Dow Sheds Nearly 600 Points, S&P 500 in Correction in a Wild Day on Wall Street

U.S. stocks plunged more than 3.5 percent on Monday, closing off session lows in high volume trade as fears of slowing growth in China pressured global markets.

S&P 500 ended nearly 80 points lower, off session lows of about 104 points lower but still in correction territory after the tech sector failed intraday attempts to post gains. Cumulative trade volume was 13.94 billion shares, the highest volume day since Aug. 10, 2011.

The major averages had a volatile day of trade, plunging sharply in the open and more than halving losses to trade less than 1 percent lower on the day, before closing down more than 3.5 percent.

"I think we probably rallied too fast. A lot of people that covered their shorts got their shorts covered," said Peter Coleman, head trader at Convergex. He noted the Dow was still trading several hundred points off session lows and that a close better than 500 points lower would be a good sign.

Related: The Stock Market's Fed Fever Is Only Going to Get Worse

"The market's going to be focused on China tonight to see if they come on tonight with something that would be considered a viable (way) to stimulate growth in that economy," said Quincy Krosby, market strategist at Prudential Financial.

The Dow Jones industrial average ended nearly 600 points lower after trading in wide range of between roughly 300 to 700 points lower in the minutes leading up to the close.

In the open, the index fell as much as 1,089 points, making Monday's move its biggest intraday swing in history. In midday trade, the index pared losses to trade about 110 points lower.

The blue-chip index posted its biggest 3-day point loss in history of 1,477.45 points.

During the first 90 minutes of trade, the index traveled more than 3,000 points in down and up moves.

"I'm hoping for some stability here but I think markets remain very, very vulnerable to bad news (out of) emerging markets," said Dan Veru, chief investment officer at Palisade Capital Management.

He attributed some of the sharp opening losses to exchange-traded funds. "It's so easy to move a bajillion dollars in a nanosecond."

Trading in stocks and exchange-traded funds was paused more than 1,200 times on Monday, Dow Jones said, citing exchanges. Such pauses total single digits on a normal day, the report said. An increase or decline of five percent or more triggers a five-minute pause in trading, Dow Jones said.

The major averages came sharply off lows in midday trade, with the Nasdaq off as low as less than half a percent after earlier falling 8.8 percent. Apple traded more than 1.5 percent lower after reversing losses to briefly jump more than 2 percent.

"There was sort of a lack of follow-through after the morning's crazy action in the overall market," said Robert Pavlik, chief market strategist at Boston Private Wealth. "The selling really dissipated once we got to around 10 o'clock."

He attributed some of the late morning gains to a short squeeze and bargain hunting.

Art Hogan, chief market strategist at Wunderlich Securities, noted that the sharp opening losses were due to great uncertainty among traders and the implementation of a rare market rule.

The New York Stock Exchange invoked Rule 48 for the Monday stock market open, Dow Jones reported.

The rule allows NYSE to open stocks without indications. "It was set up for situations like this," Hogan said. The rule was last used in the financial crisis.

Stock index futures for several major indices fell several percentage points before the open to hit limit down levels.

Circuit breakers for the S&P 500 will halt trade when the index decreases from its previous close by the following three levels: 7 percent, 13 percent, and 20 percent.

"Fear has taken over. The market topped out last week," said Adam Sarhan, CEO of Sarhan Capital. "We saw important technical levels break last week. Huge shift in investor psychology."

"The market is not falling on actual facets of a sub-prime situation. It's falling on fear of the unload of China. That's really behind this move," said Peter Cardillo, chief market economist at Rockwell Global Capital.

The CBOE Volatility Index (VIX), considered the best gauge of fear in the market, traded near 40. Earlier in the session the index leaped above 50 for the first time since February 2009.

"When the VIX is this high it means there's some panic out there," said Randy Frederick, managing director of trading and derivatives at Charles Schwab.

However, he said with stocks more than halving losses he "wouldn't be surprised if we closed positive." "If you could move it that far you could move it another 350 points" on the Dow," he said.

Overseas, European stocks plunged, with the STOXX Europe 600 down more than 5 percent, while the Shanghai Composite dropped 8.5 percent, its greatest one-day drop since 2007.

Treasury yields came off session lows, with the U.S. 10-year yield at 2.01 percent and the 2-year yield at 0.58 percent.

