Dow Sheds Nearly 600 Points, S&P 500 in Correction in a Wild Day on Wall Street

U.S. stocks plunged more than 3.5 percent on Monday, closing off session lows in high volume trade as fears of slowing growth in China pressured global markets.

S&P 500 ended nearly 80 points lower, off session lows of about 104 points lower but still in correction territory after the tech sector failed intraday attempts to post gains. Cumulative trade volume was 13.94 billion shares, the highest volume day since Aug. 10, 2011.

The major averages had a volatile day of trade, plunging sharply in the open and more than halving losses to trade less than 1 percent lower on the day, before closing down more than 3.5 percent.

"I think we probably rallied too fast. A lot of people that covered their shorts got their shorts covered," said Peter Coleman, head trader at Convergex. He noted the Dow was still trading several hundred points off session lows and that a close better than 500 points lower would be a good sign.

Related: The Stock Market's Fed Fever Is Only Going to Get Worse

"The market's going to be focused on China tonight to see if they come on tonight with something that would be considered a viable (way) to stimulate growth in that economy," said Quincy Krosby, market strategist at Prudential Financial.

The Dow Jones industrial average ended nearly 600 points lower after trading in wide range of between roughly 300 to 700 points lower in the minutes leading up to the close.

In the open, the index fell as much as 1,089 points, making Monday's move its biggest intraday swing in history. In midday trade, the index pared losses to trade about 110 points lower.

The blue-chip index posted its biggest 3-day point loss in history of 1,477.45 points.

During the first 90 minutes of trade, the index traveled more than 3,000 points in down and up moves.

"I'm hoping for some stability here but I think markets remain very, very vulnerable to bad news (out of) emerging markets," said Dan Veru, chief investment officer at Palisade Capital Management.

He attributed some of the sharp opening losses to exchange-traded funds. "It's so easy to move a bajillion dollars in a nanosecond."

Trading in stocks and exchange-traded funds was paused more than 1,200 times on Monday, Dow Jones said, citing exchanges. Such pauses total single digits on a normal day, the report said. An increase or decline of five percent or more triggers a five-minute pause in trading, Dow Jones said.

The major averages came sharply off lows in midday trade, with the Nasdaq off as low as less than half a percent after earlier falling 8.8 percent. Apple traded more than 1.5 percent lower after reversing losses to briefly jump more than 2 percent.

"There was sort of a lack of follow-through after the morning's crazy action in the overall market," said Robert Pavlik, chief market strategist at Boston Private Wealth. "The selling really dissipated once we got to around 10 o'clock."

He attributed some of the late morning gains to a short squeeze and bargain hunting.

Art Hogan, chief market strategist at Wunderlich Securities, noted that the sharp opening losses were due to great uncertainty among traders and the implementation of a rare market rule.

The New York Stock Exchange invoked Rule 48 for the Monday stock market open, Dow Jones reported.

The rule allows NYSE to open stocks without indications. "It was set up for situations like this," Hogan said. The rule was last used in the financial crisis.

Stock index futures for several major indices fell several percentage points before the open to hit limit down levels.

Circuit breakers for the S&P 500 will halt trade when the index decreases from its previous close by the following three levels: 7 percent, 13 percent, and 20 percent.

"Fear has taken over. The market topped out last week," said Adam Sarhan, CEO of Sarhan Capital. "We saw important technical levels break last week. Huge shift in investor psychology."

"The market is not falling on actual facets of a sub-prime situation. It's falling on fear of the unload of China. That's really behind this move," said Peter Cardillo, chief market economist at Rockwell Global Capital.

The CBOE Volatility Index (VIX), considered the best gauge of fear in the market, traded near 40. Earlier in the session the index leaped above 50 for the first time since February 2009.

"When the VIX is this high it means there's some panic out there," said Randy Frederick, managing director of trading and derivatives at Charles Schwab.

However, he said with stocks more than halving losses he "wouldn't be surprised if we closed positive." "If you could move it that far you could move it another 350 points" on the Dow," he said.

Overseas, European stocks plunged, with the STOXX Europe 600 down more than 5 percent, while the Shanghai Composite dropped 8.5 percent, its greatest one-day drop since 2007.

Treasury yields came off session lows, with the U.S. 10-year yield at 2.01 percent and the 2-year yield at 0.58 percent.

