphone.

Probably getting a new phone. iPhone or Android?

— Lindsey Graham (@LindseyGrahamSC) July 21, 2015

Graham has struggled to make headway in a crowded Republican presidential field, drawing the support of less than 1 percent of registered GOP voters in recent polls. That would leave him off the stage in the Aug. 6 Fox News debate, which is limited to 10 of the 16 candidates. Trump, by the way, is almost assured of a spot. So the senator and his campaign need all the attention they can get — and the new video sure is getting attention. Since it was published to YouTube yesterday, it’s already been viewed more than 1 million times.

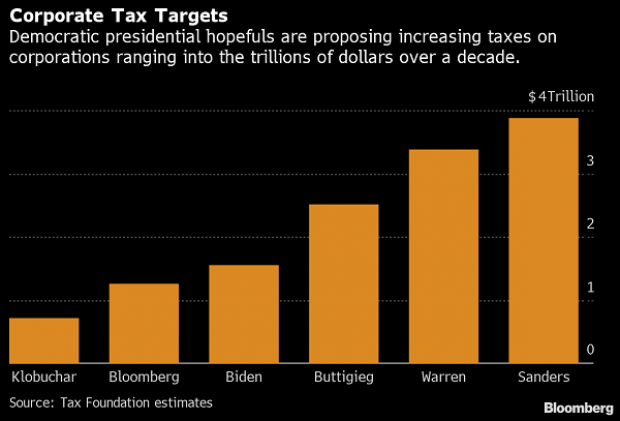

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

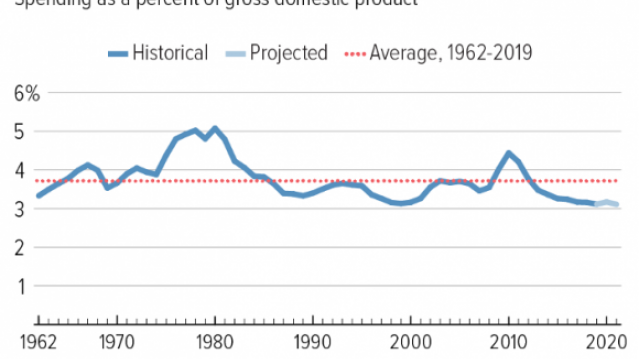

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

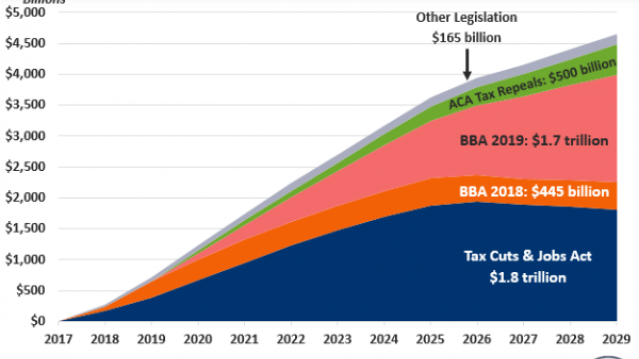

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

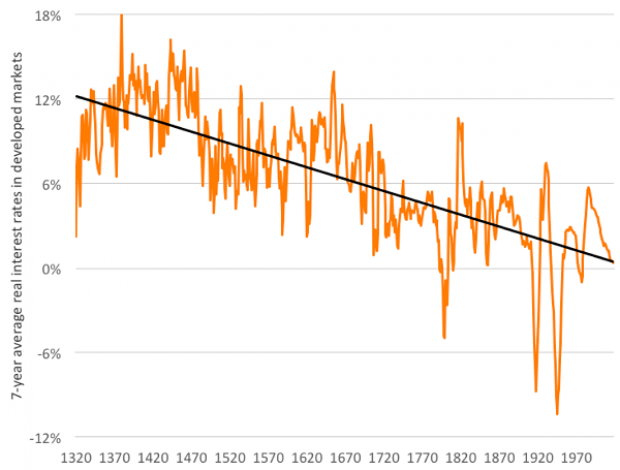

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

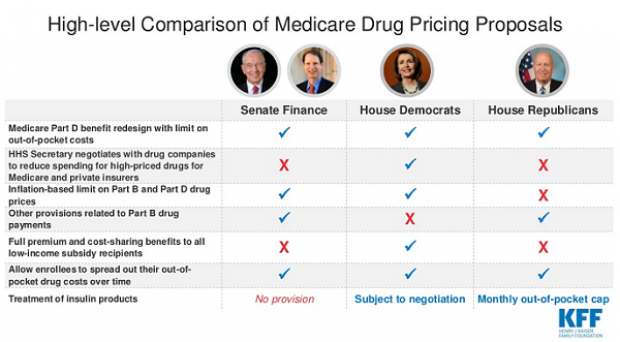

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.