The U.S. dollar fell more than 1.5 percent against major world currencies, with the euro near $1.16 and the yen stronger at 119 yen versus the greenback.

A U.S. Treasury Department spokesperson said in a statement that "We do not comment on day-to-day market developments. As always, the Treasury Department is monitoring ongoing market developments and is in regular communication with its regulatory partners and market participants."

The Dow transports ended more than 3.5 percent lower to approach bear market territory.

About 10 stocks declined for every advancer on the New York Stock Exchange, with an exchange volume of 901 million and a composite volume of 4 billion as of 2:05 p.m.

Crude oil futures settled down $2.21, or 5.46 percent, at $38.24 a barrel, the lowest since February 2009. In intraday trade, crude oil futures for October delivery fell as much as $2.70 to $37.75 a barrel, a six-and-a-half-year low.

Gold futures settled down $6.10 at $1,153.60 an ounce.

This post originally appeared on CNBC. Read More at CNBC:

- Wharton's Siegel: We're going to test, possibly break this morning's lows

- Barclays: Fed unlikely to hike before March 2016

- One of Wall St's biggest bulls throws in the towel

The Amazingly Stupid Things Smartphone Users Do While Driving

If you’re reading this while driving, put your phone down right now. This article — as engrossing as it is — will still be here when you reach your destination.

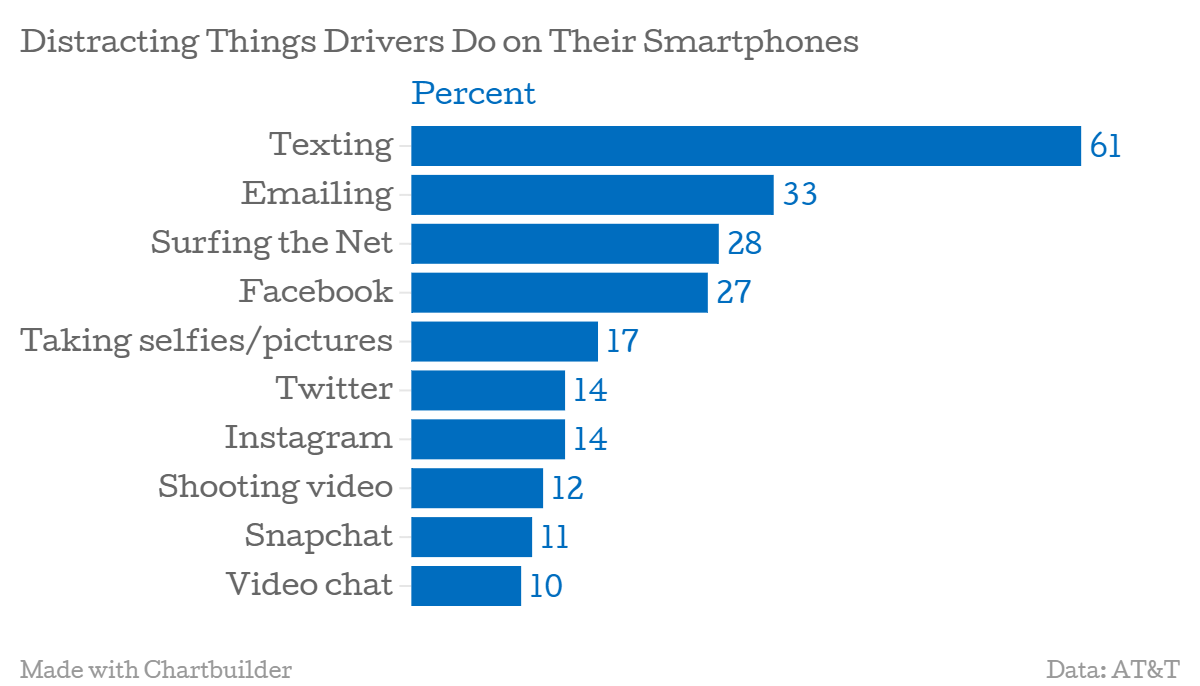

We provide that friendly bit of advice because, as The New York Times reported this morning, a whole bunch of motorists are occupying themselves with their smartphones — and distracting themselves from the road — in ways that go way beyond talking and texting, according to a new survey conducted by Braun Research for AT&T.

