Dow Sheds Nearly 600 Points, S&P 500 in Correction in a Wild Day on Wall Street

U.S. stocks plunged more than 3.5 percent on Monday, closing off session lows in high volume trade as fears of slowing growth in China pressured global markets.

S&P 500 ended nearly 80 points lower, off session lows of about 104 points lower but still in correction territory after the tech sector failed intraday attempts to post gains. Cumulative trade volume was 13.94 billion shares, the highest volume day since Aug. 10, 2011.

The major averages had a volatile day of trade, plunging sharply in the open and more than halving losses to trade less than 1 percent lower on the day, before closing down more than 3.5 percent.

"I think we probably rallied too fast. A lot of people that covered their shorts got their shorts covered," said Peter Coleman, head trader at Convergex. He noted the Dow was still trading several hundred points off session lows and that a close better than 500 points lower would be a good sign.

Related: The Stock Market's Fed Fever Is Only Going to Get Worse

"The market's going to be focused on China tonight to see if they come on tonight with something that would be considered a viable (way) to stimulate growth in that economy," said Quincy Krosby, market strategist at Prudential Financial.

The Dow Jones industrial average ended nearly 600 points lower after trading in wide range of between roughly 300 to 700 points lower in the minutes leading up to the close.

In the open, the index fell as much as 1,089 points, making Monday's move its biggest intraday swing in history. In midday trade, the index pared losses to trade about 110 points lower.

The blue-chip index posted its biggest 3-day point loss in history of 1,477.45 points.

During the first 90 minutes of trade, the index traveled more than 3,000 points in down and up moves.

"I'm hoping for some stability here but I think markets remain very, very vulnerable to bad news (out of) emerging markets," said Dan Veru, chief investment officer at Palisade Capital Management.

He attributed some of the sharp opening losses to exchange-traded funds. "It's so easy to move a bajillion dollars in a nanosecond."

Trading in stocks and exchange-traded funds was paused more than 1,200 times on Monday, Dow Jones said, citing exchanges. Such pauses total single digits on a normal day, the report said. An increase or decline of five percent or more triggers a five-minute pause in trading, Dow Jones said.

The major averages came sharply off lows in midday trade, with the Nasdaq off as low as less than half a percent after earlier falling 8.8 percent. Apple traded more than 1.5 percent lower after reversing losses to briefly jump more than 2 percent.

"There was sort of a lack of follow-through after the morning's crazy action in the overall market," said Robert Pavlik, chief market strategist at Boston Private Wealth. "The selling really dissipated once we got to around 10 o'clock."

He attributed some of the late morning gains to a short squeeze and bargain hunting.

Art Hogan, chief market strategist at Wunderlich Securities, noted that the sharp opening losses were due to great uncertainty among traders and the implementation of a rare market rule.

The New York Stock Exchange invoked Rule 48 for the Monday stock market open, Dow Jones reported.

The rule allows NYSE to open stocks without indications. "It was set up for situations like this," Hogan said. The rule was last used in the financial crisis.

Stock index futures for several major indices fell several percentage points before the open to hit limit down levels.

Circuit breakers for the S&P 500 will halt trade when the index decreases from its previous close by the following three levels: 7 percent, 13 percent, and 20 percent.

"Fear has taken over. The market topped out last week," said Adam Sarhan, CEO of Sarhan Capital. "We saw important technical levels break last week. Huge shift in investor psychology."

"The market is not falling on actual facets of a sub-prime situation. It's falling on fear of the unload of China. That's really behind this move," said Peter Cardillo, chief market economist at Rockwell Global Capital.

The CBOE Volatility Index (VIX), considered the best gauge of fear in the market, traded near 40. Earlier in the session the index leaped above 50 for the first time since February 2009.

"When the VIX is this high it means there's some panic out there," said Randy Frederick, managing director of trading and derivatives at Charles Schwab.

However, he said with stocks more than halving losses he "wouldn't be surprised if we closed positive." "If you could move it that far you could move it another 350 points" on the Dow," he said.

Overseas, European stocks plunged, with the STOXX Europe 600 down more than 5 percent, while the Shanghai Composite dropped 8.5 percent, its greatest one-day drop since 2007.

Treasury yields came off session lows, with the U.S. 10-year yield at 2.01 percent and the 2-year yield at 0.58 percent.

The U.S. dollar fell more than 1.5 percent against major world currencies, with the euro near $1.16 and the yen stronger at 119 yen versus the greenback.

A U.S. Treasury Department spokesperson said in a statement that "We do not comment on day-to-day market developments. As always, the Treasury Department is monitoring ongoing market developments and is in regular communication with its regulatory partners and market participants."

The Dow transports ended more than 3.5 percent lower to approach bear market territory.

About 10 stocks declined for every advancer on the New York Stock Exchange, with an exchange volume of 901 million and a composite volume of 4 billion as of 2:05 p.m.

Crude oil futures settled down $2.21, or 5.46 percent, at $38.24 a barrel, the lowest since February 2009. In intraday trade, crude oil futures for October delivery fell as much as $2.70 to $37.75 a barrel, a six-and-a-half-year low.

Gold futures settled down $6.10 at $1,153.60 an ounce.

This post originally appeared on CNBC. Read More at CNBC:

- Wharton's Siegel: We're going to test, possibly break this morning's lows

- Barclays: Fed unlikely to hike before March 2016

- One of Wall St's biggest bulls throws in the towel

Comcast to Cut the Cord with Time Warner

Comcast is dropping its merger with Time Warner after a year of regulatory pushback, according to Bloomberg. The news wire's unnamed sources say there will be an announcement tomorrow.

