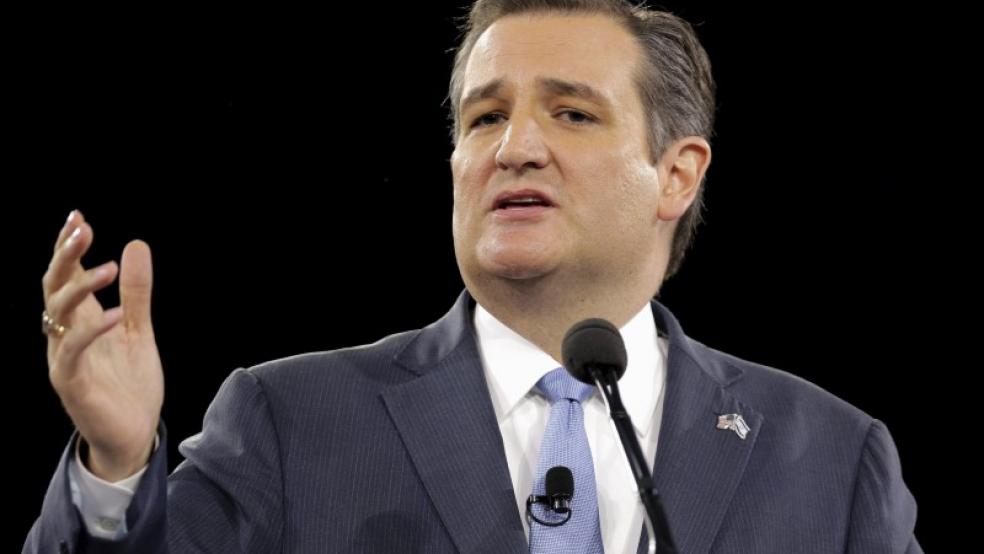

Ted Cruz is making a strong play for Wall Street support and Wall Street money, appearing for an hour on CNBC's "Squawk Box" on Friday and holding a high-dollar fundraiser at the Harvard Club in midtown on Monday.

The Texas U.S. senator needs the cash in the final sprint for the GOP nomination as he hopes to keep down Donald Trump's delegate hauls in the Northeast and the final primary in California on June 7. Cruz is counting on keeping Trump under 1,237 delegates and then winning the nomination in Cleveland based on his much stronger work wooing delegates who will be free to vote for whomever they choose after the first ballot.

Related: Trump or Cruz? Why It Doesn’t Matter Anymore for the GOP

It's a tough sell on Wall Street for Cruz, who is distrusted if not outright disliked by many in high finance and across corporate America. Many of these people despise Cruz's penchant for partisan warfare in Washington — particularly on the debt ceiling — and deplore his populist bashing of big banks.

Cruz himself acknowledged the problem on "Squawk Box": "I can't tell you how many people come in, particularly in the business world, hearing all these skeptical things about 'this guy Cruz is a troublemaker,'" he said.

But Cruz argued that his fights in Washington were meant to stand on principle against President Barack Obama on spending, immigration and health care, and that as president he would be willing to sit down and cut deals on taxes and spending. He also said Wall Street "performs an important function" while continuing his opposition to taxpayer bailouts and any other "special favors" from Washington.

Cruz also spent a good bit of time talking up his tax plan, which would impose a flat 16 percent value-added tax for business and 10 percent for individuals. Cruz claims this would ignite economic growth and dramatically simplify the tax code.

Related: Why Aren’t Presidential Candidates Talking About the Federal Reserve?

He also said that after four years as president, companies in Europe in Asia would be trying to "invert" their corporate structure into the United States to take advantage of the newly reduced tax rate. And he claimed his tax plan would bring high-paying jobs back to the U.S. while Trump's threats of big new tariffs would ignite damaging trade wars.

Cruz has a couple of problems on this front. Republicans traditionally loathe value-added taxes because they believe they are hidden from consumers and are easily boosted. Critics of Cruz's plan, including Florida Sen. Marco Rubio before he dropped out of the primaries, also say businesses will simply pass the tax on to consumers by raising prices for products.

But Cruz's issue with Wall Street is not really the fine print of his tax plan. It's that many bankers don't like his stringent stances on social issues like abortion and gay marriage and simply don't like the guy personally and think he would be a disaster as president.

Ken Langone, a Wall Street investor, co-founder of Home Depot and supporter of Ohio Governor John Kasich, told me this week he could see no scenario under which he would back Cruz.

Related: New Polls: Kasich Is the Only Republican Who Could Beat Clinton

"I couldn't do it because I just don't like the guy," Langone said, echoing sentiments uttered privately by executives all over the financial industry. "I don't like the way he presents himself and I don't like the way he isolates himself. One of the problems in Washington is you have to get things done, and I don't think he's proven that he can work in that environment. I don't like the man. I'm not a fan."

That sentiment exists all across Wall Street, which heavily backed former Florida Gov. Jeb Bush and then Rubio before both were knocked out of the race by Trump and Cruz. Now, many Republicans in high finance are simply giving up on the 2016 primaries and waiting to see whether they sit out the general election as well, back the GOP nominee or grudgingly support Hillary Clinton who has historic ties to the industry, something that has dogged her throughout her primary against Vermont Sen. Bernie Sanders.

"There is no point is supporting someone who can't win," the CEO of a large financial firm told me this week about Cruz. "We would wind up with a guy nobody really likes who can't appeal to the broad mass of the American electorate. So I'm done with 2016. I've given up any belief that I know what's going on."

Cruz is now trying to walk a fine line to turn this attitude around among deep-pocketed Wall Street donors without alienating his conservative, populist base. Ideally, Cruz would just ignore Wall Street and revel in its disdain. But he's short on cash for the expensive final sprint, so expect him to continue to make the case that business people should not hate him.

This article originally appeared on CNBC. Read more from CNBC:

Ted Cruz: Why a stock 'crash will be coming'