Sanders Pulls Ahead in Iowa, but a Tougher Clinton Aims to Even the Score

A new poll unveiled Thursday finds populist Bernie Sanders squeezing past Hillary Clinton for the first time as the preferred choice among likely Iowa caucus-goers.

The survey by Quinnipiac University shows the Vermont lawmaker receiving 41 percent, while Clinton garnered 40 percent. The figures put Sanders’ lead well within the poll’s 3.4 percent margin of error, but the numbers serve as another indication of how tight the Democratic primary has become, especially in Iowa where Clinton has long maintained an advantage.

Related: With Trump and Sanders Riding High, How Low Will Bush and Clinton Go?

The poll found another 12 percent of voters would support Vice President Joe Biden, who has yet to decide if he will enter the 2016 race. Former Maryland Governor Martin O’Malley received 3 percent, and the same number were undecided.

While many could view the survey as the latest sign Clinton’s campaign is flailing, the timing of the poll could prove crucial.

The study was conducted between August 27 and September 8. That was the same day the former secretary of State told ABC News that using a personal email account while in office was a mistake and that she is sorry for it.

Related: Hillary’s E-Mail Lapse ... Mistake ... Responsibility ... er, 'Apology'

“I do think I could have and should have done a better job answering questions earlier. I really didn’t perhaps appreciate the need to do that,” Clinton said. “What I had done was allowed, it was above board. But in retrospect, as I look back at it now, even though it was allowed, I should have used two accounts. One for personal, one for work-related emails. That was a mistake. I’m sorry about that. I take responsibility.”

The interview marked the first time she apologized for her unique email arrangement. Questions over Clinton’s use of a private server have dogged her candidacy since she entered the White House race earlier this year.

Republicans have used the controversy surrounding the server to paint Clinton as untrustworthy and unfit to serve in the White House.

Related: Clinton: Trump Is Bad for American Politics

Indeed, Thursday’s poll found that while Clinton is still liked among Democratic voters who believe she would make a good leader, Sanders fares better on the question of trustworthiness.

The Quinnipiac poll also closed before Clinton gave a muscular foreign policy speech at the Brookings Institution on, among other things, the Iran nuclear deal.

“We should anticipate that Iran will test the next president,” she said. “They'll want to see how far they can bend the rules.”

“That won't work if I'm in the White House. I'll hold the line against Iranian noncompliance,” Clinton added.

On the softer side of things, Clinton’s interview on “The Ellen DeGeneres Show” will air Thursday afternoon. The appearance will give her a chance to connect with female voters who are the backbone of her support.

Taken together, the various actions could put Clinton back atop the polls, at least in Iowa, and help her gain back ground she lost to Sanders in New Hampshire as well.

Top Reads From The Fiscal Times:

- House GOP Scores a Major Win in Obamacare Legal Challenge

- Hillary’s E-Mail Lapse ... Mistake ... Responsibility ... er, 'Apology'

- How Can You Tell There Are Russian Troops in Syria? Just Look for Some Soldier Selfies

The High Cost of Child Poverty

Childhood poverty cost $1.03 trillion in 2015, including the loss of economic productivity, increased spending on health care and increased crime rates, according to a recent study in the journal Social Work Research. That annual cost represents about 5.4 percent of U.S. GDP. “It is estimated that for every dollar spent on reducing childhood poverty, the country would save at least $7 with respect to the economic costs of poverty,” says Mark R. Rank, a co-author of the study and professor of social welfare at Washington University in St. Louis. (Futurity)

Do You Know What Your Tax Rate Is?

Complaining about taxes is a favorite American pastime, and the grumbling might reach its annual peak right about now, as tax day approaches. But new research from Michigan State University highlighted by the Money magazine website finds that Americans — or at least Michiganders — dramatically overstate their average tax rate.