In today's changing media landscape it is not really clear what the preemptive breakup of a media megacorp (formed from mere media titans) will mean for consumers, especially in the face of Verizon's push to slim down its bundled offerings, the new ala carte service from HBO and the continued expansion of Netflix's original programming. As more and more people cut the cord, the market for traditional cable TV is eroding, and more consumers opt simply for an Internet connection.

Even without that, Comcast dropping its deal probably will have no impact at all for the average cable subscriber, given the already segregated monopolies allowed individual cable companies. So, unless you own stock in either of these companies, this is pretty much just more status quo in a rapidly changing market.

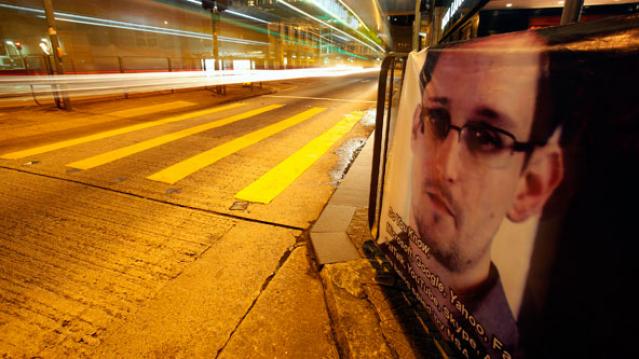

Can Low Self-Control Turn You Into Edward Snowden?

Be very wary if your employer asks you to take a test and then says please put on this cap. The cap could have sensors measuring your “self-control,” which researchers at Iowa State University have connected to—cybersecurity.

Yup—this wasn’t about eating the last cookie, having sex with a stranger, or taking a hit from some unknown new drug just because your friend said it was an amazing experience. The test measures how long someone hesitates before doing something risky or wrong.

Hmm. Maybe I’ll wait a few seconds before robbing that jewelry store! If they waited, the researchers determined that the employees were considering the consequences of their actions and therefore had higher self-control than those who simply filled their duffle bag with whatever bling was in sight.

Those with higher self-control were deemed better cyber security risks than the low self-control group.

But who knows? Maybe the high group was just casing the joint and calculating how much they could carry without getting caught. Or maybe they were searching for the largest unflawed diamond in the case that could be hidden in their pocket!

So much for brainwaves.

These Students Are Making Even More Than They Expect After Graduation

College students who major in STEM fields generally know that they can make more money than their peers once they graduate, but they don’t know how much more.

Turns out, those students majoring in science, technology, engineering and math, actually have starting salaries that are higher than expected, according to a new report by the National Association of Colleges and Employers.

Engineering majors, for example, expect to earn $56,000, but actually receive 15.5 percent more than that, with starting salaries average nearly $65,000. Computer Science majors expect to make around $51,000, but receive 22 percent for an average starting salary of $62,000.

Chemistry majors have the largest gap between expectations and reality: They expect to earn an average of $39,000 but take home an average $58,000 in their first year, a 51 percent increase.

Related: The Closing of the Millennial Mind on Campus

The typical college graduate in 2014 received a starting salary of $48,000. Liberal arts and humanities majors had the lowest starting salary, with an average of just $39,000, according to NACE.

Not only do STEM majors enjoy higher salaries, but they can also expect more job security and better job prospects. All of the top 25 jobs recently compiled by U.S. News and World Report fell into either a science- or math-based discipline.

Still, not everyone has the interest or aptitude to excel in a STEM career. A third of those who begin their college career majoring in those fields end up transferring to a difference study area, according to a recent report by RTI International.

Will Obama Send a Smoke Signal About Weed?

The resignation of Michele M. Leonhart, chief of the Drug Enforcement Administration, just one day after 4/20 -- which is sort of Thanksgiving for stoners -- offers President Obama an opportunity to replace her with someone who shares his relatively benign view of marijuana.

The right appointment might also be a gift to Hillary Rodham Clinton since it would signal to younger voters that it's not just libertarian-leaning Republicans like Senator Rand Paul of Kentucky who want to decriminalize the use of pot.

Representative Early Blumenauer, an Oregon Democrat, told The New York Times that Obama should appoint someone who "understands the federal approach to marijuana isn't working."

Related: How to Stop Cyber Attacks: Let Workers Smoke Pot

The flashpoint that led to the departure of Leonhart after a 35-year career at the D.E.A. was a congressional hearing that revealed agency agents in Colombia had taken part in parties with prostitutes paid by drug cartels. But Leonhart, who has lumped marijuana in with crack, meth and heroin, found herself at odds with the President, who has called pot no more dangerous than alcohol.

“Hopefully this is a sign that the Reefer Madness era is coming to an end at the D.E.A.,” Mason Tvert, the director on communications at the Marijuana Policy Project, told Bloomberg Politics.

How to Stop Cyber Attacks: Let Workers Smoke Pot

What’s true for the government is true for business. FBI Director James Comey thinks you can’t hire top tech talent with a ban on weed. It all started in the Reagan administration, which imposed a no-hire policy for applicants who toked up within the past three years. Good luck with that.

In 2014, Comey raised the issue during a speech: “A lot of the nation’s top computer programmers and hacking gurus are also fond of marijuana. I have to hire a great workforce to compete with those cyber criminals and some of those kids want to smoke weed on the way to the interview.”

That’s not the only reason the government can’t hire competent programmers and white hat hackers. They come at a high price, there’s a shortage, and they hate red tape and bureaucratic annoyances. For some lawmakers, though, it’s easier to get lost in the weed than try to reform the federal hiring process. That’s why Gerry Connolly (D-VA) and Earl Blumenauer (D-OR) have two proposals in the House requiring info from the intelligence director on how classifying pot as Schedule 1 narcotic crimps the feds recruiting efforts.