Republican presidential nominee Donald Trump is offering himself as a change agent for a hidebound Washington, and he showed that side again on Thursday. The revised economic plan he unveiled in New York includes a spending reduction idea that is both revolutionary and tantalizingly simple – if not totally unworkable.

In his speech to the Economic Club of New York, the billionaire businessman spelled out a much revised and downsized tax plan that would still drain the Treasury of at least $2.6 trillion over the coming decade. About $1.8 trillion of the cost would be offset, he said, by “growth-induced savings” from renegotiating trade agreements, increasing energy production and cutting through government red tape.

Related: Trump Has Backtracked on Some of Yesterday’s Economy Proposals

The remaining $800 billion would be offset by a novel “Penny Plan” – one designed to reduce spending other than for defense and major entitlement programs by one percent a year for ten years. That essentially would mean locking federal departments and agencies and most government programs into a fiscal diet in which they begin each year one percent behind where they were the year before.

"If we save just one penny of each federal dollar spent on non-defense and non-entitlement programs, we can save almost $1 trillion over the next decade,” Trump declared.

Veteran budget experts and analysts who have seen proposals like this in the past say they look good on the surface. But they have proved to be highly impractical and politically unfeasible because of the damage they would cause to a vast array of popular programs other than defense, Social Security and Medicare targeted for deep cuts.

“There are a lot of historical antecedents for this sort of proposal, but none of them has ever worked. When it comes down to cases, even an overwhelmingly conservative Congress won’t do that,” Richard Kogan, a federal budget analyst with the Center on Budget and Policy Priorities, said in an interview Friday.”

Related: Trump Has a New Economic Plan, but the Numbers Still Don’t Add Up

Georgia businessman Bruce Cook, the Chairman and CEO of Citizens for Restoring America’s Financial Future, Inc., a non-partisan effort to balance the federal budget, was an early proponent of the “one cent solution. It piqued the interest of dozens of Republicans, including Sen. Mike Enzi (R-WY), now the chair of the Senate Budget Committee, and former Rep. Connie Mack IV, who in 2011 jointly introduced legislation roughly along those lines.

Their version of the “Penny Plan” would cap overall federal spending to fit within specific targets and then would call on members of Congress to evaluate all areas of the federal government to make certain they would fit within the constraints. Congress could pick and choose among programs, leaving some unscathed while cutting deeply into others.

Once the cuts were achieved, Congress would then cap overall federal spending at 18 percent of the national economy from then on.

The proposal was far more stringent than what Trump has in mind, and was geared to reducing federal spending by $7.5 trillion over 10 years. Rather than factoring in inflation, the legislation called for “real cuts,” so that the sum of all discretionary and entitlement spending would have to go down from one year to the next.

When Enzi and Rep. Austin Scott (R-GA) reintroduced the bill in 2013, Cook declared, “The One Cent Solution/Penny Plan still offers the best solution to our nation’s debt problem. It’s simple, straightforward, and provides a strong foundation for growing our economy. What family or business can’t cut 1 percent off its budget?”

Related: Is the Race Tied? Why Trump Isn’t Really That Close to Winning

Trump would protect the Pentagon, major entitlement programs and interest on the debt from annual cuts. But that would leave only about one sixth of the federal budget vulnerable to cuts. And those include homeland security and law enforcement, Veterans Affairs, agriculture subsidies, housing assistance, food safety and air traffic controls, waterways and the national park system and museums.

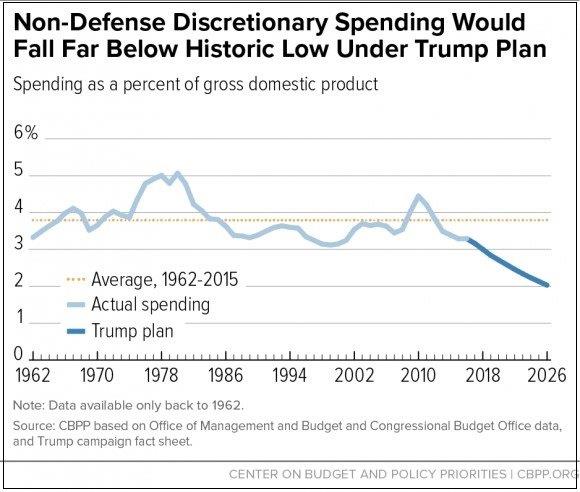

Kogan and his colleague David Reich wrote yesterday that while a one percent reduction below the previous year’s spending total may sound benign, the cumulative cut would be very substantial. By 2026, the tenth year of the plan, non-defense appropriations would be about 29 percent below current levels, after taking account of inflation.