The U.S. dollar fell more than 1.5 percent against major world currencies, with the euro near $1.16 and the yen stronger at 119 yen versus the greenback.

A U.S. Treasury Department spokesperson said in a statement that "We do not comment on day-to-day market developments. As always, the Treasury Department is monitoring ongoing market developments and is in regular communication with its regulatory partners and market participants."

The Dow transports ended more than 3.5 percent lower to approach bear market territory.

About 10 stocks declined for every advancer on the New York Stock Exchange, with an exchange volume of 901 million and a composite volume of 4 billion as of 2:05 p.m.

Crude oil futures settled down $2.21, or 5.46 percent, at $38.24 a barrel, the lowest since February 2009. In intraday trade, crude oil futures for October delivery fell as much as $2.70 to $37.75 a barrel, a six-and-a-half-year low.

Gold futures settled down $6.10 at $1,153.60 an ounce.

This post originally appeared on CNBC. Read More at CNBC:

- Wharton's Siegel: We're going to test, possibly break this morning's lows

- Barclays: Fed unlikely to hike before March 2016

- One of Wall St's biggest bulls throws in the towel

6 Traits of an Emerging Millionaire: Are You One?

It’s not just Wall Street bankers, hedge fund traders and corporate raiders who will join the one percent. Nope. By now you may have heard that the new look of affluence in America is kind of… girly. The 7th Fidelity Millionaire Outlook found that today’s emerging high rollers are 66 percent female and 25 percent non-white.

The Fidelity Outlook identified 6 wealth-building traits that multi-millionaires have in common: Their starting point—a mere $250,000 in assets.

Related: Americans Are About to Get a Nice Fat Pay Raise

1 Time Horizon: On average, emerging affluent investors are just 40 years of age with 27 years left before they reach the normal retirement age of 67. Only one percent of the emerging affluent is retired.

2. Career: Many of the emerging affluent have pursued similar professions to today’s millionaires, including information technology, finance and accounting. While they might be at lower-level positions than millionaires, they have a number of years in front of them to move up the ladder.

3. Income: At $125,000, the median annual household income for the emerging affluent is 2.5X the median U.S. household income8 and is nearing the income of today’s millionaires ($200,000 for those still employed).

Related: The 10 Best States for Taxes in 2015

4. Self-Made Status: Approximately eight in 10 emerging affluent investors have earned or increased their assets on their own, a trait they share with millionaires and deca-millionaires.

5. Long-Term Focus: The emerging affluent share millionaires’ long-term focus, with three in four of both groups focused on the long-term growth of their assets, and three in 10 focused on supporting the lifestyle they want in retirement.

6. Investing Style: Similar to deca-millionaires, the emerging affluent display a willingness to invest aggressively to help maximize returns, as well as a willingness to set aside a significant portion of their portfolio for riskier investments that promise a bigger payoff. The emerging affluent and deca-millionaires were also most likely to describe themselves as “self-directed” investors, seeking hands-on involvement with their investments.

Top Reads from The Fiscal Times:

- The 10 Worst States For Paying Taxes

- 6 Popular Social Security Myths Busted

- The Worst States For Retirement in 2015

Why Hard Science and Medicine Is Getting Mushy

Arthur Caplan, one of America’s top medical ethicists, is worried about pollution. Not the kind that ruins our oceans or makes it hard for us to breathe, but the kind that poses a threat to the “trustworthiness, utility, and value of science and medicine.”

Caplan, who directs the Division of Medical Ethics at NYU Langone Medical Center, wrote a blistering essay in last week’s Mayo Clinic Proceedings, saying, "The pollution of science and medicine by plagiarism, fraud, and predatory publishing is corroding the reliability of research. Yet neither the leadership nor those who rely on the truth of science and medicine are sounding the alarm loudly or moving to fix the problem with appropriate energy."

He goes on to cite three causes of publication pollution, which can undermine these areas of “hard science” that should be sacrosanct.

- The proliferation of journals that recruit authors who pay to get their articles published. Despite having substandard or no peer view, these "predatory publishers" now comprise an estimated 25 percent of all open-access journals. "Not only do they provide opportunities for the unscrupulous in academia and industry to pad their curriculum vitaes and bibliographies with bogus articles and editorial appointments, they also make it difficult for those involved in the assessment and promotion of scholars to discern value from junk," writes Dr. Caplan.