The pollsters surveyed 2,067 smartphone users who drive daily, and their findings should be frightening to anyone on the roads. More than six in 10 smartphone users surveyed say they text while driving. It gets scarier: Nearly 40 percent of smartphone users admit to checking in on social media while driving, with 27 percent admitting to using Facebook and another 14 percent saying they use Twitter and Instagram while behind the wheel. Of users who cop to posting on Twitter while driving, 30 percent say they do it “all the time.” Given those figures, it’s amazing that #TwitterAccident isn’t always trending.

Related: Here's How Much Likelier You Are to Be Killed in a Car Than on Amtrak

Some other troubling stats from the survey: 17 percent snap selfies or other pictures when in the driver’s seat and 12 percent shoot videos — with 27 percent of those videographers thinking they can do so safely. Astoundingly, 10 percent of drivers say they video chat while on the roads.

AT&T says it will expand its It Can Wait public service campaign about the dangers of distracted driving, which launched in 2010, to focus on hazards beyond just texting. But as Matt Richtel of the Times points out, the AT&T campaign and other efforts like it face a stiff challenge in trying to counter the social pressures and strongly ingrained habits that keep people constantly checking their phones.

Tough laws and widespread educational efforts have been effective at reducing drunk driving and encouraging use of seat belts. But we still have a way to go in getting drivers to understand that “mobile” doesn’t mean when you’re behind the wheel. Right now, 46 states and the District of Columbia have outlawed texting while driving. As you can see above, that hasn't helped much yet. Smartphone users still need to be convinced of the danger they pose — or face — if they use their devices while driving.

As Lori Lee, AT&T’s global marketing officer, put it: “For the sake of you and those around you, please keep your eyes on the road, not on your phone.”

Trouble for Tesla: Why Consumer Reports Says Its Model S Was ‘Undriveable’

Consumer Reports in 2013 gave the Telsa Model S the highest rating of any vehicle in its history. This year’s review did not go as well for Elon Musk’s company.

The venerable magazine had to delay testing of the company’s newest model because its drivers couldn’t open the doors on the $127,000 sedan, temporarily making the car “undriveable.”

The door handles on the Model S P85 retract automatically and lay flush against the vehicle when they are not in use. Once the vehicle receives a signal from the key fob, the handles move to allow people to grip them. Unfortunately, the door handles stopped working after Consumer Reports testers had the vehicle for 27 days and had driven just over 2,300 miles.

That malfunction caused other problems, the magazine says: “[S]ignificantly, the car wouldn't stay in Drive, perhaps misinterpreting that the door was open due to the issue with the door handle.”

Consumer Reports’ troubles aren’t unique. The non-profit’s car reliability survey found that the Model S has had a far higher than average number of problems with doors, locks and latches, according to the organization’s website.

The testing experience wasn’t all bad, though, because the automaker’s customer service is top notch. A technician was sent to the Consumer Reports Auto Test Center the morning after the problem was reported and quickly diagnosed the problem.

“Our car needed a new door-handle control module — the part inside the door itself that includes the electronic sensors and motors to operate the door handle and open the door,” Consumer Reports says. “The whole repair took about two hours and was covered under the warranty.”

Eric Lyman, vice president of industry insights at TrueCar, told The Fiscal Times that the speed in which Tesla addressed that issue will earn it more kudos from customers who have seen carmakers drag their feet in making needed repairs. The door handle issue isn’t a big deal, he said.

“Telsa is still a relatively new automaker,” he said. “The reality is that we see this kind of thing happen all of the time. This is pretty normal in the course of business in the auto industry.”

The timing of the mishap comes as Telsa is struggling to repair its credibility with Wall Street after the electric vehicle maker’s disappointing earnings performance. Bloomberg News reported last week that the Palo Alto, Calif.-based company might have to raise money because of what one analyst described as its “eye watering” cash burn rate, or else it might run out of money in the next three quarters.

The electric vehicle maker also is facing increased competition from more established rivals. General Motors (GM), for instance, recently unveiled a Chevrolet Bolt concept car that is set to hit the market in 2017 with a projected price of about $30,000 and a battery range of 200 miles. The next generation Nissan Leaf, another electric vehicle, will hit the market at about the same time.