In a survey of 978 adults in the Wolverine State, almost 220 people said they didn’t know what percentage of their income went to federal taxes. Of the people who did provide an answer, almost 85 percent overstated their actual rate, sometimes by a large margin. On average, those taxpayers said they pay 25.5 percent of their income in federal taxes. But the study’s authors estimated that their actual average tax rate was just under 14 percent.

The large number of people who didn’t want to venture a guess as to their tax rate and the even larger number who were wildly off both suggest to the researchers “that a very substantial portion of the population is uninformed or misinformed about average federal income-tax rates.”

Why don’t we know what we’re paying?

Part of the answer may be that our tax system is complicated and many of us rely on professionals or specialized software to prepare our filings. Money’s Ian Salisbury notes that taxpayers in the survey who relied on that kind of help tended to be further off in their estimates, after controlling for other factors.

Also, many people likely don’t understand the different types of taxes they pay. While the survey asked specifically about federal taxes, the tax rates people provided more closely matched their total tax rate, including federal, state, local and payroll taxes.

But our politics likely play a role here as well. People who believe that taxes on households like theirs should be lower and those who believe tax dollars are spent ineffectively tended to overstate their tax rates more.

“Since the time of Ronald Reagan, American[s] have been inundated with messages about how high taxes are,” one of the study’s authors told Salisbury. “The notion they are too high has become deeply ingrained.”

Wealthy Investors Are Worried About Washington, and the Debt

A new survey by the Spectrem Group, a market research firm, finds that almost 80 percent of investors with net worth between $100,000 and $25 million (not including their home) say that the U.S. political environment is their biggest concern, followed by government gridlock (76 percent) and the national debt (75 percent).

Trump’s Push to Reverse Parts of $1.3 Trillion Spending Bill May Be DOA

At least two key Republican senators are unlikely to support an effort to roll back parts of the $1.3. trillion spending bill passed by Congress last month, The Washington Post’s Mike DeBonis reported Monday evening. While aides to President Trump are working with House Majority Leader Kevin McCarthy (R-CA) on a package of spending cuts, Sens. Susan Collins (R-ME) and Lisa Murkowski (R-AK) expressed opposition to the idea, meaning a rescission bill might not be able to get a simple majority vote in the Senate. And Roll Call reports that other Republican senators have expressed significant skepticism, too. “It’s going nowhere,” Sen. Lindsey Graham said.

Goldman Sees Profit in the Tax Cuts

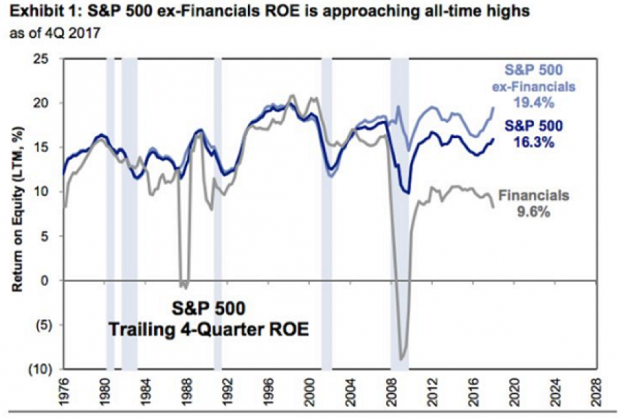

David Kostin, chief U.S. equity strategist at Goldman Sachs, said in a note to clients Friday cited by CNBC that companies in the S&P 500 can expect to see a boost in return on equity (ROE) thanks to the tax cuts. Return on equity should hit the highest level since 2007, Kostin said, providing a strong tailwind for stock prices even as uncertainty grows about possible conflicts over trade.

Return on equity, defined as the amount of net income returned as a percentage of shareholders’ equity, rose to 16.3 percent in 2016, and Kostin is forecasting an increase to 17.6 percent in 2018. "The reduction in the corporate tax rate alone will boost ROE by roughly 70 [basis points], outweighing margin pressures from rising labor, commodity, and borrow costs," Kostin wrote.