You’ve Got to See This GOP Hawk’s Grisly Ad Opposing the Iran Deal

A group led by John Bolton, the aggressively hawkish Republican insider who served as George W. Bush's ambassador to the United Nations, has released an unusually grisly ad that vividly portrays a nuclear attack on the United States.

The 30-second video was produced by the Foundation for American Security and Freedom, which Bolton leads. It shows an all-American family of four sitting down to a dinner of pasta and red sauce. The father kindly asks, “How was your day?” As his wife and children enthusiastically reply, a blinding flash rips through the scene to the sound of burning and destruction. The screen fades to black, and then we see and hear Sen. Rand Paul speaking, with his words also written on the screen: “Rand Paul: ‘our national security is not threatened by Iran having one nuclear weapon’.” The screen fades to black again, and then we see a nuclear explosion, with the words: “It only takes one.” As the nuclear cloud boils up into the sky, we see the final message: “A nuclear threat is a threat to our national security.”

The 30-second video seems to consciously mimic Lyndon Johnson's infamous "Daisy" ad from the 1964 presidential election. That ad was widely criticized for using a nuclear explosion to frighten the audience into believing that, if elected, Republican nominee Barry Goldwater would risk all-out war with the Soviet Union. The ad was shown only once (on September 7, 1964) but that proved to be enough.

Several differences between the Bolton group’s ad and “Daisy” stand out. For one, the new ad shows a family being destroyed by a nuclear blast. By contrast, the Johnson ad implied the death of a small girl and many others, but without showing the blast and its victims together.

Another difference is the target. The “Daisy” ad took aim at a hawkish Republican candidate for president, implying that an aggressive attitude toward a major enemy could lead to the destruction of the world. The Bolton group’s ad takes aim at a dovish Republican candidate — and, by implication, a dovish American president — while suggesting that a diplomatic approach toward a major enemy could lead to war on American soil.

A final difference: The Johnson campaign withdrew the “Daisy” ad as the criticism poured in. The Bolton group’s ad is on the Internet, where it can be seen over and over again. And thanks to the dynamics of social media, it will likely reach a larger audience than “Daisy” ever did — though to what effect, it remains to be seen.

Here’s the Daisy ad:

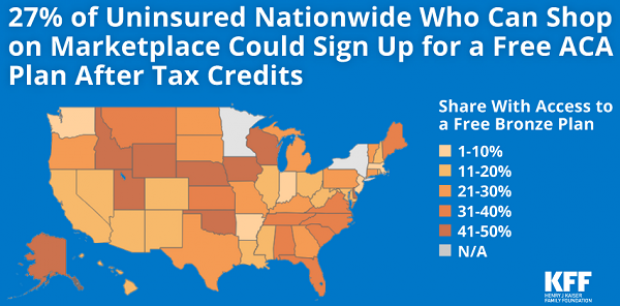

4.2 Million Uninsured People Could Get Free Obamacare Plans

About 4.2 million uninsured people could sign up for a bronze-level Obamacare health plan and pay nothing for it after tax credits are applied, the Kaiser Family Foundation said Tuesday. That means that 27 percent of the country’s 15.9 million uninsured people could get covered for free. The chart below breaks down the eligible population by state.

Takedown of the Day: Ezra Klein on Paul Ryan's Legacy of Debt

Vox’s Ezra Klein says that retiring House Speaker Paul Ryan’s legacy can be summed up in one number: $343 billion. “That’s the increase between the deficit for fiscal year 2015 and fiscal year 2018— that is, the difference between the fiscal year before Ryan became speaker of the House and the fiscal year in which he retired.”