- Research misconduct, like falsifying or fabricating data or concealing serious violations. Fourteen percent of scientists report that their colleagues falsify data, and 72 percent report other questionable practices, according to one 2009 study published in PLoS One.

- Plagiarism, which, according to a 2010 Nature article was "staggering," requiring editors to spend "inordinate amounts of time" checking submissions they receive.

Top Reads from The Fiscal Times:

- The Biggest Outrage in Atlanta’s Crazy Teacher Cheating Case

- $45 Billion in Tax Dollars Goes Missing in Afghanistan

- How Dark Money Is Distorting Politics and Undermining Democracy

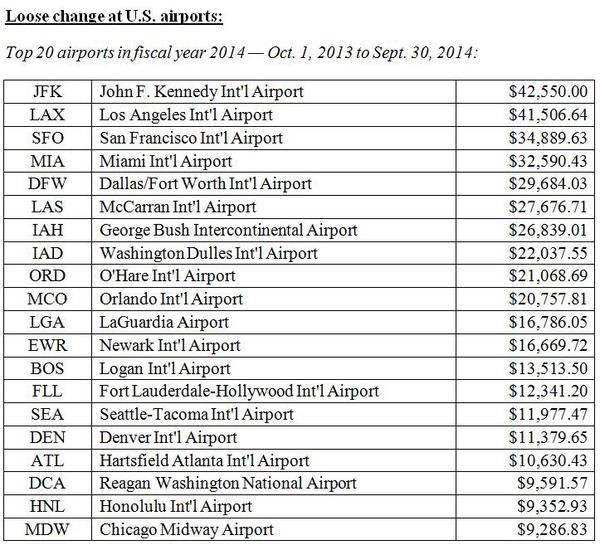

TSA Made $674,841 from Travelers’ Loose Change Last Year

That loose change in your pocket really adds up…for the government: The Transportation Security Administration collected $674,841.06 in quarters, nickels, dimes and pennies left behind by busy travelers at airport security in fiscal 2014.

In 2005, Congress allowed the TSA to put unclaimed money toward its security operations. The agency says it “makes every effort to reunite passengers with items left behind at the checkpoint, however there are instances where loose change or other items are left behind and unclaimed.” That money is turned into the TSA’s financial office.

Related: 10 Outrageous Items Confiscated by the TSA in 2014

The amount collected has been climbing each year since 2010. The 2014 total is almost $37,000 more than the agency collected the previous year and nearly $300,000 more than was left behind in 2008. In all, over the past seven years travelers have gifted the TSA $3,557,538.39.

Yes, that’s $3.5 million in spare change the agency has added to its coffers courtesy of harried travelers.

Maybe the yearly total have been climbing because travelers are increasingly engrossed with their smartphones, or maybe it’s a sign that the economy has perked up a bit so they no longer care to scoop up those nickels and dimes. Maybe it’s just that getting through a TSA checkpoint is such a hassle that travelers are willing to donate a few coins to be done with the process several seconds sooner.

Whatever the reason, here are the 20 airports where travelers left behind the most spare change in 2014:

Top Reads from The Fiscal Times:

- It Just Got Even Cheaper to Travel Overseas

- How Many Agencies Does It Take to Change a Lightbulb?

- The Government’s $125 Billion Slap in the Face to Taxpayers

Baseball in 2015: Record High Revenues

e 2015 Major League Baseball season gets underway on Monday with the sport dealing with an aging, shrinking television audience—yet league revenues, franchise valuations and player salaries are all rising faster than the stock market.

With the average MLB team now worth more than $1.2 billion and the average salary breaking $4 million, let's take a look at how the business of baseball has changed in the last few years.

A shrinking, aging television audience

"The five most-watched World Series aired in the five-year period between 1978 and 1982," said Brad Adgate of Horizon Media. All five averaged more than 38 million viewers. Contrast that with the 2014 World Series audience—a skinny 13.8 million—down 64 percent despite an increased U.S. population. Media buyer Adgate said that's "unlike the Super Bowl, which has set an audience record in five of the last six years."

Related: Madison Bumgarner: Exhibit A in Baseball’s Screwball Salary System

Not only is the audience declining, but it's aging too: Last year's World Series had a viewer with a median age of 55.6—a new high. Just five years prior, it had been sub-50 at 49.9, and was in the 44-46 range during the early 1990s.