You’ve Got to See This GOP Hawk’s Grisly Ad Opposing the Iran Deal

A group led by John Bolton, the aggressively hawkish Republican insider who served as George W. Bush's ambassador to the United Nations, has released an unusually grisly ad that vividly portrays a nuclear attack on the United States.

The 30-second video was produced by the Foundation for American Security and Freedom, which Bolton leads. It shows an all-American family of four sitting down to a dinner of pasta and red sauce. The father kindly asks, “How was your day?” As his wife and children enthusiastically reply, a blinding flash rips through the scene to the sound of burning and destruction. The screen fades to black, and then we see and hear Sen. Rand Paul speaking, with his words also written on the screen: “Rand Paul: ‘our national security is not threatened by Iran having one nuclear weapon’.” The screen fades to black again, and then we see a nuclear explosion, with the words: “It only takes one.” As the nuclear cloud boils up into the sky, we see the final message: “A nuclear threat is a threat to our national security.”

The 30-second video seems to consciously mimic Lyndon Johnson's infamous "Daisy" ad from the 1964 presidential election. That ad was widely criticized for using a nuclear explosion to frighten the audience into believing that, if elected, Republican nominee Barry Goldwater would risk all-out war with the Soviet Union. The ad was shown only once (on September 7, 1964) but that proved to be enough.

Several differences between the Bolton group’s ad and “Daisy” stand out. For one, the new ad shows a family being destroyed by a nuclear blast. By contrast, the Johnson ad implied the death of a small girl and many others, but without showing the blast and its victims together.

Another difference is the target. The “Daisy” ad took aim at a hawkish Republican candidate for president, implying that an aggressive attitude toward a major enemy could lead to the destruction of the world. The Bolton group’s ad takes aim at a dovish Republican candidate — and, by implication, a dovish American president — while suggesting that a diplomatic approach toward a major enemy could lead to war on American soil.

A final difference: The Johnson campaign withdrew the “Daisy” ad as the criticism poured in. The Bolton group’s ad is on the Internet, where it can be seen over and over again. And thanks to the dynamics of social media, it will likely reach a larger audience than “Daisy” ever did — though to what effect, it remains to be seen.

Here’s the Daisy ad:

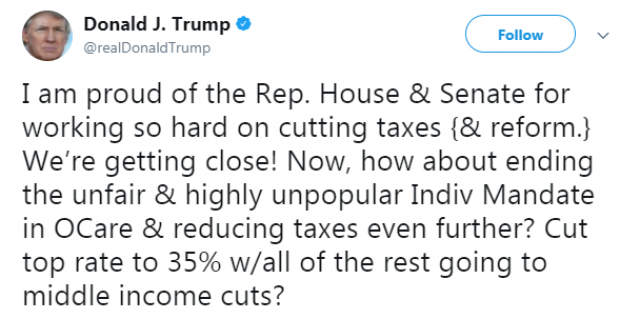

Trump: Repeal the Obamacare Mandate to Cut the Top Tax Rate

President Trump repeated his call Monday to repeal the Affordable Care Act’s individual mandate as part of the tax bill. In a tweet — geotagged from Pennsylvania, not the Philippines , where Trump currently is — Trump added that the billions in savings from ending the mandate should be used to cut the top marginal rate to 35 percent and the rest on cuts for the middle class.

The Congressional Budget Office said last week that eliminating the mandate would save $338 billion over the next decade.

The current version of the House tax bill keeps the top individual income tax rate at 39.6 percent, while the Senate bill lowers it to 38.5 percent. However, mandate repeal is not currently part of either tax bill, and, as The New York Times notes, “repeal of the individual mandate was not on the list of 355 amendments that the [Senate Finance Committee] released on Sunday night.”

Tax Reform Is Hard, but the GOP Could Have Made This Easier

The Tax Policy Center’s William G. Gale writes that the GOP’s approach to the tax bill combines a $5.8 trillion tax cut with a $4.3 trillion tax increase to offset the costs. There may have been an easier way. “What if the House GOP simply tried to cut business and individual taxes by $1.5 trillion. No offsets needed. They could have distributed small tax cuts to middle-income individuals by, say, modestly expanding the earned income tax credit and raising the standard deduction. And they could have trimmed the top corporate tax rate by a few percentage points. It would not have been base-broadening tax reform, but neither is the current bill. ... Tax reform is never easy, but crafting the bill this way has vastly increased the challenge of passing it.”

Alan Greenspan: Deal with the National Debt Before Cutting Taxes

Former Federal Reserve Chairman Alan Greenspan is warning that sharply cutting taxes right now would be an economic “mistake.”

In an interview with Maria Bartiromo on the Fox Business Network Thursday, the 91-year-old Greenspan said it’s more important for President Trump and Congress to put the nation on a sustainable fiscal path by addressing rising entitlement spending driven by the aging of the U.S. population.

“Frankly, I think what we ought to be concerned about is the fact the federal debt is rising at a very rapid pace, and there’s nothing in this bill that will essentially stop that from happening," Greenspan said. "So my view is that we’re premature on fiscal stimulus, whether it’s tax cuts or expenditure increases. We’ve got to get the debt stabilized before we can even think in those terms.”

GOP’s Estate-Tax Repeal Details Would Save Super-Rich Tens of Billions Extra

It’s no surprise that the House Republicans’ tax bill includes the eventual repeal of the estate tax, a long-held GOP goal. But The Washington Post’s Glenn Kessler highlights an unexpectedly generous aspect of the current bill: It “allows the beneficiaries of estates to not pay capital gains taxes on the increase in value of assets held by the estates. That has not been a feature of most previous estate-tax bills.”

Currently, estates face a federal tax if they’re valued at more than $5.49 million for individuals or almost $11 million for couples. But, for tax purposes, the value of assets passed on to heirs gets “stepped-up” or reset to their value at the time of death. Kessler’s example: “Imagine a home that had been purchased for $250,000 but was now worth $1 million. The ‘stepped-up basis’ would be $1 million. If the heirs sold the house for $1.1 million, they would only owe capital-gains tax on the $100,000 difference, not the $850,000 difference from the original purchase price.”

The GOP bill repeals the estate tax, but also keeps the stepped-up basis — a seemingly small detail that creates a huge tax shelter. It means that heirs of large estates would save tens of billions of dollars a year when they sell assets that have appreciated in value over time — or, as Kessler puts it, that the bill will allow “tens of billions of untapped capital gains to remain beyond the reach of the U.S. government.”

Republicans Are Still Coming After Obamacare’s Individual Mandate

Speaker Paul Ryan said Sunday that House Republicans are still considering a repeal of the Obamacare individual mandate as part of their tax bill. "We have an active conversation with our members and a whole host of ideas on things to add to this bill. And that’s one of the things that’s being discussed," Ryan said on Fox News. President Trump touted the idea in a tweet last week, and Sens. Tom Cotton and Rand Paul have recently spoken in favor of using the tax bill to eliminate the mandate. The move would save the government $416 billion over 10 years as roughly 15 million people go without insurance due to lower spending on subsidies and health care services, according to the CBO. Those savings could be appealing as Republicans look for revenues in their revised tax bill. But if the controversial repeal of the mandate isn’t included in the tax bill, the White House is reportedly ready to roll out an executive order weakening the requirement that taxpayers provide proof of insurance to avoid paying a penalty.