For now, Tesla’s biggest challenge may in convincing consumers to buy electric vehicles while oil remains cheap.

Biden's Rules: 4 Takeaways for New Graduates

Vice President Biden spoke to graduating Yale students Sunday, sporting his signature aviators. He spoke about lessons he learned in his lengthy political career that could apply elsewhere, including being No. 2 to the POTUS and his notorious big mouth, which sometimes gets him into trouble.

Here are four big political takeaways from Biden's speech:

He told listeners to "try to look beyond the caricature of the person with whom you have to work. ... It gets in the way of being able to reach consensus for things that matter to you and many other people."

Biden said when he first entered the U.S. Senate, he criticized then-Sen. Jesse Helms (R-N.C.) for his stance on a bill related to disability but later found out Helms had adopted a disabled child. "When you question a man's motives, when you say they're acting out of greed or in the pocket of an interest group, it's awful hard to reach consensus," he said.

"I realize no one ever doubts I mean what I say. The problem occasionally is I say all that I mean. I have a bad reputation for being straight, sometimes at inappropriate times."

"Look, you know it's tough to end a great man's basketball and football season one touchdown away from beating Harvard this year for the first time since 2006," Biden said, pointing to painfully close losses in football and basketball to the rival Crimson in recent months. "So close to something you wanted for eight years. I can only imagine how you feel. I can only imagine. So close. So close."

A Demographic Edge for Hillary Clinton in 2016

Are the GOP’s 2016 presidential hopes dying out?

No matter how many GOP candidates enter the 2016 presidential sweepstakes, it will be an uphill climb for any Republican to secure the White House. That’s not simply because Democratic voters outpace Republicans by a four-point edge, according to Gallup. It’s because the GOP is dying — literally —according to an analysis published Sunday in Politico.

Seems 2.75 million Republican voters will be dead by the time the 2016 election rolls around, Daniel J. McGraw claims in what he calls his “back-of-the-napkin” math. By comparison, roughly 2.3 million Obama supporters will have died by the time the 2016 election rolls around. McGraw is right, of course, that Republicans tend to be older than Democrats, and that the surge of millennials (about 78 million) tends to vote Democratic. They’re young, energetic, tilt left on social issues like gay marriage and believe women are underrepresented in the boardroom as well as the White House.

Republicans could still connect with millennial voters on economic issues, but on the whole, the demographic trends will only make it harder for the GOP’s eventual nominee.

Related: How the Clinton Scandals Can Bring Down the Democrats

McGraw’s estimates can only go so far, though. They can’t fully account for state-by-state differences that could tilt the Electoral College, and they don’t factor in specific candidates and how they might appeal to various age groups, or not. Can a youthful Marco Rubio, for example, find a way to draw younger voters? Will Hillary Clinton trip over her political baggage, packed in part by her husband?

In the end, regardless of who is nominated by the GOP, the election will rest on the 43 percent of Americans who identify themselves as independents. Including independents, Democrats had a three-point edge as of last year. But if McGraw is right, that edge could widen before long.

Why the Class of 2015 May Actually Get Good Jobs

Not only are there more jobs available for 2015 college grads, there are more good jobs available to them, according to a new analysis by economists with the Federal Reserve Bank of New York.

The New York fed found that the underemployment rate for recent graduates—which had risen steadily with the exception of a fleeting dip in 2011—has finally started to fall. It has dropped about 2 percentage points since last June to 44.6.

That trend, coupled with a continued decline in unemployment for recent college grads, offers reason for hope for the class of 2015. Job postings for college graduates have increased by about 10 percent since last summer.

Related: The 10 Best Cities for New Grads to Launch their Careers

“While the demand for college graduates appears to be picking up, significant labor market slack remains,” write authors Jaison R. Abel and Richard Dietz. “So continued strong growth in the demand for college graduates may well be necessary to make a more serious dent in the underemployment rate.”

A separate study released last month by the National Association of Colleges and Employers found that employers expect to hire nearly 10 percent more new college graduates this year than last year.

The ease with which students can find jobs will depend not only on their major (those with degrees in engineering, business and computer science are the most in demand), but also on their location. A recent report by WalletHub ranking the nation’s largest cities from best to worst places to start a career found showed that cities in Texas and California have the most opportunities.