Klein writes that Ryan’s choices while in office — especially the 2017 tax cuts and the $1.3 trillion spending bill he helped pass and the expansion of the earned income tax credit he talked up but never acted on — should be what define his legacy:

“[N]ow, as Ryan prepares to leave Congress, it is clear that his critics were correct and a credulous Washington press corps — including me — that took him at his word was wrong. In the trillions of long-term debt he racked up as speaker, in the anti-poverty proposals he promised but never passed, and in the many lies he told to sell unpopular policies, Ryan proved as much a practitioner of post-truth politics as Donald Trump. …

“Ultimately, Ryan put himself forward as a test of a simple, but important, proposition: Is fiscal responsibility something Republicans believe in or something they simply weaponize against Democrats to win back power so they can pass tax cuts and defense spending? Over the past three years, he provided a clear answer. That is his legacy, and it will haunt his successors.”

Number of the Day: $300 Million

Mick Mulvaney, the acting director of the Consumer Financial Protection Bureau, wants the agency to be known as the Bureau of Consumer Financial Protection, the name under which it was established by Title X of the 2010 Dodd-Frank Wall Street reform law. Mulvaney even had new signage put up in the lobby of the bureau. But the rebranding could cost the banks and other financial businesses regulated by the bureau more than $300 million, according to an internal agency analysis reported by The Hill’s Sylvan Lane. The costs would arise from having to update internal databases, regulatory filings and disclosure forms with the new name. The rebranding would cost the agency itself between $9 million and $19 million, the analysis estimated. Lane adds that it’s not clear whether Kathy Kraninger, President Trump’s nominee to serve as the bureau’s full-time director, would follow through on Mulvaney’s name change once she is confirmed by the Senate.

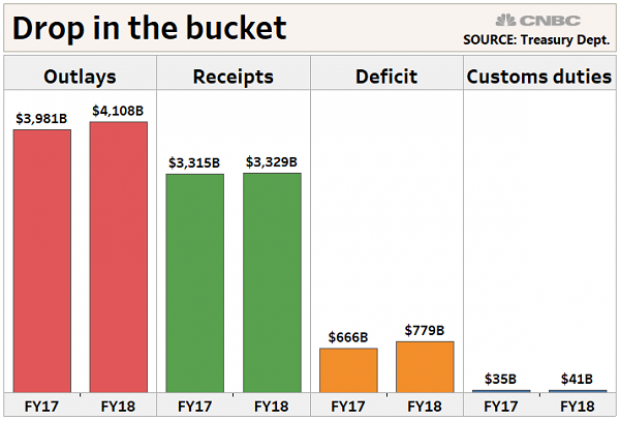

Why Trump's Tariffs Are Just a Drop in the Bucket

President Trump said this week that tariff increases by his administration are producing "billions of dollars" in revenues, thereby improving the country’s fiscal situation. But CNBC’s John Schoen points out that while tariff revenues are indeed higher by several billion dollars this year, the total revenue is a drop in the bucket compared to the sheer size of government outlays and receipts – and the growing annual deficit.

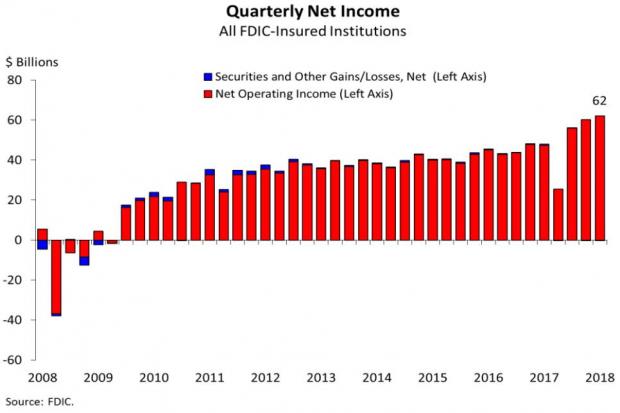

Bank Profits Hit New Record Thanks to 2017 Tax Law

Bank profits reached a record $62 billion in the third quarter, up $14 billion, or 29.3 percent, from the same period last year, according to data from the Federal Deposit Insurance Corporation. The FDIC said that about half of the increase in net income was attributable to last year’s tax cuts. The FDIC estimated that, with the effective tax rates from before the new law, bank profits for the quarter would have risen by about 14 percent, to $54.6 billion.