Moreover, the cuts would come on top of across-the-board spending cuts that were mandated by the 2011 Budget Control Act and related sequestration. Within ten years, non-defense discretionary funding would fall 37 percent below the 2010 levels when adjusted for inflation.

“If within this category there are programs that you don’t want to cut – you don’t want to shrink in real terms by nearly 30 percent over 10 years, then everything else has to be cut substantially more deeply,” Kogan said. “It’s always tempting to close your eyes to ‘what everything else’ means or ‘substantially more deeply’ means, but ultimately it becomes wildly unrealistic.”

Related: With Clinton Campaigning Again, Trump Renews Attacks on Her Health

Even so, Trump’s proposal is probably good politics this year when so many voters are frustrated with the status quo and have indicated a willingness to try just about anything to shake things up in Washington.

The gross national debt recently surpassed $19.5 trillion – a historic milestone – and the Congressional Budget Office has repeatedly warned about a coming new era of budget deficits. And – with time running out before the threat of another government shutdown at the end of the month -- Republican and Democratic lawmakers remain deadlocked over appropriations for the coming fiscal year. And House conservative Republicans are complaining that Congress will end up spending too much money this year.

There’s no doubt that a number of federal agencies—if not all--are guilty of wasteful spending. When President Obama was elected, he vowed to eliminate billions in wasteful spending by consolidating redundant federal programs. One current example: As we pour a portion of $1.9 billion into developing a vaccine for Zika and preventing its spread, the U.S. Army is already testing a vaccine on humans.

As technology has replaced jobs in the private sector, so has it in the public sector. But relatively new agencies, like Homeland Security, and new initiatives like cyber security, require new investments and new expertise. Rather than looking exclusively at the existing federal workforce and structure as starting point for cost savings, a better opportunity might be reining in America’s “shadow government.”

It seems no one knows how many contractors work for the federal government. What we do know, according to the Congressional Budget Office, is that four years ago outsourcing cost taxpayers a cool $500 billion on products and services.

Voters trust Trump more than Democratic presidential nominee Hillary Clinton to handle the economy and jobs, 51 percent to 43 percent, according to a new New York Times/CBS News poll released yesterday. And his “Penny Plan” for essentially no-muss, no-fuss budget constraints are in line with other so-called “one cent solution” ideas that have been around for years.

However, the practical problems of implementing such a plan are legion. And Congress has had problems in the past setting and meeting targets or ceilings for spending, as has been the case under the 2011 Budget Control Act. Trump’s approach, if implemented, would come at a time when the portion of the budget that would be targeted for the deepest cuts already is on course to its lowest levels as a share of the economy since 1962, according to the CBO.

Maya MacGuineas, head of the Committee for a Responsible Federal Budget that supports strong deficit-reduction policies, said in a statement that while Trump is proposing a “clever way” to reduce spending, “it would ultimately cut the non-defense budget by a quarter.

Related: 5 Gimmicks in the GOP’s ‘Gimmick-Free’ Budget

“He includes no detail on how to achieve these cuts,” she said. “The biggest concern may be that he has taken about two-thirds of the budget off the table – including Social Security, defense, Medicare, and veterans spending – making it difficult to imagine how future policy changes will improve our debt situation.

Douglas Holtz-Eakins of the American Action Forum, a conservative Republican policy adviser, told The Fiscal Times yesterday that he was skeptical of Trump’s promises of economic growth more than doubling under his plan and his promise of a 1 percent per year reduction in non-defense spending for the next decade. “There’s no way,” he said.